Delta Airlines 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

WeaccountfortheinvestmentundertheequitymethodofaccountingandrecognizeourportionofVirginAtlantic'sfinancialresultsinotherexpenseinour

ConsolidatedStatementsofOperations.Aspartoftheequitymethodofaccounting,weallocatedtheinvestmentinVirginAtlanticto(1)ourportionoftheir

equity,(2)adjustmentsinthefairmarketvalueofassetsandliabilitiesand(3)impliedgoodwill.

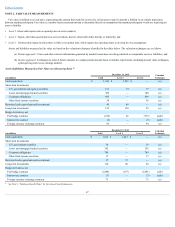

NOTE4.DERIVATIVESANDRISKMANAGEMENT

Changesinaircraftfuelprices,interestratesandforeigncurrencyexchangeratesimpactourresultsofoperations.Inanefforttomanageourexposuretothese

risks,weenterintoderivativecontractsandadjustourderivativeportfolioasmarketconditionschange.

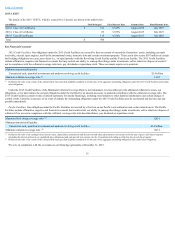

Aircraft Fuel Price Risk

Changesinaircraftfuelpricesmateriallyimpactourresultsofoperations.Weactivelymanageourfuelpriceriskthroughahedgingprogramintendedtoreduce

thefinancialimpactfromchangesinthepriceofjetfuel.Weutilizedifferentcontractandcommoditytypesinthisprogramandfrequentlytesttheireconomic

effectivenessagainstourfinancialtargets.Wecloselymonitorthehedgeportfolioandrebalancetheportfoliobasedonmarketconditions,whichmayresultin

lockingingainsorlossesonhedgecontractspriortotheirsettlementdates.DuringtheyearsendedDecember31,2015and2014,werecordedfuelhedgelosses

of$741millionand$2.0billion,respectively.

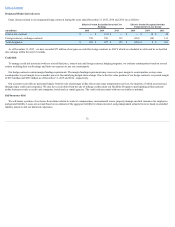

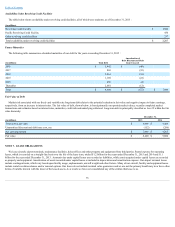

During2015,weeffectivelydeferredsettlementofaportionofourhedgeportfoliountil2016byenteringintofuelderivativetransactionsthat,excluding

marketmovementsfromthedateofinception,wouldsettleandprovideapproximately$300millionincashreceiptsduringthesecondhalfof2015andrequire

approximately$300millionincashpaymentsin2016.Byeffectivelydeferringsettlementofaportionoftheoriginalderivativetransactions,therestructuredhedge

portfolioprovidedadditionaltimeforthefuelmarkettostabilize.Weearlyterminatedcertainofthesedeferraltransactionsin2015.Asaresult,wereported$429

millionincashreceiptsand$71millionincashpaymentsassociatedwiththesedeferraltransactionsascashflowsfromfinancingactivitiesonourConsolidated

StatementofCashFlowsfortheyearendedDecember31,2015.

Duetothecontinuedvolatilityinthefuelmarket,duringJanuaryandFebruary2016,weenteredintoadditionaldeferraltransactionstofurtherdefersettlement

ofaportionofourhedgeportfoliountil2017.Thesedeferraltransactions,excludingmarketmovementsfromthedateofinception,willsettleandprovide

approximately$300millionincashreceiptsduringthesecondhalfof2016andrequireapproximately$300millionincashpaymentsin2017.Wewillreportthe

cashreceiptsandcashpaymentsassociatedwiththesedeferraltransactionsascashflowsfromfinancingactivitiesonourConsolidatedStatementsofCashFlows.

DuringtheDecember2015quarter,weenteredintohedgesdesignedtooffsetandeffectivelyterminateourexistinghedgepositionsfortheMarch2016

quarter.InJanuary2016,wecontinuedthisprocessforsubstantiallyallofourpositionswithcontractsettlementdatesthroughDecember31,2016.Asaresult,we

havebothneutralizedourhedgeportfolioandlockedincashpaymentsofapproximately$725millionin2016,includingthedeferraltransactionsdiscussedabove.

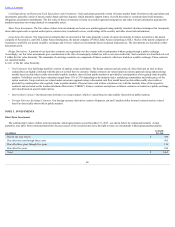

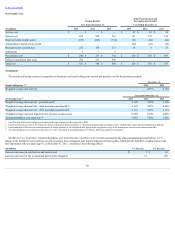

Interest Rate Risk

Ourexposuretomarketriskfromadversechangesininterestratesisprimarilyassociatedwithourlong-termdebtobligations.Marketriskassociatedwithour

fixedandvariableratelong-termdebtrelatestothepotentialreductioninfairvalueandnegativeimpacttofutureearnings,respectively,fromanincreasein

interestrates.

Inanefforttomanageourexposuretotheriskassociatedwithourvariableratelong-termdebt,weperiodicallyenterintointerestrateswaps.Wedesignate

interestratecontractsusedtoconverttheinterestrateexposureonaportionofourdebtportfoliofromafloatingratetoafixedrateascashflowhedges,while

thosecontractsconvertingourinterestrateexposurefromafixedratetoafloatingratearedesignatedasfairvaluehedges.During2014,weterminatedour

remaininginterestrateswapagreementsdesignatedascashflowhedgesinconnectionwiththeextinguishmentoftheunderlyingdebt.

Wealsohaveexposuretomarketriskfromadversechangesininterestratesassociatedwithourcashandcashequivalentsandbenefitplanobligations.Market

riskassociatedwithourcashandcashequivalentsrelatestothepotentialdeclineininterestincomefromadecreaseininterestrates.Pension,postretirement,

postemploymentandworker'scompensationobligationriskrelatestothepotentialincreaseinourfutureobligationsandexpensesfromadecreaseininterestrates

usedtodiscounttheseobligations.

70