Energizer 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exhibit 13

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

106

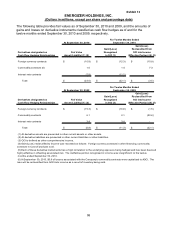

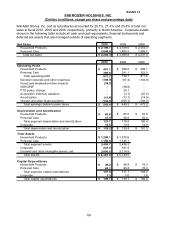

(18) Quarterly Financial Information – (Unaudited)

The results of any single quarter are not necessarily indicative of the Company’s results for the

full year. Net earnings of the Company are impacted in the first quarter by the additional battery

product sales volume associated with the December holiday season. Earnings per share data

are computed independently for each of the periods presented. As a result, the sum of the

earnings per share amounts for the quarter may not equal the total for the year.

First Second Third Fourth

Fiscal 2010

Net sales 1,176.7$ 935.1$ 1,076.8$ 1,059.7$

Gross profit 560.2 447.2 517.6 494.3

Net earnings 125.7 88.5 104.0 84.8

Basic earnings per share $1.80 $1.27 $1.48 $1.21

Diluted earnings per share $1.78 $1.25 $1.47 $1.20

Items increasing/(decreasing) net earnings:

Venezuela (25.5)$ 2.8$ 5.7$ 2.8$

VERO/Separation costs - - (0.1) 0.2

Integration costs (1.0) (0.6) (0.3) 0.1

Provisions for restructuring and related costs (3.5) (0.5) (0.5) (1.1)

Tax benefits - special foreign tax credit - - - 23.5

Adjustment to prior years tax accruals - - 3.7 2.4

First Second Third Fourth

Fiscal 2009

Net sales 1,042.5$ 880.4$ 997.5$ 1,079.4$

Gross profit 513.5 413.6 457.8 473.7

Net earnings 111.0 77.0 72.7 37.1

.

Basic earnings per share $1.90 $1.32 $1.15 $0.53

Diluted earnings per share $1.88 $1.30 $1.13 $0.53

Items increasing/(decreasing) net earnings:

PTO adjustment -$ 14.5$ 0.7$ -$

VERO/Separation costs - - - (24.3)

Acquisition inventory valuation - - - (2.3)

Integration costs (0.9) (1.1) - (1.1)

Provisions for restructuring and related costs (2.1) (3.1) (0.2) (0.4)

Adjustment to prior years tax accruals 0.9 0.1 (1.4) (1.1)

Earnings per share data are computed independently for each of the periods presented. As a

result, the sum of the earnings per share amounts for the quarters may not equal the total for the

year.

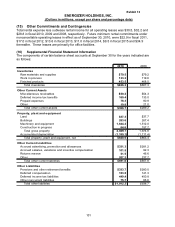

(19) Subsequent Events

On November 1, 2010, which is fiscal 2011, the Board of Directors (the “Board”) authorized a

Household Products multi-year program designed to accelerate investments in both geographic

and product growth opportunities, streamline our worldwide manufacturing operations and

improve the efficiency of our administrative operations. The Board authorized a broad

restructuring plan and has delegated authority to management to determine the final plan with

respect to the initiatives, which are expected to result in pre-tax charges in the range of $65 to

$85 over the next twelve months, with the vast majority associated with manufacturing capacity

rationalization. The remainder relates to overhead reductions. Although the specific actions to

be taken are not yet resolved, annual pre-tax savings, related primarily to headcount reduction