Express Scripts 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report 63

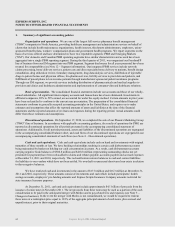

Self-insurance accruals. We maintain insurance coverage for claims that arise in the normal course of

business. Where insurance coverage is not available, or, in our judgment, is not cost-effective, we maintain self-

insurance accruals to reduce our exposure to future legal costs, settlements and judgments. Self-insured losses are

accrued based upon estimates of the aggregate liability for the costs of uninsured claims incurred using certain

actuarial assumptions followed in the insurance industry and our historical experience (see Note 11 – Commitments

and contingencies). It is not possible to predict with certainty the outcome of these claims, and we can give no

assurances any losses, in excess of our insurance and any self-insurance accruals, will not be material.

Fair value of financial instruments. The carrying value of cash and cash equivalents, restricted cash and

investments, accounts receivable, claims and rebates payable, and accounts payable approximated fair values due to

the short-term maturities of these instruments. The fair value, which approximates the carrying value, of our bank

credit facility was estimated using either quoted market prices or the current rates offered to us for debt with similar

maturity (see Note 2 – Fair value measurements).

Revenue recognition. Revenues from our PBM segment are earned by dispensing prescriptions from our

home delivery and specialty pharmacies, processing claims for prescriptions filled by retail pharmacies in our

networks, and providing services to drug manufacturers, including administration of discount programs (see also

―Rebate accounting‖ below).

Revenues from dispensing prescriptions from our home delivery pharmacies are recorded when drugs are

shipped. At the time of shipment, our earnings process is complete: the obligation of our customer to pay for the

drugs is fixed, and, due to the nature of the product, the member may not return the drugs nor receive a refund.

Revenues from our specialty line of business are from providing medications/pharmaceuticals for diseases

that rely upon high-cost injectable, infused, oral, or inhaled drugs which have sensitive handling and storage needs,

bio-pharmaceutical services including marketing, reimbursement, customized logistics solutions and providing

fertility services to providers and patients. Specialty revenues earned by our PBM segment are recognized at the

point of shipment. At the time of shipment, we have performed substantially all of our obligations under our

customer contracts and do not experience a significant level of reshipments. Appropriate reserves are recorded for

discounts and contractual allowances which are estimated based on historical collections over a recent period. Any

differences between our estimates and actual collections are reflected in operations in the period in which payment is

received. Differences may affect the amount and timing of our revenues for any period if actual performance varies

from our estimates. Allowances for returns are estimated based on historical return trends.

Revenues from our PBM segment are also derived from the distribution of pharmaceuticals requiring

special handling or packaging where we have been selected by the pharmaceutical manufacturer as part of a limited

distribution network and the distribution of pharmaceuticals through Patient Assistance Programs where we receive

a fee from the pharmaceutical manufacturer for administrative and pharmacy services for the delivery of certain

drugs free of charge to doctors for their low-income patients. These revenues include administrative fees received

from these programs.

Revenues related to the distribution of prescription drugs by retail pharmacies in our networks consist of

the prescription price (ingredient cost plus dispensing fee) negotiated with our clients, including the portion to be

settled directly by the member (co-payment), plus any associated administrative fees. These revenues are recognized

when the claim is processed. When we independently have a contractual obligation to pay our network pharmacy

providers for benefits provided to our clients’ members, we act as a principal in the arrangement and we include the

total prescription price as revenue in accordance with applicable accounting guidance. Although we generally do not

have credit risk with respect to retail co-payments, the primary indicators of gross treatment are present. When a

prescription is presented by a member to a retail pharmacy within our network, we are solely responsible for

confirming member eligibility, performing drug utilization review, reviewing for drug-to-drug interactions,

performing clinical intervention, which may involve a call to the member’s physician, communicating plan

provisions to the pharmacy, directing payment to the pharmacy and billing the client for the amount it is

contractually obligated to pay us for the prescription dispensed, as specified within our client contracts. We also

provide benefit design and formulary consultation services to clients. We have separately negotiated contractual

relationships with our clients and with network pharmacies, and under our contracts with pharmacies we assume the

credit risk of our clients’ ability to pay for drugs dispensed by these pharmacies to clients’ members. We, not our

clients, are obligated to pay the retail pharmacies in our networks the contractually agreed upon amount for the

prescription dispensed, as specified within our provider contracts. These factors indicate we are a principal as

defined by applicable accounting guidance and, as such, we record the total prescription price contracted with clients

in revenue.