Delta Airlines 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

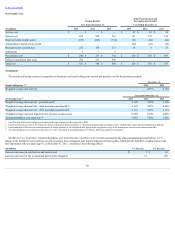

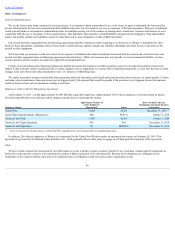

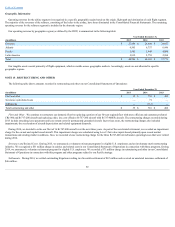

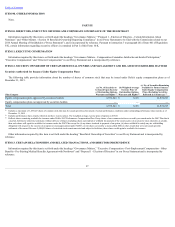

NOTE13.ACCUMULATEDOTHERCOMPREHENSIVELOSS

Thefollowingtableshowsthecomponentsofaccumulatedothercomprehensiveloss:

(inmillions)

Pensionand

OtherBenefits

Liabilities(2)

Derivative

Contracts(3) Investments Total

BalanceatJanuary1,2013 $ (8,307) $ (263) $ (7) $ (8,577)

Changesinvalue(netoftaxeffectof$0) 2,760 296 (19) 3,037

Reclassificationintoearnings(netoftaxeffectof$321)(1) 224 186 — 410

BalanceatDecember31,2013 (5,323) 219 (26) (5,130)

Changesinvalue(netoftaxeffectof$1,276) (2,267) 83 10 (2,174)

Reclassificationintoearnings(netoftaxeffectof$4)(1) 73 (80) — (7)

BalanceatDecember31,2014 (7,517) 222 (16) (7,311)

Changesinvalue(netoftaxeffectof$41) 10 43 (45) 8

Reclassificationintoearnings(netoftaxeffectof$16)(1) 153 (125) — 28

BalanceatDecember31,2015 $ (7,354) $ 140 $ (61) $ (7,275)

(1) AmountsreclassifiedfromAOCIforpensionandotherbenefitsarerecordedinsalariesandrelatedcostsintheConsolidatedStatementsofOperations.AmountsreclassifiedfromAOCIfor

derivativecontractsdesignatedasforeigncurrencycashflowhedgesandinterestratecashflowhedgesarerecordedinpassengerrevenueandinterestexpense,net,respectively,inthe

ConsolidatedStatementsofOperations.

(2)Includes$1.9billionofdeferredincometaxexpense,primarilyrelatedtopensionobligations,thatwillnotberecognizedinnetincomeuntilthepensionobligationsarefullyextinguished.

(3)Included$321millionofdeferredincometaxexpensethatremainedinAOCIuntilDecember2013whenallamountsinAOCIthatrelatedtoderivativecontractsdesignatedasfuelcash

flowhedgeswererecognizedintheConsolidatedStatementofOperations.

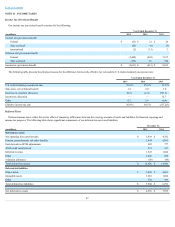

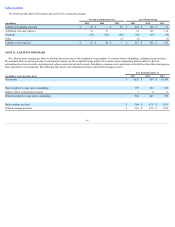

NOTE14.SEGMENTSANDGEOGRAPHICINFORMATION

Operatingsegmentsaredefinedascomponentsofanenterpriseaboutwhichseparatefinancialinformationisavailablethatisevaluatedregularlybythechief

operatingdecisionmaker,ordecisionmakinggroup,andisusedinresourceallocationandperformanceassessments.Ourchiefoperatingdecisionmakeris

consideredtobeourexecutiveleadershipteam.Ourexecutiveleadershipteamregularlyreviewsdiscreteinformationforourtwooperatingsegments,whichare

determinedbytheproductsandservicesprovided:ourairlinesegmentandourrefinerysegment.

Airline Segment

OurairlinesegmentismanagedasasinglebusinessunitthatprovidesscheduledairtransportationforpassengersandcargothroughouttheU.S.andaroundthe

worldandotherancillaryairlineservices.Thisallowsustobenefitfromanintegratedrevenuepricingandroutenetwork.Ourflightequipmentformsonefleet,

whichisdeployedthroughasinglerouteschedulingsystem.Whenmakingresourceallocationdecisions,ourchiefoperatingdecisionmakerevaluatesflight

profitabilitydata,whichconsidersaircrafttypeandrouteeconomics,butgivesnoweighttothefinancialimpactoftheresourceallocationdecisiononanindividual

carrierbasis.Ourobjectiveinmakingresourceallocationdecisionsistooptimizeourconsolidatedfinancialresults.

Refinery Segment

InJune2012,ourwholly-ownedsubsidiaries,MonroeEnergy,LLC,andMIPC,LLC(collectively,“Monroe”),acquiredtheTraineroilrefineryandrelated

assetslocatednearPhiladelphia,Pennsylvaniafor$180millionaspartofourstrategytomitigatethecostoftherefiningmarginreflectedinthepriceofjetfuel.

TheacquisitionincludedpipelinesandterminalassetsthatallowtherefinerytosupplyjetfueltoourairlineoperationsthroughouttheNortheasternU.S.,including

ourNewYorkhubsatLaGuardiaandJFK.Monroereceiveda$30milliongrantfromtheCommonwealthofPennsylvania.

Weaccountedfortherefineryacquisitionasabusinesscombination.Therefinery,pipelinesandterminalassetsacquiredwererecordedat$180millionin

propertyandequipment,netbasedontheirrespectivefairvaluesontheclosingdateofthetransaction.

90