Delta Airlines 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

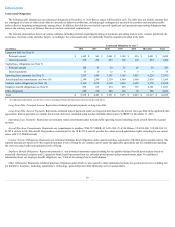

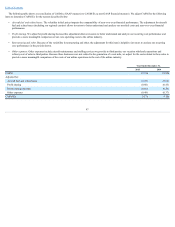

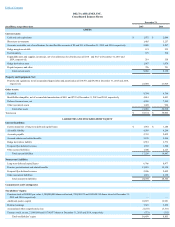

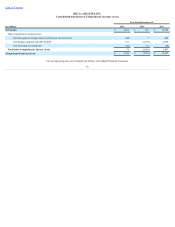

ThefollowingtableshowsareconciliationofROIC.WepresentROICasmanagementbelievesthismetricishelpfultoinvestorsinassessingourabilityto

generatereturnsusingitsinvestedcapital.ROICisoperatingincome,adjusted,dividedbyadjustedaverageinvestedcapital.WeadjustoperatingincomeforMTM

adjustmentsandsettlementsandrestructuringandotherforthesamereasonsdiscussedaboveforpre-taxincome.AlladjustmentstocalculateROICareintendedto

provideamoremeaningfulcomparisonofourresultstotheairlineindustryandotherhigh-qualityindustrialcompanies.

YearEndedDecember31,

(inmillions,except%ofreturn)

2015

2014

Operatingincome

$ 7,802

$ 2,206

Adjustedfor:

MTMadjustmentsandsettlements

(1,301)

2,346

Restructuringandother

35

716

7xannualinterestexpenseincludedinaircraftrent

172

149

Amortizationofretirementactuarialloss

230

112

Operatingincome,adjusted

$ 6,938

$ 5,529

Adjustedbookvalueofequity

$ 17,564

$ 18,518

Averageadjustednetdebt

6,970

8,215

Adjustedaverageinvestedcapital(1)

$ 24,534

$ 26,733

ROIC

28.3%

20.7%

(1) Adjustedaverageinvestedcapitalrepresentsthesumoftheaveragebookvalueofequityattheendofthelastfivequarters,adjustedforpensionandfuelhedgeimpactswithinother

comprehensiveincome.Averageadjustednetdebtiscalculatedusingamountsasoftheendofthelastfivequarters.

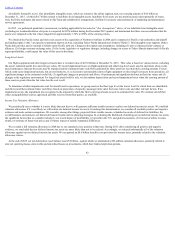

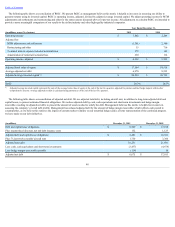

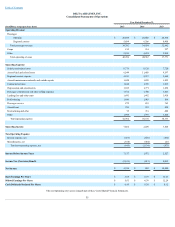

Thefollowingtableshowsareconciliationofadjustednetdebt.Weuseadjustedtotaldebt,includingaircraftrent,inadditiontolong-termadjusteddebtand

capitalleases,topresentestimatedfinancialobligations.Wereduceadjusteddebtbycash,cashequivalentsandshort-terminvestmentsandhedgemargin

receivable,resultinginadjustednetdebt,topresenttheamountofassetsneededtosatisfythedebt.Managementbelievesthismetricishelpfultoinvestorsin

assessingthecompany’soveralldebtprofile.Managementhasreducedadjusteddebtbytheamountofhedgemarginreceivable,whichreflectscashpostedto

counterparties,aswebelievethisremovestheimpactofcurrentmarketvolatilityonourunsettledhedgesandisabetterrepresentationofthecontinuedprogress

wehavemadeonourdebtinitiatives.

(inmillions)

December31,2015

December31,2009

Debtandcapitalleaseobligations

$ 8,329

$ 17,198

Plus:unamortizeddiscount,netanddebtissuancecosts

152

1,123

Adjusteddebtandcapitalleaseobligations

$ 8,481

$ 18,321

Plus:7xlasttwelvemonths'aircraftrent

1,750

3,360

Adjustedtotaldebt

10,231

21,681

Less:cash,cashequivalentsandshort-terminvestments

(3,437)

(4,678)

Less:hedgemargin(receivable)payable

(119)

10

Adjustednetdebt

$ 6,675

$ 17,013

48