Delta Airlines 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

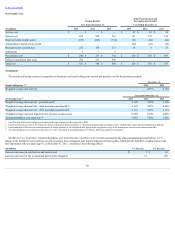

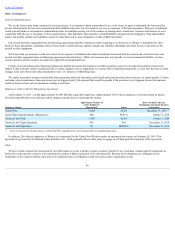

ExpectedLong-TermRateofReturn.Ourexpectedlong-termrateofreturnonplanassetsisbasedprimarilyonplan-specificinvestmentstudiesusinghistorical

marketreturnandvolatilitydata.Modestexcessreturnexpectationsversussomepublicmarketindicesareincorporatedintothereturnprojectionsbasedonthe

activelymanagedstructureoftheinvestmentprogramsandtheirrecordsofachievingsuchreturnshistorically.Wealsoexpecttoreceiveapremiumforinvesting

inlessliquidprivatemarkets.Wereviewourrateofreturnonplanassetsassumptionsannually.Ourannualinvestmentperformanceforoneparticularyeardoes

not,byitself,significantlyinfluenceourevaluation.Theinvestmentstrategyforourdefinedbenefitpensionplanassetsistoearnalong-termreturnthatmeetsor

exceedsourannualizedreturntargetwhiletakinganacceptablelevelofriskandmaintainingsufficientliquiditytopaycurrentbenefitsandothercashobligations

oftheplan.Thisisachievedbyinvestinginagloballydiversifiedmixofpublicandprivateequity,fixedincome,realassets,hedgefundsandotherassetsand

instruments.Ourexpectedlong-termrateofreturnonassetsfornetperiodicpensionbenefitcostfortheyearendedDecember31,2015was9%.

LifeExpectancy.WehavehistoricallyutilizedtheSocietyofActuaries'("SOA")publishedmortalitydataindevelopingabestestimateoflifeexpectancy.

During2014,theSOApublishedupdatedmortalitytablesforU.S.plansandanupdatedimprovementscale,whichbothreflectimprovedlongevity.Basedonan

evaluationofthesenewtablesandourperspectiveoffuturelongevity,weupdatedthemortalityassumptionsin2014forpurposesofmeasuringpensionandother

postretirementandpostemploymentbenefitobligations.Theimprovementinlifeexpectancyincreasesourbenefitobligationsandfutureexpenseasbenefit

paymentsarepaidoveranextendedperiodoftime.In2015,wereviewedthemortalityassumptionsandconcludedthattheassumptionsusedin2014continueto

representourbestestimateoflong-termlifeexpectancy.Wewillcontinuetoreviewourassumptionsonanannualbasis.

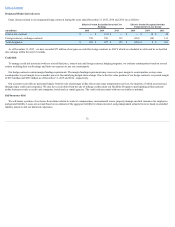

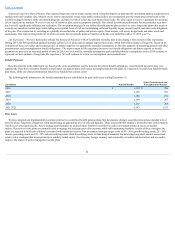

Benefit Payments

Benefitpaymentsinthetablebelowarebasedonthesameassumptionsusedtomeasuretherelatedbenefitobligations.Actualbenefitpaymentsmayvary

significantlyfromtheseestimates.Benefitsearnedunderourpensionplansandcertainpostemploymentbenefitplansareexpectedtobepaidfromfundedbenefit

plantrusts,whileourotherpostretirementbenefitsarefundedfromcurrentassets.

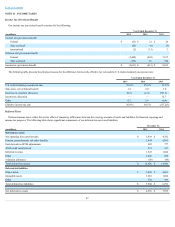

Thefollowingtablesummarizes,thebenefitpaymentsthatarescheduledtobepaidintheyearsendingDecember31:

(inmillions) PensionBenefits

OtherPostretirementand

PostemploymentBenefits

2016 $ 1,154 $ 286

2017 1,158 281

2018 1,180 271

2019 1,199 267

2020 1,219 268

2021-2025 6,343 1,335

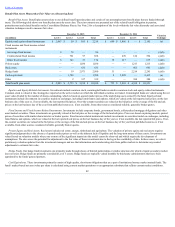

Plan Assets

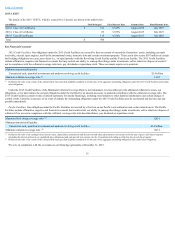

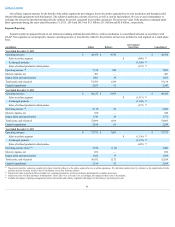

Wehaveadoptedandimplementedinvestmentpoliciesforourdefinedbenefitpensionplansthatincorporatestrategicassetallocationmixesintendedtobest

meettheplans’long-termobligations,whilemaintaininganappropriatelevelofriskandliquidity.Theseassetportfoliosemployadiversifiedmixofinvestments,

whicharereviewedperiodically.Activemanagementstrategiesareutilizedwherefeasibleinanefforttorealizeinvestmentreturnsinexcessofmarket

indices.Derivativesintheplansareprimarilyusedtomanageriskandgainassetclassexposurewhilestillmaintainingliquidity.Aspartofthesestrategies,the

plansarerequiredtoholdcashcollateralassociatedwithcertainderivatives.Ourinvestmentstrategiestargetamixof40-50%growth-seekingassets,20-30%

income-generatingassetsand25-30%risk-diversifyingassets.Riskdiversifyingassetsincludehedgedmandatesimplementinglong-short,marketneutraland

relativevaluestrategiesthatinvestprimarilyinpublicly-tradedequity,fixedincome,foreigncurrencyandcommoditysecuritiesandderivativesandareusedto

improvetheimpactofactivemanagementontheplans.

81