Energizer 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exhibit 13

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

85

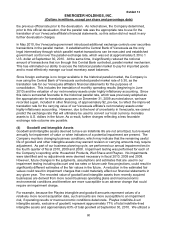

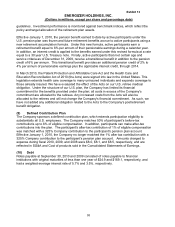

which were not included in the diluted net earnings per share calculations for the reason noted

above.

(7) Share-Based Payments

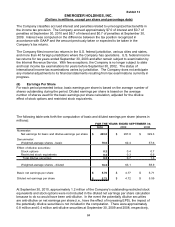

The Company's Incentive Stock Plan was initially adopted by the Board of Directors in March

2000 and approved by shareholders at the 2001 Annual Meeting of Shareholders. This plan was

superseded in January 2009 as the Board of Directors approved a new plan, which was

approved by shareholders at the 2009 Annual Meeting of Shareholders. New awards granted

after January 2009 are issued under the latest plan. Under the latest plan, awards of restricted

stock, restricted stock equivalents or options to purchase the Company's common stock (ENR

stock) may be granted to directors, officers and employees. A maximum of 4.0 million shares of

ENR stock was approved to be issued under the latest plan. For purposes of determining the

number of shares available for future issuance under the latest plan, awards of restricted stock

and restricted stock equivalents reduces the shares available for future issuance by 1.95 for

every one share awarded. Options awarded reduces the number of shares available for future

issuance on a one-for-one basis. At September 30, 2010 and 2009, there were 2.0 million and

3.4 million shares, respectively, available for future awards under the January 2009 plan. At

September 30, 2008, there were 2.8 million shares available for future awards under the original

plan adopted in March 2001. Since the original plan has been superseded, no further shares

under this original plan were available for future awards after the adoption of the 2009 plan.

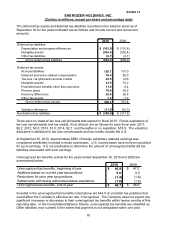

Options are granted at the market price on the grant date and generally have vested ratably over

three to seven years. These awards typically have a maximum term of 10 years. Restricted

stock and restricted stock equivalent awards may also be granted. Option shares and prices,

and restricted stock and stock equivalent awards, are adjusted in conjunction with stock splits

and other recapitalizations so that the holder is in the same economic position before and after

these equity transactions.

The Company permits deferrals of bonus and for directors, retainers and fees, under the terms of

its Deferred Compensation Plan. Under this plan, employees or directors deferring amounts into

the Energizer Common Stock Unit Fund are credited with a number of stock equivalents based

on the fair value of ENR stock at the time of deferral. In addition, the participants are credited

with an additional number of stock equivalents, equal to 25% for employees and 33 1/3% for

directors, of the amount deferred. This additional match vests immediately for directors and

three years from the date of initial crediting for employees. Effective January 1, 2011, the 33

1/3% match for directors was eliminated for future deferrals. Amounts deferred into the

Energizer Common Stock Unit Fund, and vested matching deferrals, may be transferred to other

investment options offered under the plan after specified restriction periods. At the time of

termination of employment, or for directors, at the time of termination of service on the Board, or

at such other time for distribution, which may be elected in advance by the participant, the

number of equivalents then vested and credited to the participant's account is determined and an

amount in cash equal to the fair value of an equivalent number of shares of ENR stock is paid to

the participant. This plan is reflected in Other liabilities on the Consolidated Balance Sheets.

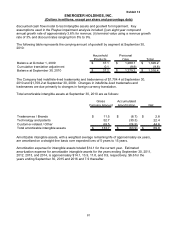

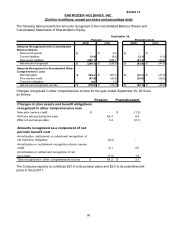

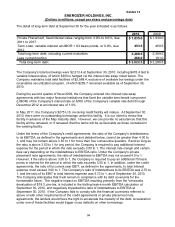

The Company uses the straight-line method of recognizing compensation cost. Total

compensation cost charged against income for the Company’s share-based compensation

arrangements was $28.2, $15.3 and $26.4 for the years ended September 30, 2010, 2009 and

2008, respectively, and was recorded in SG&A expense. The total income tax benefit

recognized in the Consolidated Statements of Earnings for share-based compensation

arrangements was $9.4, $5.6 and $9.6 for the years ended September 30, 2010, 2009 and

2008, respectively. Restricted stock issuance and shares issued for stock option exercises