Delta Airlines 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

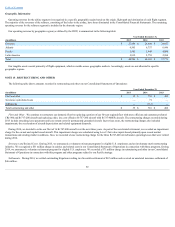

NOTE12.EQUITYANDEQUITYCOMPENSATION

Equity

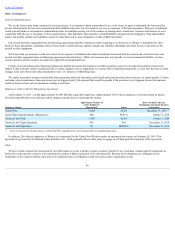

Weareauthorizedtoissue2.0billionsharesofcapitalstock,ofwhichupto1.5billionmaybesharesofcommonstock,parvalue$0.0001pershare,andupto

500millionmaybesharesofpreferredstock.

PreferredStock.Wemayissuepreferredstockinoneormoreseries.TheBoardofDirectorsisauthorized(1)tofixthedescriptions,powers(includingvoting

powers),preferences,rights,qualifications,limitationsandrestrictionswithrespecttoanyseriesofpreferredstockand(2)tospecifythenumberofsharesofany

seriesofpreferredstock.Wehavenotissuedanypreferredstock.

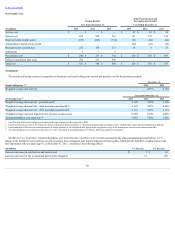

TreasuryStock.WegenerallywithholdsharesofDeltacommonstocktocoveremployees'portionofrequiredtaxwithholdingswhenemployeeequityawards

areissuedorvest.Thesesharesarevaluedatcost,whichequalsthemarketpriceofthecommonstockonthedateofissuanceorvesting.Theweightedaverage

costofsharesheldintreasurywas$17.70and$15.82asofDecember31,2015and2014,respectively.

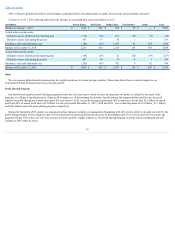

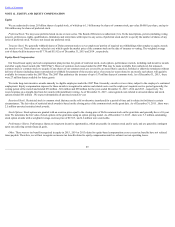

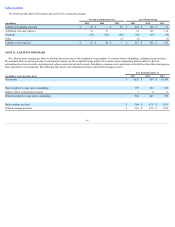

Equity-Based Compensation

Ourbroad-basedequityandcashcompensationplanprovidesforgrantsofrestrictedstock,stockoptions,performanceawards,includingcashincentiveawards

andotherequity-basedawards(the"2007Plan").Sharesofcommonstockissuedunderthe2007Planmaybemadeavailablefromauthorized,butunissued,

commonstockorcommonstockweacquire.Ifanysharesofourcommonstockarecoveredbyanawardthatiscanceled,forfeitedorotherwiseterminateswithout

deliveryofshares(includingsharessurrenderedorwithheldforpaymentoftheexercisepriceofanawardortaxesrelatedtoanaward),suchshareswillagainbe

availableforissuanceunderthe2007Plan.The2007Planauthorizestheissuanceofupto157millionsharesofcommonstock.AsofDecember31,2015,there

were27millionsharesavailableforfuturegrants.

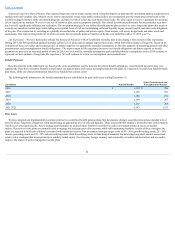

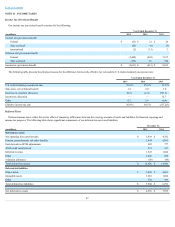

Wemakelong-termincentiveawardsannuallytoeligibleemployeesunderthe2007Plan.Generally,awardsvestovertime,subjecttotheemployee'scontinued

employment.Equitycompensationexpensefortheseawardsisrecognizedinsalariesandrelatedcostsovertheemployee'srequisiteserviceperiod(generally,the

vestingperiodoftheaward)andtotaled$76million,$81millionand$90millionfortheyearsendedDecember31,2015,2014and2013,respectively.We

recordexpenseonastraight-linebasisforawardswithinstallmentvesting.AsofDecember31,2015,unrecognizedcostsrelatedtounvestedsharesandstock

optionstotaled$61million.Weexpectsubstantiallyallunvestedawardstovest.

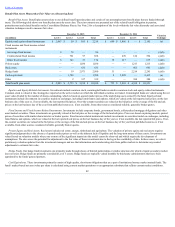

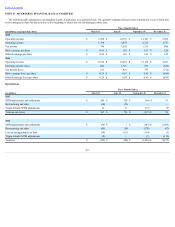

RestrictedStock.Restrictedstockiscommonstockthatmaynotbesoldorotherwisetransferredforaperiodoftimeandissubjecttoforfeitureincertain

circumstances.Thefairvalueofrestrictedstockawardsisbasedontheclosingpriceofthecommonstockonthegrantdate.AsofDecember31,2015,therewere

2.5millionunvestedrestrictedstockawards.

StockOptions.StockoptionsaregrantedwithanexercisepriceequaltotheclosingpriceofDeltacommonstockonthegrantdateandgenerallyhavea10-year

term.Wedeterminethefairvalueofstockoptionsatthegrantdateusinganoptionpricingmodel.AsofDecember31,2015,therewere5.3millionoutstanding

stockoptionawardswithaweightedaverageexercisepriceof$15.05,and4.6millionwereexercisable.

PerformanceShares.Performancesharesarelong-termincentiveopportunities,whicharepayableincommonstockand/orcash,andaregenerallycontingent

uponourachievingcertainfinancialgoals.

Other.Therewasnotaxbenefitrecognizedinequityin2015,2014or2013relatedtoequity-basedcompensationasourexcesstaxbenefitshavenotreduced

taxespayable.Therefore,wewillnotrecognizeanincometaxbenefitrelatedtoequitycompensationuntilweexhaustournetoperatinglosses.

89