Delta Airlines 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191

|

|

TableofContents

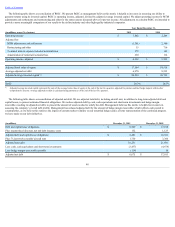

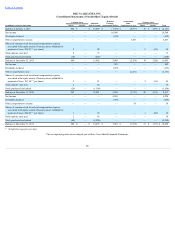

Interest Rate Risk

Ourexposuretomarketriskfromadversechangesininterestratesisprimarilyassociatedwithourlong-termdebtobligations.Marketriskassociatedwithour

fixedandvariableratelong-termdebtrelatestothepotentialreductioninfairvalueandnegativeimpacttofutureearnings,respectively,fromanincreasein

interestrates.

AtDecember31,2015,wehad$4.0billionoffixed-ratelong-termdebtand$4.1billionofvariable-ratelong-termdebt.Anincreaseof100basispointsin

averageannualinterestrateswouldhavedecreasedtheestimatedfairvalueofourfixed-ratelong-termdebtby$160millionatDecember31,2015andwouldhave

increasedtheannualinterestexpenseonourvariable-ratelong-termdebtby$39million,exclusiveoftheimpactofourinterestratehedgecontract.Wehaveone

interestratehedgecontractwithanotionalvalueof$384million.

Foreign Currency Exchange Risk

Wearesubjecttoforeigncurrencyexchangerateriskbecausewehaverevenueandexpensedenominatedinforeigncurrencieswithourprimaryexposures

beingtheJapaneseyenandCanadiandollar.Tomanageexchangeraterisk,weexecutebothourinternationalrevenueandexpensetransactionsinthesameforeign

currencytotheextentpracticable.Fromtimetotime,wemayalsoenterintoforeigncurrencyoptionandforwardcontracts.AtDecember31,2015,wehadopen

foreigncurrencyforwardcontractstotalinga$94millionassetposition.Weestimatethata10%depreciationorappreciationinthepriceoftheJapaneseyenand

CanadiandollarinrelationtotheU.S.dollarwouldchangetheprojectedcashsettlementvalueofouropenhedgecontractsbya$38milliongainor$46million

loss,respectively,fortheyearendingDecember31,2016.

51