Energizer 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exhibit 13

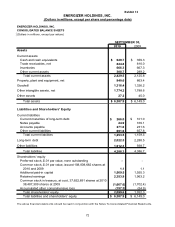

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

68

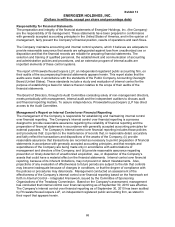

Responsibility for Financial Statements

The preparation and integrity of the financial statements of Energizer Holdings, Inc. (the Company)

are the responsibility of its management. These statements have been prepared in conformance

with generally accepted accounting principles in the United States of America, and in the opinion of

management, fairly present the Company’s financial position, results of operations and cash flows.

The Company maintains accounting and internal control systems, which it believes are adequate to

provide reasonable assurance that assets are safeguarded against loss from unauthorized use or

disposition and that the financial records are reliable for preparing financial statements. The

selection and training of qualified personnel, the establishment and communication of accounting

and administrative policies and procedures, and an extensive program of internal audits are

important elements of these control systems.

The report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, on

their audits of the accompanying financial statements appears herein. This report states that the

audits were made in accordance with the standards of the Public Company Accounting Oversight

Board (United States). These standards include a study and evaluation of internal control for the

purpose of establishing a basis for reliance thereon relative to the scope of their audits of the

financial statements.

The Board of Directors, through its Audit Committee consisting solely of non-management directors,

meets periodically with management, internal audit and the independent auditors to discuss audit

and financial reporting matters. To assure independence, PricewaterhouseCoopers LLP has direct

access to the Audit Committee.

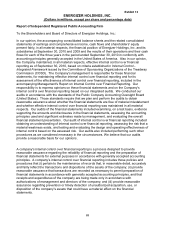

Management’s Report on Internal Control over Financial Reporting

The management of the Company is responsible for establishing and maintaining internal control

over financial reporting. The Company’s internal control over financial reporting is a process

designed to provide reasonable assurance regarding the reliability of financial reporting and the

preparation of financial statements in accordance with generally accepted accounting principles for

external purposes. The Company’s internal control over financial reporting includes those policies

and procedures that: (i) pertain to the maintenance of records that, in reasonable detail, accurately

and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide

reasonable assurance that transactions are recorded as necessary to permit preparation of financial

statements in accordance with generally accepted accounting principles, and that receipts and

expenditures of the Company are being made only in accordance with authorizations of

management and directors of the Company; and (iii) provide reasonable assurance regarding

prevention or timely detection of unauthorized acquisition, use, or disposition of the Company’s

assets that could have a material effect on the financial statements. Internal control over financial

reporting, because of its inherent limitations, may not prevent or detect misstatements. Also,

projections of any evaluation of effectiveness to future periods are subject to the risk that controls

may become inadequate because of changes in conditions, or that the degree of compliance with

the policies or procedures may deteriorate. Management conducted an assessment of the

effectiveness of the Company’s internal control over financial reporting based on the framework set

forth in Internal Control – Integrated Framework, issued by the Committee of Sponsoring

Organizations of the Treadway Commission. Based on the Company’s assessment, management

has concluded that internal control over financial reporting as of September 30, 2010 was effective.

The Company’s internal control over financial reporting as of September 30, 2010 has been audited

by PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in

their report that appears herein.