Energizer 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exhibit 13

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

60

in the Consolidated Statements of Cash Flows as the period activity associated with the

Company’s deferred compensation liability, which was cash flow from operations.

Seasonal Factors

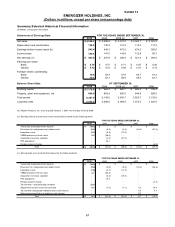

The Company's Household Products segment results are impacted in the first quarter of the

fiscal year by the additional sales volume associated with the December holiday season,

particularly in North America. First quarter sales accounted for 32%, 31% and 32% of total

Household Products net sales in fiscal 2010, 2009 and 2008, respectively. In addition, natural

disasters, such as hurricanes, can create conditions that drive exceptional needs for portable

power and spike battery and lighting products sales.

Customer orders for the Company’s sun care products are highly seasonal, which has

historically resulted in higher sun care sales in the second and third quarters of our fiscal year

and lower sales in the first and fourth quarters of our fiscal year. As a result, sales, operating

income, working capital and cash flows for the Personal Care segment can vary significantly

between quarters of the same and different years due to the seasonality of orders for sun care

products.

Other factors may also have an impact on the timing and amounts of sales, operating income,

working capital and cash flows. They include: the timing of new product launches by

competitors or by the Company, the timing of advertising, promotional, merchandising or other

marketing activities by competitors or by the Company, and the timing of retailer merchandising

decisions and actions.

Environmental Matters

The operations of the Company, like those of other companies, are subject to various federal,

state, foreign and local laws and regulations intended to protect the public health and the

environment. These regulations relate primarily to worker safety, air and water quality,

underground fuel storage tanks and waste handling and disposal. The Company has received

notices from the U.S. Environmental Protection Agency, state agencies and/or private parties

seeking contribution, that it has been identified as a “potentially responsible party” (PRP) under

the Comprehensive Environmental Response, Compensation and Liability Act, and may be

required to share in the cost of cleanup with respect to eight federal “Superfund” sites. It may

also be required to share in the cost of cleanup with respect to state-designated sites or other

sites outside of the U.S.

Accrued environmental costs at September 30, 2010 were $10.2, of which $2.8 is expected to

be spent in fiscal 2011. This accrual is not measured on a discounted basis. It is difficult to

quantify with certainty the cost of environmental matters, particularly remediation and future

capital expenditures for environmental control equipment. Nevertheless, based on information

currently available, the Company believes the possibility of material environmental costs in

excess of the accrued amount is remote. Total environmental capital expenditures and

operating expenses are not expected to have a material effect on our total capital and

operating expenditures, consolidated earnings or competitive position. However, current

environmental spending estimates could be modified as a result of changes in our plans,

changes in legal requirements, including any requirements related to global climate change, or

other factors.

Inflation

Management recognizes that inflationary pressures may have an adverse effect on the

Company, through higher material, labor and transportation costs, asset replacement costs and