Energizer 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exhibit 13

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

54

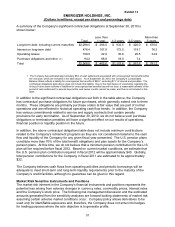

Liquidity and Capital Resources

At September 30, 2010, the Company had $629.7 in available cash and $259.7 available under

its committed debt facilities, exclusive of available borrowings under the receivables

securitization program.

On November 23, 2010, Energizer completed the acquisition of ASR for a cash purchase price

of $301. The Company financed this transaction with available cash of approximately $150

and borrowings from our existing receivables securitization program.

In May 2011, the Company’s $275 U.S. revolving credit facility will mature. At September 30,

2010, there were no outstanding borrowings under this facility. It is our intent to renew this

facility in advance of the May maturity date. However, we can provide no assurances that this

facility will be renewed, or if renewed, that the terms will be as favorable as those contained in

the existing facility.

Operating Activities

Cash flow from operations is the primary funding source for operating needs and capital

investments. Cash flow from operations was $652.4 in fiscal 2010, an increase of $163.2 as

compared to fiscal 2009. Cash flow from operations was $489.2 in fiscal 2009, an increase of

$22.7 as compared to $466.5 for fiscal 2008. The increase in cash flow from operations in

fiscal 2010 was due to higher operating cash flow before changes in working capital, which

exceeded the same measure in the prior year by $147.2 due primarily to higher net earnings.

The increase in cash flow from operations in fiscal 2009 as compared to fiscal 2008 was due

primarily to lower assets used in operations partially offset by lower liabilities.

From a working capital perspective, changes in assets and liabilities used in operations

(working capital) provided positive cash flow of $26.8 in fiscal 2010, an improvement of $16.0

as compared to the cash flow generated by changes in working capital in fiscal 2009. The

most significant impact was in accounts payable and other current liabilities, which increased

collectively by $54.1 in fiscal 2010 due primarily to the level of promotional activities during the

fourth quarter of fiscal 2010 and the timing of payments. The favorable cash flow impact due to

a higher level of accounts payable and other current liabilities at the end of fiscal 2010 was

partially offset by higher accounts receivable of $26.4 due primarily to inclusion of the fully

integrated shave preparation brands at year-end fiscal 2010.

The most significant driver of the higher cash flow from operations in fiscal 2009 as compared

to fiscal 2008 was accounts receivable, which was lower by $106.7 at year-end fiscal 2009,

excluding the impact of acquired brands. This decrease was due to lower net sales as

compared to the prior period and improved accounts receivable aging. This decrease in

accounts receivable in fiscal 2009 coupled with lower inventories on a year over year basis of

$21.8 more than offset a reduction in accounts payable and other current liabilities, which were

collectively lower by $109.5 due primarily to reduced advertising and promotional accruals

resulting from lower spending and lower accruals for compensation and benefits including the

impact of the change in PTO policy.

Investing Activities

Net cash used by investing activities was $113.3, $412.2 and $1,994.5 in fiscal 2010, 2009 and

2008, respectively. Capital expenditures were $108.7, $139.7 and $160.0 in fiscal 2010, 2009

and 2008, respectively. These capital expenditures were funded by cash flow from operations.

Capital expenditures decreased somewhat in fiscal 2010 due to the timing of project-related