Delta Airlines 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

ITEM7A.QUANTITATIVEANDQUALITATIVEDISCLOSURESABOUTMARKETRISK

Wehavemarketriskexposurerelatedtoaircraftfuelprices,interestratesandforeigncurrencyexchangerates.Marketriskisthepotentialnegativeimpactof

adversechangesinthesepricesorratesonourConsolidatedFinancialStatements.Inanefforttomanageourexposuretotheserisks,weenterintoderivative

contractsandmayadjustourderivativeportfolioasmarketconditionschange.Weexpectadjustmentstothefairvalueoffinancialinstrumentstoresultinongoing

volatilityinearningsandstockholders'equity.

Thefollowingsensitivityanalysisdoesnotconsidertheeffectsofachangeindemandforairtravel,theeconomyasawholeoractionswemaytaketoseekto

mitigateourexposuretoaparticularrisk.Fortheseandotherreasons,theactualresultsofchangesinthesepricesorratesmaydiffermateriallyfromthefollowing

hypotheticalresults.

Aircraft Fuel Price Risk

Changesinaircraftfuelpricesmateriallyimpactourresultsofoperations.Weactivelymanageourfuelpriceriskthroughahedgingprogramintendedtoreduce

thefinancialimpactfromchangesinthepriceofjetfuel.Weutilizedifferentcontractandcommoditytypesinthisprogramandfrequentlytesttheireconomic

effectivenessagainstourfinancialtargets.Wecloselymonitorthehedgeportfolioandrebalancetheportfoliobasedonmarketconditions,whichmayresultin

lockingingainsorlossesonhedgecontractspriortotheirsettlementdates.

Ourfuelhedgeportfolioconsistsofoptions,swapsandfutures.Thehedgecontractsincludecrudeoil,dieselfuelandjetfuel,asthesecommoditiesarehighly

correlatedwiththepriceofjetfuelthatweconsume.Ourfuelhedgecontractscontainmarginfundingrequirements.Themarginfundingrequirementsmaycause

ustopostmargintocounterpartiesormaycausecounterpartiestopostmargintousasmarketpricesintheunderlyinghedgeditemschange.Iffuelpriceschange

significantlyfromthelevelsexistingatthetimeweenterintofuelhedgecontracts,wemayberequiredtopostasignificantamountofmargin.Wemayadjustour

hedgeportfoliofromtimetotimeinresponsetomarginpostingrequirements.

FortheyearendedDecember31,2015,aircraftfuelandrelatedtaxes,includingourregionalcarriers,accountedfor$7.6billion,or23.0%,ofourtotal

operatingexpense.Werecognized$741millionoffuelhedgelossesduringtheyearendedDecember31,2015,duetounfavorableMTMadjustments.

DuringtheDecember2015quarter,weenteredintohedgesdesignedtooffsetandeffectivelyterminateourexistinghedgepositionsfortheMarch2016

quarter.InJanuary2016,wecontinuedthisprocessforsubstantiallyallofourpositionswithcontractsettlementdatesthroughDecember31,2016.Asaresult,we

havebothneutralizedourhedgeportfolioandlockedincashpaymentsofapproximately$725millionin2016.

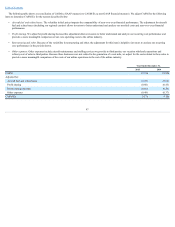

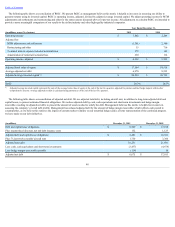

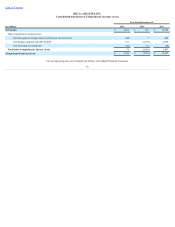

Thefollowingtableshowstheprojectedcashimpacttofuelcostassuming20%and40%increasesordecreasesinfuelpricesfortheperiodfromFebruary1,

2016toDecember31,2016.Asaresultofeffectivelyterminatingourhedgepositionsasdiscussedabove,theimpactofourhedgeportfolioduetochangesinfuel

pricesduring2016isnotsignificant.

(inmillions,exceptforpercentages) (Increase)Decrease(1)

+40% $ (1,630)

+20% (820)

-20% 820

-40% 1,630

(1) Projectionsbaseduponthe(increase)decreasetounhedgedfuelcostascomparedtothejetfuelpricepergallonof$1.01,excludingtransportationcostsandtaxes,atJanuary31,2016and

estimatedfuelconsumptionof3.7billiongallonsfortheperiodfromFebruary1,2016toDecember31,2016.

50