Express Scripts 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report

42

The examples noted above are not all-inclusive, and the Company shall consider other relevant events and

circumstances that affect the fair value of a reporting unit in determining whether to perform the first step of the goodwill

impairment test.

If we were to perform Step 1, the measurement of possible impairment is based on a comparison of the fair value

of each reporting unit to the carrying value of the reporting unit’s assets. Impairment losses, if any, would be determined

based on the fair value of the individual assets and liabilities of the reporting unit, using discount rates that reflect the

inherent risk of the underlying business. We would record an impairment charge to the extent the carrying value of

goodwill exceeds the implied fair value of goodwill resulting from this calculation. This valuation process involves

assumptions based upon management’s best estimates and judgments that approximate the market conditions experienced

for our reporting units at the time the impairment assessment is made. These assumptions include, but are not limited to,

earnings and cash flow projections, discount rate and peer company comparability. Actual results may differ from these

estimates due to the inherent uncertainty involved in such estimates.

We performed a qualitative analysis as allowed under the new guidance for our U.S. PBM reporting unit for the

2011 annual impairment test. Based on the results of this assessment, management determined that performance of Step 1

was unnecessary for the U.S. PBM reporting unit. We did not perform a qualitative assessment for any of our other

reporting units, and instead began with Step 1 of the goodwill impairment analysis, as allowed under the new guidance. No

impairment existed for any of our reporting units at December 31, 2011 or December 31, 2010.

Other intangible assets include, but are not limited to, customer contracts and relationships, deferred financing fees

and trade names. Deferred financing fees are recorded at cost. Customer contracts and relationships are valued at fair

market value when acquired using the income method. Customer contracts and relationships related to the 10-year contract

with WellPoint under which we provide pharmacy benefit management services to WellPoint and its designated affiliates

(the ―PBM agreement‖) are being amortized using a modified pattern of benefit method over an estimated useful life of 15

years. All other intangible assets, excluding trade names which have an indefinite life, are amortized on a straight-line

basis, which approximates the pattern of benefit, over periods from 5 to 20 years for customer-related intangibles and nine

months to 30 years for other intangible assets (see Note 6 – Goodwill and other intangibles).

In connection with the discontinued operations of our Phoenix Marketing Group line of business (―PMG‖) and

pursuant to our policies for assessing impairment of goodwill and long-lived assets, approximately $22.1 million of

goodwill was written off in the second quarter of 2010 along with intangible assets with a net book value of $1.7 million

(gross carrying value of $5.7 million net of accumulated amortization of $4.0 million), consisting of trade names and

customer relationships.

FACTORS AFFECTING ESTIMATE

The fair values of reporting units, asset groups, or acquired businesses are measured based on market prices, when

available. When market prices are not available, we estimate fair value using the income approach and/or the market

approach. The income approach uses cash flow projections which require inputs and assumptions that reflect current market

conditions as well as management judgment. We base our fair values on projected financial information which we believe

to be reasonable. However, actual results may differ from those projections, and those differences may be material.

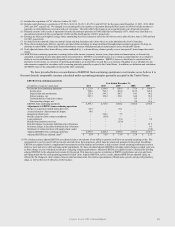

The key assumptions included in our income approach include, but are not limited to, earnings growth rates,

discount rates and inflation rates. Assessment of these factors could be impacted by internal factors and/or external

economic conditions. We performed various sensitivity analyses on the key assumptions which did not indicate any

potential impairment.

CONTRACTUAL GUARANTEES

ACCOUNTING POLICY

Many of our contracts contain terms whereby we make certain financial and performance guarantees, including the

minimum level of discounts or rebates a client may receive, generic utilization rates, and various service guarantees. These

clients may be entitled to performance penalties if we fail to meet a financial or service guarantee. Actual performance is

compared to the guarantee for each measure throughout the period, and accruals are recorded if we determine that our

performance against the guarantee indicates a potential liability. These estimates are adjusted to actual when the guarantee

period ends and we have either met the guaranteed rate or paid amounts to clients.