Delta Airlines 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

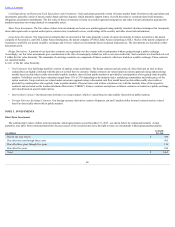

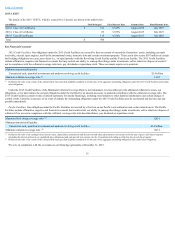

Long-Term Investments

Wehavedevelopedstrategicrelationshipswithcertainairlinesthroughequityinvestmentsandotherformsofcooperationandsupport.Thesestrategic

relationshipsareimportanttousastheyimprovecoordinationwiththeseairlinesandenableourcustomerstoseamlesslyreachmoredestinations.

• Aeroméxico.InordertoexpandoureconomicinterestinAeroméxico,weenteredintoaderivativecontractfor58.9millionsharesofAeroméxico'sparent

company.Throughtheinterestinthederivative,wewillparticipateintheincreasesanddecreasesinvalueofthesharesandrecordthosechangesinother

expenseontheConsolidatedStatementsofOperations.Atthematuritydateofthederivativecontract,wemayacquirealloraportionofthesharesorsettle

incash.Ifthederivativetermisnotextended,thederivativewillmatureinMay2016.Wehavealsoannouncedourintentiontocommenceatenderofferfor

additionalcapitalstockofGrupoAeroméxico(theparentcompanyofAeroméxico)thatwouldresultinusowningupto49%oftheoutstandingshares.

•GOL.During2015,weacquiredpreferredsharesofGOL'sparentcompanyfor$50million,increasingourownershipto9.5%ofGOL'soutstandingcapital

stock.Additionally,GOLenteredintoa$300millionfive-yeartermloanfacilitywiththirdparties,whichwehaveguaranteed.Ourguarantyisprimarily

securedbyGOL'sownershipinterestinSmiles,GOL'spublicly-tradedloyaltyprogram.AsGOLremainsincompliancewiththetermsofitsloanfacility,

wehavenotrecordedaliabilityonourConsolidatedBalanceSheetsasofDecember31,2015.Inconjunctionwiththesetransactions,weandGOLagreed

toextendourexistingcommercialagreements.

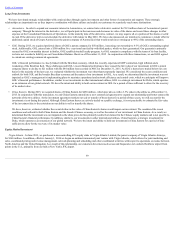

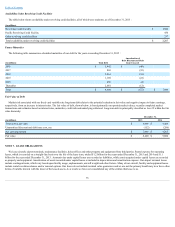

GOL’sfinancialperformanceiscloselylinkedwiththeBrazilianeconomy,whichhasrecentlyexperiencedGDPcontraction,highinflationanda

weakeningoftheBrazilianReal.ThesechallengesandGOL’srecentfinancialperformancehavecausedthefairvalueofourinvestmentinGOL’sparent

companysharestodeclineto$21millionwiththe$84millionlossrecordedinAOCIatDecember31,2015.AsGOL’sshareshavetradedbelowourcost

basisforthemajorityofthelastyear,weevaluatedwhethertheinvestmentwasother-than-temporarilyimpaired.Weconsideredtherecentconditionsand

outlookforbothGOLandthebroaderBrazilianeconomyandthenatureofourinvestmentinGOL.Asaresult,wedeterminedthattheinvestmentwasnot

impairedasGOL’smanagementisimplementingplanstomaximizeoperationalandnetworkefficiencyandcontrolcosts,whichweanticipatewillimprove

GOL’sfinancialperformance.Inaddition,similartoourinvestmentsinotherinternationalairlines,GOLisastrategicinvestmentforDelta,whichoperates

asanextensionofourglobalnetwork.WehavetheintentandabilitytoholdourinvestmentinGOLforaperiodoftimesufficienttoallowfortherecovery

ofitsmarketvalue.

•ChinaEastern.During2015,weacquiredsharesofChinaEasternfor$450million,whichprovidesuswitha3.5%stakeintheairlineasofDecember31,

2015.Inconjunctionwiththistransaction,weandChinaEasternenteredintoanewcommercialagreementtoexpandourrelationshipandbetterconnectthe

networksofthetwoairlines.Astheinvestmentagreementrestrictsoursaleortransferofthesesharesforaperiodofthreeyears,wewillaccountforthe

investmentatcostduringthisperiod.AlthoughChinaEasternsharesareactivelytradedonapublicexchange,itisnotpracticabletoestimatethefairvalue

oftheinvestmentduetotherestrictiononourabilitytosellortransfertheshares.

Wehave,however,evaluatedwhethertherecentdeclineinthevalueofChinaEastern'sshareswouldimpairourinvestment.Weconsideredtherecent

conditionsandoutlookforbothChinaEasternandthebroaderChineseeconomy,aswellasthenatureofourinvestmentinChinaEastern.Asaresult,we

determinedthattheinvestmentwasnotimpairedasthesharepricedeclineprimarilyresultsfromturmoilintheChineseequitymarketsandisnotspecificto

ChinaEastern'sfinancialperformance.Inaddition,similartoourinvestmentsinotherinternationalairlines,ChinaEasternisastrategicinvestmentfor

Delta,whichoperatesasanextensionofourglobalnetwork.WehavetheintentandabilitytoholdourinvestmentinChinaEasternforaperiodoftime

sufficienttoallowfortherecoveryofitsmarketvalue.

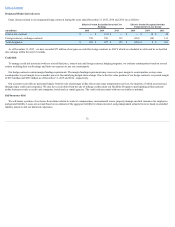

Equity Method Investment

VirginAtlantic.InJune2013,wepurchasedanon-controlling49%equitystakeinVirginAtlanticLimited,theparentcompanyofVirginAtlanticAirways,

for$360million.Inaddition,effectiveJanuary1,2014webegananantitrustimmunizedjointventurewithVirginAtlantic,whichallowsforjointmarketingand

sales,coordinatedpricingandrevenuemanagement,networkplanningandschedulingandothercoordinatedactivitieswithrespecttooperationsonroutesbetween

NorthAmericaandtheUnitedKingdom.Asaresultofthisrelationship,ourcustomershaveincreasedaccessandfrequenciestoLondon'sHeathrowairportfrom

pointsintheU.S.,primarilyfromourhubatNewYork'sJFKairport.

69