Express Scripts 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report

70

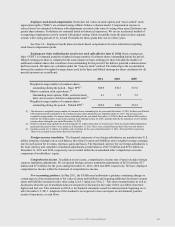

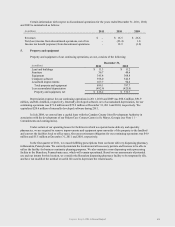

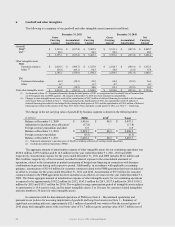

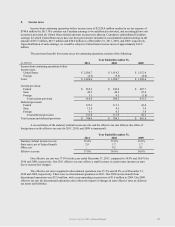

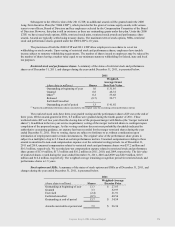

6. Goodwill and other intangibles

The following is a summary of our goodwill and other intangible assets (amounts in millions):

December 31, 2011

December 31, 2010

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Goodwill

PBM(1)

$ 5,512.6

$ (107.4)

$ 5,405.2

$ 5,513.1

$ (107.4)

$ 5,405.7

EM(1)

80.5

-

80.5

80.5

-

80.5

$ 5,593.1

$ (107.4)

$ 5,485.7

$ 5,593.6

$ (107.4)

$ 5,486.2

Other intangible assets

PBM

Customer contracts

$ 2,018.5

$ (494.7)

$ 1,523.8

$ 2,018.7

$ (346.4)

$ 1,672.3

Other (2)

126.6

(60.1)

66.5

20.8

(5.0)

15.8

2,145.1

(554.8)

1,590.3

2,039.5

(351.4)

1,688.1

EM

Customer relationships

68.4

(38.5)

29.9

68.4

(32.2)

36.2

Other

0.7

-

0.7

0.7

-

0.7

69.1

(38.5)

30.6

69.1

(32.2)

36.9

Total other intangible assets

$ 2,214.2

$ (593.3)

$ 1,620.9

$ 2,108.6

$ (383.6)

$ 1,725.0

(1) As discussed in Note 12 – Segment information, during the third quarter of 2011 we reorganized our FreedomFP line of business from

our EM segment into our PBM segment. All amounts at December 31, 2010 have been restated for comparability.

(2) Changes in other intangible assets are a result of the capitalization of $29.9 million of deferred financing fees related to the November

2011 Senior Notes (as defined in Note 7 – Financing) issued in the fourth quarter of 2011, the capitalization of $65.0 million of

deferred financing fees related to the bridge facility during the third quarter of 2011 and the capitalization of $10.9 million of deferred

financing fees related to the issuance of the May 2011 Senior Notes during the second quarter of 2011 (see Note 7 — Financing).

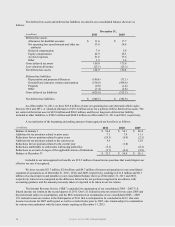

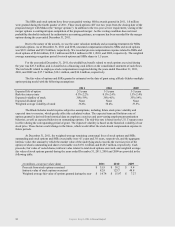

The change in the net carrying value of goodwill by business segment is shown in the following table:

(in millions)

PBM

EM2

Total

Balance at December 31, 2009

$

5,416.6

$

80.5

$

5,497.1

Adjustment to purchase price allocation1

(17.8)

-

(17.8)

Foreign currency translation and other

6.9

-

6.9

Balance at December 31, 2010

$

5,405.7

$

80.5

$

5,486.2

Foreign currency translation

(0.5)

-

(0.5)

Balance at December 31, 2011

$

5,405.2

$

80.5

$

5,485.7

(1) Represents adjustments to purchase price of NextRx, including settlement of working capital adjustment.

(2) Excludes discontinued operations of PMG.

The aggregate amount of amortization expense of other intangible assets for our continuing operations was

$236.0 million, $159.8 million and $114.6 million for the year ended December 31, 2011, 2010 and 2009,

respectively. Amortization expense for the years ended December 31, 2011 and 2009 includes $81.0 million and

$66.3 million, respectively, of fees incurred, recorded in interest expense in the consolidated statement of

operations, related to the termination or partial termination of bridge loan financing in connection with business

combinations in process during each respective period. Additionally, in accordance with applicable accounting

guidance, amortization of $114.0 million for customer contracts related to the PBM agreement has been included as

an offset to revenues for the years ended December 31, 2011 and 2010. Amortization of $9.5 million for customer

contracts related to the PBM agreement has been included as an offset to revenues for the year ended December 31,

2009. The future aggregate amount of amortization expense of other intangible assets for our continuing operations

is expected to be approximately $192.2 million for 2012, $163.5 million for 2013, $157.8 million for 2014, $138.2

million for 2015 and $135.1 million for 2016. The weighted average amortization period of intangible assets subject

to amortization is 14.4 years in total, and by major intangible class is 5 to 20 years for customer-related intangibles

and nine months to 30 years for other intangible assets.

In connection with the discontinued operations of PMG (see Note 4 – Discontinued operations) and

pursuant to our policies for assessing impairment of goodwill and long-lived assets (see Note 1 – Summary of

significant accounting policies), approximately $22.1 million of goodwill was written off in the second quarter of

2010 along with intangible assets with a net book value of $1.7 million (gross carrying value of $5.7 million net of