Express Scripts 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report 31

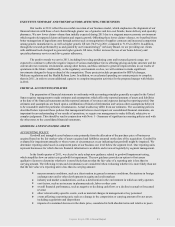

the merger. If we are unable to obtain sufficient financing or other sources of capital, we may be subject to significant

monetary or other damages under the Merger Agreement as a result of our breach.

The market price of our common stock may decline as a result of the merger with Medco.

The market price of the common stock of our company or the combined company may decline as a result of the

merger if, among other things, we are unable to achieve the expected growth in earnings, or if the operational cost savings

estimates in connection with the integration of Medco’s business with ours are not realized, or if the transaction costs

related to the merger are greater than expected, or if the financing related to the transaction is on unfavorable terms. The

market price also may decline if we do not achieve the perceived benefits of the merger as rapidly or to the extent

anticipated by financial or industry analysts or if the effect of the merger on our financial results is not consistent with the

expectations of financial or industry analysts.

The merger will substantially reduce the percentage ownership interests of our current stockholders; it may not be

accretive and may cause dilution to our earnings per share, which may negatively affect the market price of our common

stock.

If the merger is completed, based on the closing price of our stock on December 31, 2011, we will pay

approximately $25.9 billion and issue approximately 363.4 million shares of stock of New Express Scripts to Medco’s

stockholders, and Medco’s stockholders are expected to hold approximately 41% of the common stock of New Express

Scripts after the merger. We currently anticipate that the merger will be accretive to our earnings per share. This

expectation is based on preliminary estimates which may materially change. We could also encounter additional transaction

and integration-related costs or other factors such as the failure to realize all of the benefits anticipated in the merger, or

unforeseen liabilities or other issues existing or arising with the business of Medco or otherwise resulting from the merger.

All of these factors could cause dilution to our earnings per share or decrease or delay the expected accretive effect of the

merger and cause a decrease in the price of our common stock.

Item 1B—Unresolved Staff Comments

There are no unresolved written comments that were received from the SEC Staff 180 days or more before the end

of our fiscal year relating to our periodic or current reports under the Securities Exchange Act of 1934.