Energizer 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exhibit 13

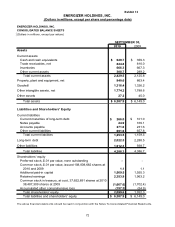

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

64

asset also requires judgment. Certain brand intangibles are expected to have indefinite

lives based on their history and our plans to continue to support and build the acquired

brands. Other intangible assets are expected to have determinable useful lives. Our

assessment of intangible assets that have an indefinite life and those that have a

determinable life is based on a number of factors including the competitive environment,

market share, brand history, underlying product life cycles, operating plans and the

macroeconomic environment. Our estimates of the useful lives of determinable-lived

intangible assets are primarily based on the same factors. The costs of determinable-lived

intangible assets are amortized to expense over the estimated useful life. The value of

indefinite-lived intangible assets and residual goodwill is not amortized, but is tested at least

annually for impairment.

Our annual impairment testing for both goodwill and indefinite-lived intangible assets

indicated that all reporting unit and intangible asset fair values exceeded their respective

carrying values. However, future changes in the judgments, assumptions and estimates

that are used in our impairment testing including discount and tax rates or future cash flow

projections, could result in significantly different estimates of the fair values in the future. A

reduction in the estimated fair values could result in impairment charges that could

materially affect our financial statements in any given year. The recorded value of goodwill

and intangible assets from recently acquired businesses are derived from more recent

business operating plans and macroeconomic environmental conditions and therefore are

more susceptible to an adverse change that could require an impairment charge.

For example, because the Playtex intangible and goodwill amounts represent values of a

relatively more recent acquisition date, such amounts are more susceptible to an impairment

risk, if operating results or macroeconomic conditions deteriorate. Playtex indefinite-lived

intangible assets, exclusive of goodwill, represent approximately 77% of total indefinite-lived

intangible assets and approximately 63% of total goodwill at September 30, 2010. We utilized

a discounted cash flow model to test intangible assets and goodwill for impairment. Key

assumptions used in the Playtex impairment analysis included (i) an eight year compound

annual growth rate of approximately 3.6% for revenue; (ii) terminal value using a revenue

growth rate of 3% and discount rates ranging from 8% to 9%.

Accounting Standards

See discussion in Note 2 to the Consolidated Financial Statements related to recently issued

accounting standards.

Forward-Looking Statements

This document contains both historical and forward-looking statements. Forward-looking

statements are not based on historical facts but instead reflect our expectations, estimates or

projections concerning future results or events, including, without limitation; our expectations as

to anticipated pre-tax restructuring charges and future cost savings; the impact of further

decline in the battery category; our competitive position and market share presence in both

Household Products and Personal Care categories; capital expenditures and other investments

during fiscal 2011; advertising and promotional spending; the impact of foreign currency

movements (excluding Venezuela); raw material and commodity costs; the impact of

contractual purchase obligations; and the possibility of material environmental costs in excess

of accruals.