Delta Airlines 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

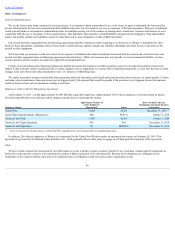

AtDecember31,2015,wehad$379millionoffederalalternativeminimumtaxcreditcarryforwards,whichdonotexpire,and$9.5billionoffederalpre-tax

netoperatinglosscarryforwards,whichwillnotbegintoexpireuntil2024.

Valuation Allowance

Weperiodicallyassesswhetheritismorelikelythannotthatwewillgeneratesufficienttaxableincometorealizeourdeferredincometaxassets.Weestablish

valuationallowancesifitisnotlikelywewillrealizeourdeferredincometaxassets.Inmakingthisdetermination,weconsiderallavailablepositiveandnegative

evidenceandmakecertainassumptions.Weconsider,amongotherthings,projectedfuturetaxableincome,scheduledreversalsofdeferredtaxliabilities,the

overallbusinessenvironment,ourhistoricalfinancialresultsandtaxplanningstrategies.Werecordedafullvaluationallowancein2004duetoourcumulativeloss

positionatthattime,compoundedbythenegativeindustry-widebusinesstrendsandoutlook.

AtDecember31,2013,wereleasedsubstantiallyallofthevaluationallowanceagainstournetdeferredtaxassets,resultinginan$8.3billionbenefitinour

provisionforincometaxes.During2014and2015,wecontinuedourtrendofsustainedprofitability.Afterconsideringallavailablepositiveandnegativeevidence,

wereleasedadditionalvaluationallowancesrelatedtonetoperatinglossesandcapitallosscarryoversineachofthoseyears.Asaresult,atDecember31,2014and

2015,weretainedvaluationallowancesof$46millionand$56million,respectively,primarilyrelatedtostatenetoperatinglosses,statecreditsandunrealized

lossesoninvestments,whichhavelimitedexpirationperiods.

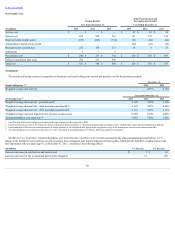

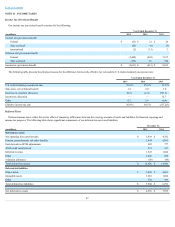

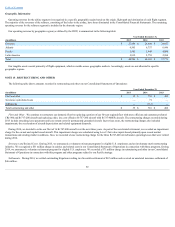

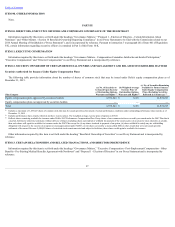

Thefollowingtableshowsthebalanceofourvaluationallowanceandtheassociatedactivity:

(inmillions) 2015 2014 2013

Valuationallowanceatbeginningofperiod $ 46 $ 177 $ 10,963

Incometaxprovision — (9) (975)

Othercomprehensiveincometaxbenefit(provision) 24 (3) (1,186)

Expirations (4) (91) —

Releaseofvaluationallowance (10) (28) (8,310)

Other — — (315)

Valuationallowanceatendofperiod $ 56 $ 46 $ 177

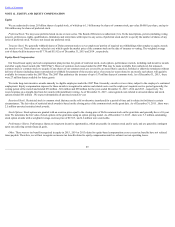

Income Tax Allocation

Weconsiderallincomesources,includingothercomprehensiveincome,indeterminingtheamountoftaxbenefitallocatedtocontinuingoperations.Attheend

of2013,wereleasedourtaxvaluationallowance,asdiscussedabove,andsettledallofourfuelderivativesdesignatedasaccountinghedges.Asaresult,anincome

taxbenefitof$1.9billionrelatedtoourvaluationallowancereleaseandanincometaxexpenseof$321millionrelatedtosettlementofourfuelderivativewas

recognizedinourConsolidatedStatementofOperationsfortheyearendedDecember31,2013.Incometaxexpenseof$1.9billionremainsinAOCI,primarily

relatedtopensionobligations.Thistaxexpensewillnotberecognizedinnetincomeuntilthepensionobligationsarefullyextinguished.

Uncertain Tax Positions

Theamountof,andchangesto,ouruncertaintaxpositionswerenotmaterialinanyoftheyearspresented.Theamountofunrecognizedtaxbenefitsat

December31,2015,2014and2013was$32million,$40millionand$37million,respectively.Weaccrueinterestandpenaltiesrelatedtounrecognizedtax

benefitsininterestexpenseandoperatingexpense,respectively.Interestandpenaltiesarenotmaterialinanyperiodpresented.

WearecurrentlyunderauditbytheIRSforthe2015,2014and2013taxyears.

88