Energizer 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exhibit 13

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

102

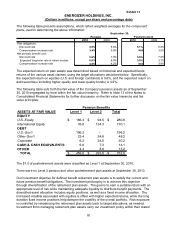

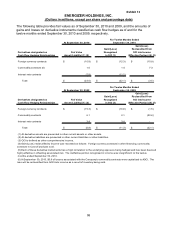

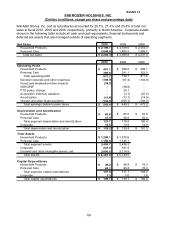

Allowance for Doubtful Accounts

2010 2009 2008

Balance at beginning of year 11.3$ 11.2$ 9.8$

Impact of Playtex acquisition - - 4.0

Provision charged to expense, net of reversals 4.6 5.9 (0.2)

Write-offs, less recoveries, translation, other (2.7) (5.8) (2.4)

Balance at end of year 13.2$ 11.3$ 11.2$

Income Tax Valuation Allowance

2010 2009 2008

Balance at beginning of year 10.3$ 9.1$ 4.9$

Impact of Playtex acquisition - - 5.0

Provision charged to expense 2.7 1.2 0.1

Reversal of provision charged to expense (1.3) - (0.4)

Write-offs, translation, other (0.7) - (0.5)

Balance at end of year 11.0$ 10.3$ 9.1$

Supplemental Disclosure of Cash Flow Information

2010 2009 2008

Interest paid 122.1$ 150.4$ 143.6$

Income taxes paid 131.5 167.3 90.6

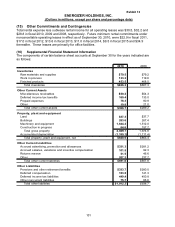

(17) Segment Information

Operations for the Company are managed via two segments - Household Products (Battery and

Lighting Products) and Personal Care (Wet Shave, Skin Care, Feminine Care and Infant Care).

Segment performance is evaluated based on segment operating profit, exclusive of general

corporate expenses, share-based compensation costs, costs associated with most restructuring,

integration or business realignment activities and amortization of intangible assets. Financial

items, such as interest income and expense, are managed on a global basis at the corporate

level.

For the twelve months ended September 30, 2010, the Company recorded a pre-tax loss of

$18.3, due primarily to the recent devaluation of our Venezuela affiliate’s U.S. dollar based

intercompany payable. This impact, which is included in Other financing expense, net on the

Consolidated Statements of Earnings, is shown collectively as a separate line item on the table

below and is not considered in evaluating segment performance. However, normal operating

results in Venezuela, such as sales, gross margin and spending have been impacted by

translating at less favorable exchange rates and unfavorable local economic conditions. These

operating results remain as part of the reported segment totals.

The reduction in gross profit associated with the write-up and subsequent sale of the inventory

acquired in the Edge/Skintimate acquisition in fiscal 2009, which was $3.7, and the Playtex

acquisition in fiscal 2008, which was $27.5, as well as the related acquisition integration costs in

all periods presented are not reflected in the Personal Care segment, but rather presented below

segment profit, as they are non-recurring items directly associated with the acquisitions. Such

presentation reflects management’s view on how it evaluates segment performance.

In the fourth quarter of fiscal 2009, the Company implemented a voluntary employee retirement

option (VERO) for eligible U.S. colleagues. The decision to accept the cash benefits offered

under the VERO was at the election of the colleague and was irrevocable. Payments under the

VERO were cash only, and did not include any enhancement to pension or retirement benefits.