Delta Airlines 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

DefinedBenefitPensionPlans

Wesponsordefinedbenefitpensionplansforeligibleemployeesandretirees.Theseplansareclosedtonewentrantsandfrozenforfuturebenefitaccruals.As

ofDecember31,2015,theunfundedbenefitobligationfortheseplansrecordedonourConsolidatedBalanceSheetwas$11.2billion.During2015,we

contributed$1.2billiontotheseplansandrecorded$240millionofexpenseinsalariesandrelatedcostsonourConsolidatedStatementofOperations.In2016,we

estimatewewillcontributeatleast$1.0billiontotheseplans,including$500millionofcontributionsabovetheminimumfundingrequirements,andthatour

expensewillbeapproximately$250million.Themostcriticalassumptionsimpactingourdefinedbenefitpensionplanobligationsandexpensesarethediscount

rate,theexpectedlong-termrateofreturnonplanassetsandlifeexpectancy.

WeightedAverageDiscountRate.Wedetermineourweightedaveragediscountrateonourmeasurementdateprimarilybyreferencetoannualizedratesearned

onhigh-qualityfixedincomeinvestmentsandyield-to-maturityanalysisspecifictoourestimatedfuturebenefitpayments.Weusedaweightedaveragediscount

ratetovaluetheobligationsof4.57%and4.14%atDecember31,2015and2014,respectively.Ourweightedaveragediscountratefornetperiodicpension

benefitcostineachofthepastthreeyearshasvariedfromtherateselectedonourmeasurementdate,rangingfrom4.10%to4.99%between2013and2015.

ExpectedLong-TermRateofReturn.Ourexpectedlong-termrateofreturnonplanassetsisbasedprimarilyonplan-specificinvestmentstudiesusinghistorical

marketreturnandvolatilitydata.Modestexcessreturnexpectationsversussomepublicmarketindicesareincorporatedintothereturnprojectionsbasedonthe

activelymanagedstructureoftheinvestmentprogramsandtheirrecordsofachievingsuchreturnshistorically.Wealsoexpecttoreceiveapremiumforinvesting

inlessliquidprivatemarkets.Wereviewourrateofreturnonplanassetsassumptionsannually.Ourannualinvestmentperformanceforoneparticularyeardoes

not,byitself,significantlyinfluenceourevaluation.Theinvestmentstrategyforourdefinedbenefitpensionplanassetsistoearnalong-termreturnthatmeetsor

exceedsourannualizedreturntargetwhiletakinganacceptablelevelofriskandmaintainingsufficientliquiditytopaycurrentbenefitsandothercashobligations

oftheplan.Thisisachievedbyinvestinginagloballydiversifiedmixofpublicandprivateequity,fixedincome,realassets,hedgefundsandotherassetsand

instruments.Ourexpectedlong-termrateofreturnonassetsfornetperiodicpensionbenefitcostfortheyearendedDecember31,2015was9%.

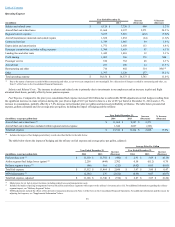

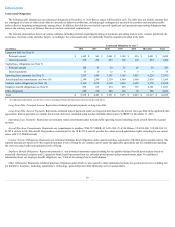

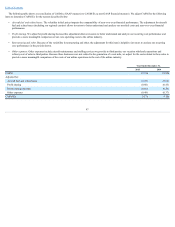

Theimpactofa0.50%changeintheseassumptionsisshowninthetablebelow:

ChangeinAssumption

Effecton2016

PensionExpense

EffectonAccrued

PensionLiabilityat

December31,2015

0.50%decreaseinweightedaveragediscountrate -$1million +$1.3billion

0.50%increaseinweightedaveragediscountrate -$2million -$1.2billion

0.50%decreaseinexpectedlong-termrateofreturnonassets +$50million —

0.50%increaseinexpectedlong-termrateofreturnonassets -$50million —

LifeExpectancy.WehavehistoricallyutilizedtheSocietyofActuaries'("SOA")publishedmortalitydataindevelopingabestestimateoflifeexpectancy.

During2014,theSOApublishedupdatedmortalitytablesforU.S.plansandanupdatedimprovementscale,whichbothreflectimprovedlongevity.Basedonan

evaluationofthesenewtablesandourperspectiveoffuturelongevity,weupdatedthemortalityassumptionsin2014forpurposesofmeasuringpensionandother

postretirementandpostemploymentbenefitobligations.Theimprovementinlifeexpectancyincreasesourbenefitobligationsandfutureexpenseasbenefit

paymentsarepaidoveranextendedperiodoftime.In2015,wereviewedthemortalityassumptionsandconcludedthattheassumptionsusedin2014continueto

representourbestestimateoflong-termlifeexpectancy.Wewillcontinuetoreviewourassumptionsonanannualbasis.

Funding.OurfundingobligationsforqualifieddefinedbenefitplansaregovernedbytheEmployeeRetirementIncomeSecurityAct.ThePensionProtection

Actof2006allowscommercialairlinestoelectalternativefundingrules(“AlternativeFundingRules”)fordefinedbenefitplansthatarefrozen.Deltaelectedthe

AlternativeFundingRulesunderwhichtheunfundedliabilityforafrozendefinedbenefitplanmaybeamortizedoverafixed17-yearperiodandiscalculated

usingan8.85%discountrate.Inaddition,becauseofstatutorypensionfundingreliefthatappliestous,wehaveuntil2031tofullyfundourpensionplans.

43