Delta Airlines 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

ITEM7.MANAGEMENT'SDISCUSSIONANDANALYSISOFFINANCIALCONDITIONANDRESULTSOFOPERATIONS

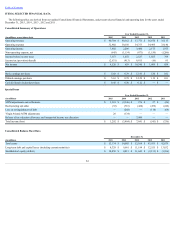

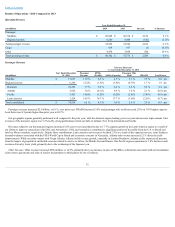

FinancialHighlights-2015Comparedto2014

Ourpre-taxincomefor2015was$7.2billion,representinga$6.1billionincreasecomparedtotheprioryearpredominantlyasaresultoflowerfuelpricesand

strongnon-fuelcostcontrols.Pre-taxincome,adjustedforspecialitems(anon-GAAPfinancialmeasure)increased$1.3billion,or29.3%,to$5.9billion.Special

itemsin2015wereprimarilyrelatedtofuelhedgeMTMadjustmentsandsettlements,whichtotaled$1.3billion.

Revenue.Ouroperatingrevenueincreased$342millioncomparedtotheprioryearprimarilyresultingfromourBrandedFaresinitiativeandouragreementwith

AmericanExpress.Passengerrevenueperavailableseatmile("PRASM")decreased3.3%on3.0%highercapacity.ThedecreaseinPRASMwaslargelydrivenby

competitivepressureinthecurrentlowfuelpriceenvironmentandtheimpactofU.S.dollarstrengthonticketssoldininternationalmarkets,whichare

predominantlypricedinlocalcurrency.

OperatingExpense.Totaloperatingexpensedecreased$5.3billionfrom2014drivenbylowerfuelprices,partiallyoffsetbyfuelhedgelosses,highersalaries

andrelatedcostsandprofitsharing.During2015,Brentcrudeoilaveraged$52perbarrelandclosedtheyearbelow$40perbarrel,whichissignificantlylower

thantheaverageof$99perbarrelduring2014.Salariesandrelatedcostswerehigherasaresultofincreasesinpilotandflightattendantblockhoursduetohigher

capacityandpayrateincreasesimplementedin2015.

Ourconsolidatedoperatingcostperavailableseatmile("CASM")for2015decreased16.3%to13.33centsfrom15.92centsin2014,ona3.0%increasein

capacity,primarilyduetolowerfuelprices.Non-fuelunitcosts("CASM-Ex,"anon-GAAPfinancialmeasure)wereflatin2015comparedto2014at9.17cents

duetostrongnon-fuelcostcontrolsandthestrengthoftheU.S.dollar.Our2015unitcostperformancewasin-linewithourgoaloflimitingnon-fuelunitcost

growthtobelow2%annually.

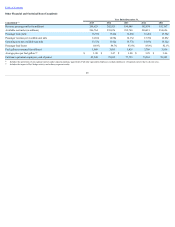

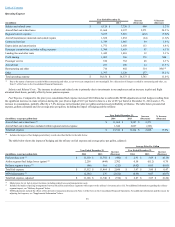

Thenon-GAAPfinancialmeasuresforpre-taxincome,adjustedforspecialitemsandCASM-Exusedinthissectionandreturnoninvestedcapital("ROIC")

andadjustednetdebt,usedinthesectionbelow,aredefinedandreconciledin"SupplementalInformation"below.

CompanyInitiatives

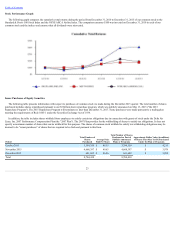

Runningareliable,customer-focusedairlinehasproducedahigherROIC(anon-GAAPfinancialmeasure),whichincreasedfrom20.7%in2014to28.3%in

2015.Thisimprovedfinancialperformancehasallowedustoimproveourbalancesheetbyreducingadjustednetdebt(anon-GAAPfinancialmeasure)to$6.7

billion,increasefundingofourdefinedbenefitpensionplansandincreasetheamountofcapitalreturnedtoourshareholders.Wearefocusedondelivering

additionalvalueforshareholdersinthefuturethroughrevenuegrowth,costproductivityandprudentdeploymentofcashflows.

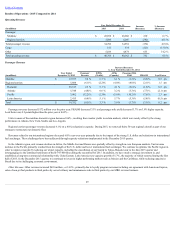

Driving Revenue Growth

OperationalReliability

Akeydriverofourrevenuegrowthishighercustomersatisfactionresultingfromstrongoperationalreliability.Wehavesignificantlyinvestedinourbusiness

since2010toimproveouroperationalperformance,whichconsistentlyranksfirstamongthemajorU.S.carriers.During2015,weoperated161dayswithzero

mainlinecanceledflights,a69%improvementoverour2014performance.Inaddition,ourreportedcompletionfactorof99.6%andon-timearrivalrateof85.9%

placesusatthetopamongthemajorglobalU.S.carriers.Thisoperationalexcellenceresultedinafourpointincreaseinourdomesticnetpromoterscorecompared

to2014.Accordingly,ourcorporateticketvolumeincreased4%in2015,reflectingourreliableserviceandhigh-qualityproduct.

GlobalStrategy

Weareexpandingourglobalnetwork.Underthisstrategy,wearestrengtheningourpresenceinmajoranddevelopingmarketsaroundtheworldinaneffortto

increaseanddiversifyournetworkintohighrevenueandhighgrowthmarkets.Thegrowthofourglobalpresencewillenablecustomerstoseamlesslyconnectto

moreplaceswhileenjoyingaconsistent,high-qualitytravelexperience.WearedeployingthisstrategythroughinvestmentsinEurope,AsiaandLatinAmerica.

26