Energizer 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exhibit 13

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

88

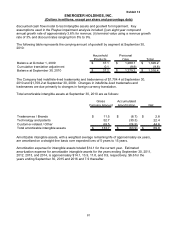

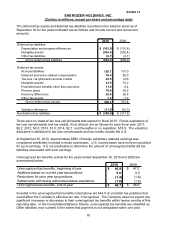

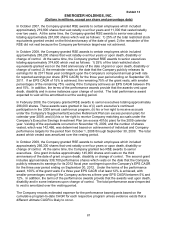

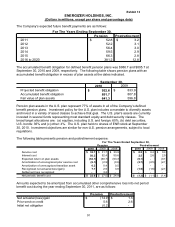

The following table summarizes RSE activity during the current year (shares in millions):

Shares

Weighted-Average

Grant Date Fair

Value

Nonvested RSE at October 1, 2009 1.83 $75.95

Granted 0.76 65.60

Vested (0.41) 69.24

Cancelled (0.40) 67.27

Nonvested RSE at September 30, 2010 1.78 $75.04

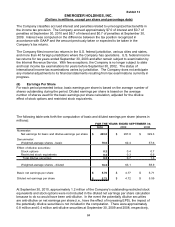

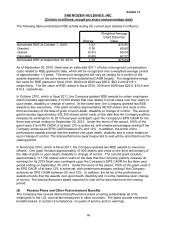

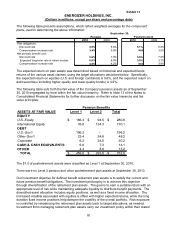

As of September 30, 2010, there was an estimated $37.1 of total unrecognized compensation

costs related to RSE granted to date, which will be recognized over a weighted-average period

of approximately 1.4 years. The amount recognized will vary as vesting for a portion of the

awards depends on the achievement of the established CAGR targets. The weighted-average

fair value for RSE granted in fiscal 2010, 2009 and 2008 was $65.6, $63.2 and $116.1,

respectively. The fair value of RSE vested in fiscal 2010, 2009 and 2008 was $25.8, $18.0 and

$10.4, respectively.

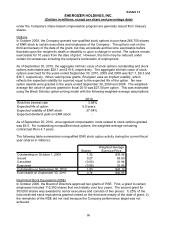

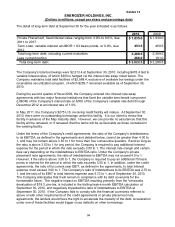

In October 2010, which is fiscal 2011, the Company granted RSE awards to certain employees

which included approximately 313,300 shares that vest ratably in most cases over four years or

upon death, disability or change of control. At the same time, the Company granted two RSE

awards to key executives. One grant includes approximately 86,700 shares and vests on the

third anniversary of the date of grant or upon death, disability or change of control. The second

grant includes approximately 202,300 shares which vests on the date that the Company publicly

releases its earnings for its 2013 fiscal year contingent upon the Company’s EPS CAGR for the

three year period ending on September 30, 2013. Under the terms of the award, 100% of the

grant vests if an EPS CAGR of at least 12% is achieved, with smaller percentages vesting if the

Company achieves an EPS CAGR between 5% and 12%. In addition, the terms of the

performance awards provide that the awards vest upon death, disability and in some instances

upon change of control. The total performance award expected to vest will be amortized over the

vesting period.

In November 2010, which is fiscal 2011, the Company granted two RSE awards to executive

officers. One grant includes approximately 47,900 shares and vests on the third anniversary of

the date of grant or upon death, disability or change of control. The second grant includes

approximately 111,700 shares which vests on the date that the Company publicly releases its

earnings for its 2013 fiscal year contingent upon the Company’s EPS CAGR for the three year

period ending on September 30, 2013. Under the terms of the award, 100% of the grant vests if

an EPS CAGR of at least 12% is achieved, with smaller percentages vesting if the Company

achieves an EPS CAGR between 5% and 12%. In addition, the terms of the performance

awards provide that the awards vest upon death, disability and in some instances upon change

of control. The total performance award expected to vest will be amortized over the vesting

period.

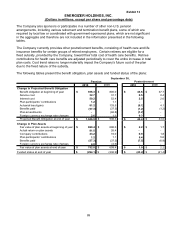

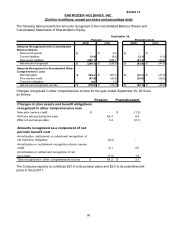

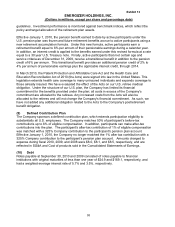

(8) Pension Plans and Other Postretirement Benefits

The Company has several defined benefit pension plans covering substantially all of its

employees in the U.S. and certain employees in other countries. The plans provide retirement

benefits based, in certain circumstances, on years of service and on earnings.