Energizer 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exhibit 13

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

93

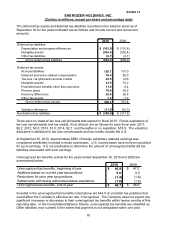

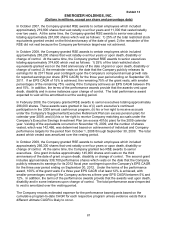

guidelines. Investment performance is monitored against benchmark indices, which reflect the

policy and target allocation of the retirement plan assets.

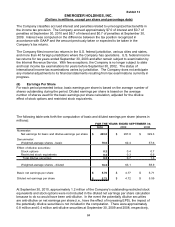

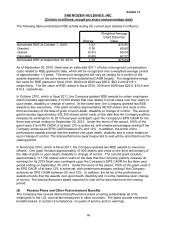

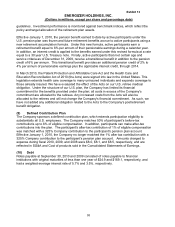

Effective January 1, 2010, the pension benefit earned to date by active participants under the

U.S. pension plan was frozen and future retirement benefits accrue to active participants using a

new retirement accumulation formula. Under this new formula, active participants earn a

retirement benefit equal to 6% per annum of their pensionable earnings during a calendar year.

In addition, an interest credit is applied to the benefits earned under this revised formula at a rate

equal to a 30 year U.S. Treasury note. Finally, active participants that met certain age and

service criteria as of December 31, 2009, receive a transitional benefit in addition to the pension

credit of 6% per annum. This transitional benefit provides an additional pension credit of 2% to

4% per annum of pensionable earnings plus the applicable interest credit, through 2014.

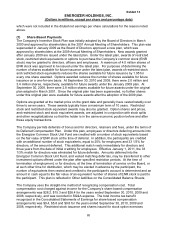

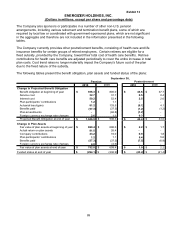

In March 2010, the Patient Protection and Affordable Care Act and the Health Care and

Education Reconciliation Act of 2010 (the Acts) were signed into law in the United States. This

legislation extends health care coverage to many uninsured individuals and expands coverage to

those already insured. We have evaluated the effect of the Acts on our U.S. retiree medical

obligation. Under the structure of our U.S. plan, the Company has limited its financial

commitment for the benefits provided under the plan; all costs in excess of the Company's

commitment are allocated to the retirees. Any increased costs from the Acts will also be

allocated to the retirees and will not change the Company's financial commitment. As such, we

have not added any additional obligation related to the Acts to the Company's postretirement

benefit obligation.

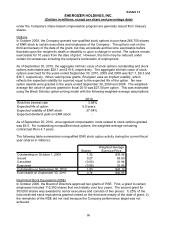

(9) Defined Contribution Plan

The Company sponsors a defined contribution plan, which extends participation eligibility to

substantially all U.S. employees. The Company matches 50% of participant’s before-tax

contributions up to 6% of eligible compensation. In addition, participants can make after-tax

contributions into the plan. The participant’s after-tax contribution of 1% of eligible compensation

was matched with a 325% Company contribution to the participant’s pension plan account.

Effective January 1, 2010, the Company no longer matched the 1% after tax contribution with a

325% Company contribution to the participant’s pension plan account. Amounts charged to

expense during fiscal 2010, 2009, and 2008 were $8.0, $8.1, and $8.5, respectively, and are

reflected in SG&A and Cost of products sold in the Consolidated Statements of Earnings.

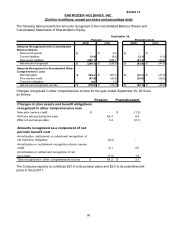

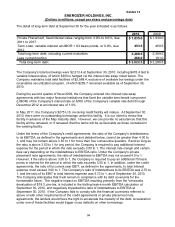

(10) Debt

Notes payable at September 30, 2010 and 2009 consisted of notes payable to financial

institutions with original maturities of less than one year of $24.9 and $169.1, respectively, and

had a weighted-average interest rate of 5.7% and 3.5%, respectively.