Delta Airlines 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

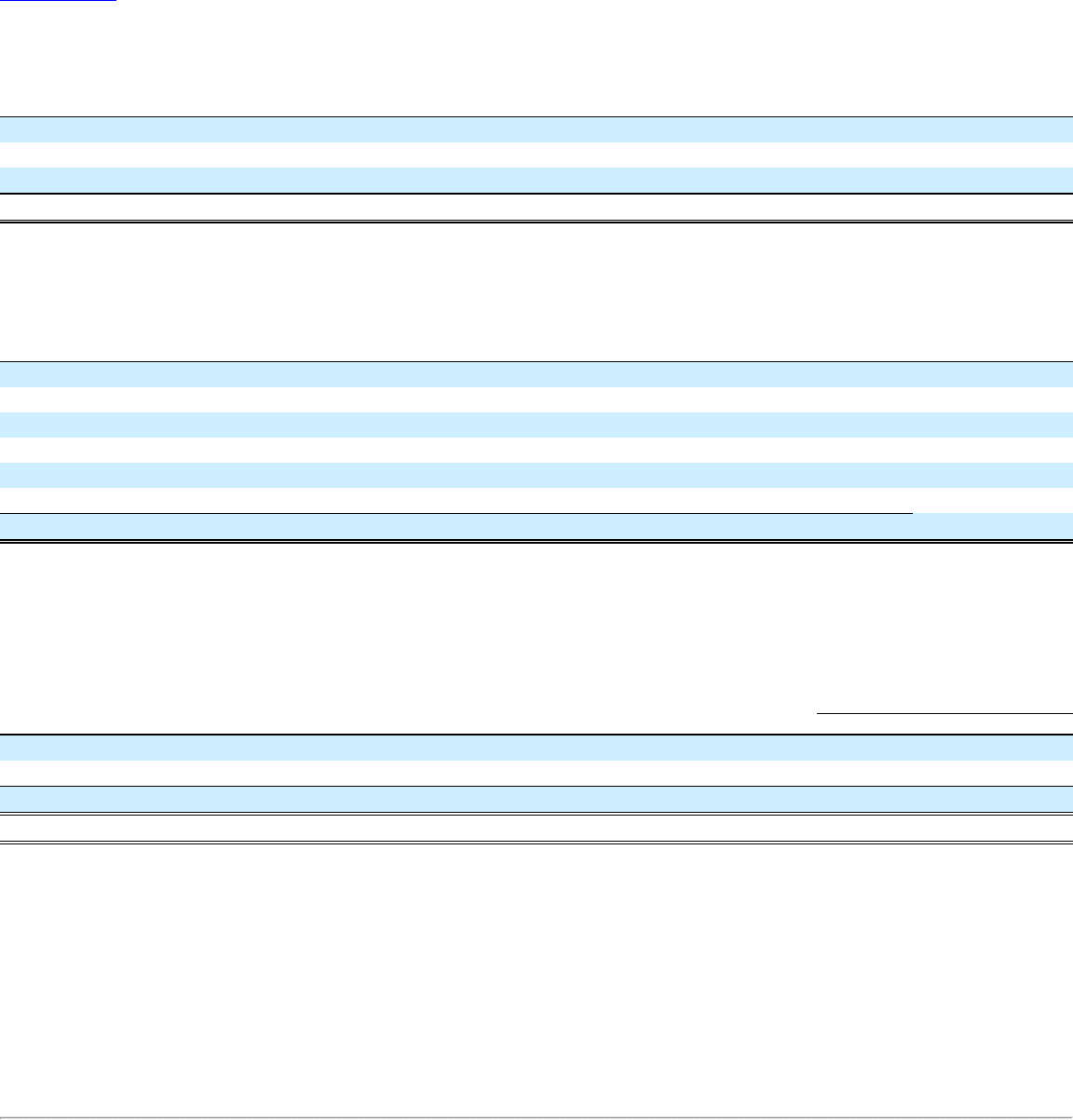

TableofContents

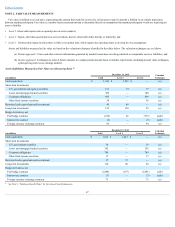

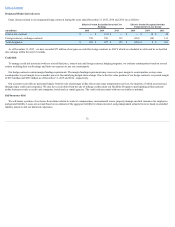

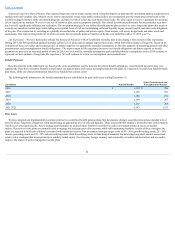

Availability Under Revolving Credit Facilities

Thetablebelowshowsavailabilityunderrevolvingcreditfacilities,allofwhichwereundrawn,asofDecember31,2015:

(inmillions)

RevolvingCreditFacility $ 1,500

PacificRevolvingCreditFacility 450

Otherrevolvingcreditfacilities 257

Totalavailabilityunderrevolvingcreditfacilities $ 2,207

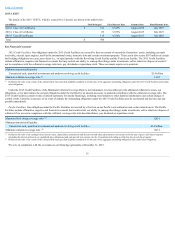

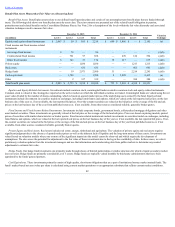

Future Maturities

ThefollowingtablesummarizesscheduledmaturitiesofourdebtfortheyearssucceedingDecember31,2015:

(inmillions) TotalDebt

Amortizationof

DebtDiscountandDebt

IssueCost,net

2016 $ 1,442

$ (40)

2017 869

(39)

2018 2,061

(35)

2019 1,189

(22)

2020 456

(4)

Thereafter 2,081

(12)

Total $ 8,098

$ (152)

$ 7,946

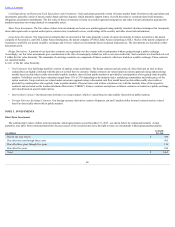

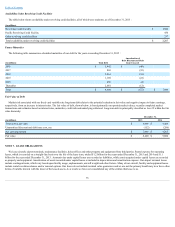

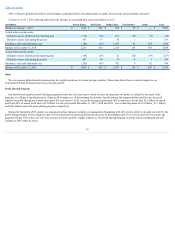

Fair Value of Debt

Marketriskassociatedwithourfixed-andvariable-ratelong-termdebtrelatestothepotentialreductioninfairvalueandnegativeimpacttofutureearnings,

respectively,fromanincreaseininterestrates.Thefairvalueofdebt,shownbelow,isbasedprimarilyonreportedmarketvalues,recentlycompletedmarket

transactionsandestimatesbasedoninterestrates,maturities,creditriskandunderlyingcollateral.Long-termdebtisprincipallyclassifiedasLevel2withinthefair

valuehierarchy.

December31,

(inmillions) 2015 2014

Totaldebtatparvalue $ 8,098 $ 9,469

Unamortizeddiscountanddebtissuecost,net (152) (206)

Netcarryingamount $ 7,946 $ 9,263

Fairvalue $ 8,400 $ 9,800

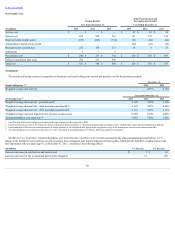

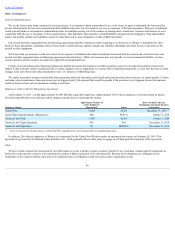

NOTE7.LEASEOBLIGATIONS

Weleaseaircraft,airportterminals,maintenancefacilities,ticketofficesandotherpropertyandequipmentfromthirdparties.Rentalexpenseforoperating

leases,whichisrecordedonastraight-linebasisoverthelifeoftheleaseterm,totaled$1.2billionfortheyearsendedDecember31,2015and2014and$1.1

billionfortheyearendedDecember31,2013.Amountsdueundercapitalleasesarerecordedasliabilities,whileassetsacquiredundercapitalleasesarerecorded

aspropertyandequipment.Amortizationofassetsrecordedundercapitalleasesisincludedindepreciationandamortizationexpense.Ourairportterminalleases

includecontingentrents,whichvarybaseduponfacilityusage,enplanements,aircraftweightandotherfactors.Manyofouraircraft,facilityandequipmentleases

includerentalescalationclausesand/orrenewaloptions.Ourleasesdonotincluderesidualvalueguaranteesandwearenottheprimarybeneficiaryinorhaveother

formsofvariableinterestwiththelessoroftheleasedassets.Asaresult,wehavenotconsolidatedanyoftheentitiesthatleasetous.

76