Delta Airlines 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

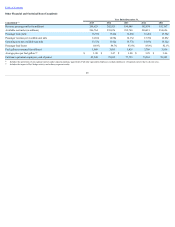

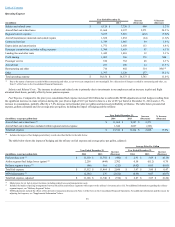

Non-OperatingResults

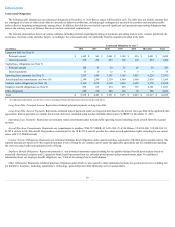

YearEndedDecember31,

Favorable(Unfavorable)

(inmillions) 2015 2014 2013

2015vs.2014 2014vs.2013

Interestexpense,net $ (481) $ (650) $ (852)

$ 169 $ 202

Miscellaneous,net (164) (484) (21)

320 (463)

Totalnon-operatingexpense,net $ (645) $ (1,134) $ (873)

$ 489 $ (261)

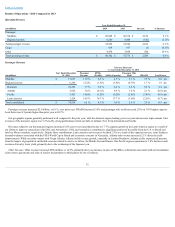

Thedeclineininterestexpense,netresultsfromreducedlevelsofdebtandunamortizeddebtdiscountsandfromtherefinancingofdebtobligationsatlower

interestrates.Theprincipalamountofdebtandcapitalleaseshasdeclinedfrom$13.2billionatthebeginningof2013to$8.5billionatDecember31,2015.

Miscellaneous,netisfavorableprimarilyduetoareductionindebtextinguishmentlossescomparedto2014.Thedebtextinguishmentlossesprimarilyrelated

tounamortizeddebtdiscountsresultingfromfairvalueadjustmentsrecordedinthe2008purchaseaccountingofNorthwestAirlines.Wedidnotearlyextinguish

anydebtin2013.AlsocontributingtotheincreaseisourproportionateshareofearningsfromourequityinvestmentinVirginAtlantic.ThegainfromVirgin

Atlanticprimarilyresultsfromyear-over-yearprofitandimprovementsinMTMadjustmentsonfuelhedges.

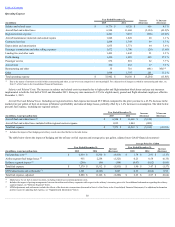

IncomeTaxes

Oureffectivetaxratefor2015was36.8%.Weexpectourannualeffectivetaxratetobebetween35%and36%for2016.Theexpectedreductioninourrate

fromprioryearsisprimarilyrelatedtodifferencesinourglobaltaxrates.Incertainperiodswemayhaveadjustmentstoourdeferredtaxassetsasaresultof

changesinprioryearestimatesandtaxlawsenactedduringtheperiod,whichwillimpacttheeffectivetaxrateforthatperiod.AtDecember31,2015,wehad

approximately$9.5billionofU.S.federalpre-taxnetoperatinglosscarryforwards,whichdonotbegintoexpireuntil2024.Accordingly,webelievewewillnot

payanycashfederalincometaxesbefore2018.SeeNote11oftheNotestotheConsolidatedFinancialStatementsformoreinformation.

WereleasedsubstantiallyallofourvaluationallowanceagainstournetdeferredtaxassetsonDecember31,2013.Thereleaseoftheallowanceprimarily

resultedinanettaxbenefitof$8.0billionthatwasrecordedinincometax(provision)benefitinourConsolidatedStatementofOperations.

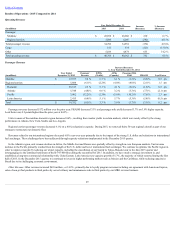

RefinerySegment

Therefineryprimarilyproducesgasoline,dieselandjetfuel.Monroeexchangessubstantiallyallthenon-jetfuelproductstherefineryproduceswiththird

partiesforjetfuelconsumedinourairlineoperations.Thejetfuelproducedandprocuredthroughexchanginggasolineanddieselfuelproducedbytherefinery

providedapproximately171,000barrels(approximatelysevenmilliongallons)perdayforuseinourairlineoperationsduring2015.Webelievethattheincrease

injetfuelsupplyduetotherefinery'soperationhasreducedtheoverallmarketpriceofjetfuel,andthusloweredourcostofjetfuel.

ArefineryissubjecttoannualEPArequirementstoblendrenewablefuelsintothegasolineandon-roaddieselfuelitproduces.Alternatively,arefinerymay

purchaserenewableenergycredits,calledRINs,fromthirdpartiesinthesecondarymarket.BecausetherefineryoperatedbyMonroedoesnotblendrenewable

fuels,itmustpurchaseitsentireRINsrequirementinthesecondarymarketorobtainawaiverfromtheEPA.Werecognized$75million,$111millionand$64

millionofexpenserelatedtotheRINsrequirementin2015,2014and2013,respectively.WeareinpossessionoftheRINsneededtosatisfyour2013obligation

andaportionofour2014and2015obligations.

Therefineryrecordedaprofitof$290millionin2015,comparedto$96millionin2014andalossof$116millionrecordedin2013.Therefinery's

profitabilityimprovedyear-over-yeardespitelowerrevenuesresultingfromadeclineinrefinedfuelmarketprices.Therefinery’sincreaseinprofitswas

attributabletohigherproductcrackspreadsandhigherthroughputasaresultofenhancedoperationalreliability,logisticalimprovementsandutilizationof

intermediates(partiallyrefinedfuels).Formoreinformationregardingtherefinery’sresults,seeNote14oftheNotestotheConsolidatedFinancialStatements.

35