Delta Airlines 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

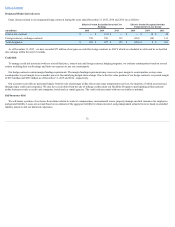

CashEquivalentsandRestrictedCashEquivalentsandInvestments.Cashequivalentsgenerallyconsistofmoneymarketfunds.Restrictedcashequivalentsand

investmentsgenerallyconsistofmoneymarketfundsandtimedeposits,whichprimarilysupportlettersofcreditthatrelatetocertainprojectedself-insurance

obligationsandairportcommitments.Thefairvalueoftheseinvestmentsisbasedonamarketapproachusingpricesandotherrelevantinformationgeneratedby

markettransactionsinvolvingidenticalorcomparableassets.

Short-TermInvestments.Thefairvaluesofshort-terminvestmentsarebasedonamarketapproachusingindustrystandardvaluationtechniquesthatincorporate

observableinputssuchasquotedmarketprices,interestrates,benchmarkcurves,creditratingsofthesecurityandotherobservableinformation.

Long-TermInvestments.Ourlong-terminvestmentsthataremeasuredatfairvalueprimarilyconsistofequityinvestmentsinGrupoAeroméxico,theparent

companyofAeroméxico,andGOLLinhasAéreasInteligentes,theparentcompanyofVRGLinhasAéreas(operatingasGOL).Sharesoftheparentcompaniesof

AeroméxicoandGOLaretradedonpublicexchangesandwehavevaluedourinvestmentsbasedonquotedmarketprices.Theinvestmentsareclassifiedinother

noncurrentassets.

HedgeDerivatives.Aportionofourderivativecontractsarenegotiatedover-the-counterwithcounterpartieswithoutgoingthroughapublicexchange.

Accordingly,ourfairvalueassessmentsgiveconsiderationtotheriskofcounterpartydefault(aswellasourowncreditrisk).SuchcontractsareclassifiedasLevel

2withinthefairvaluehierarchy.Theremainderofourhedgecontractsarecomprisedoffuturescontracts,whicharetradedonapublicexchange.Thesecontracts

areclassifiedwithin

Level1ofthefairvaluehierarchy.

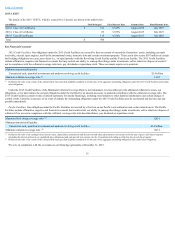

•FuelContracts.Ourfuelhedgeportfolioconsistsofoptions,swapsandfutures.Thehedgecontractsincludecrudeoil,dieselfuelandjetfuel,asthese

commoditiesarehighlycorrelatedwiththepriceofjetfuelthatweconsume.Optioncontractsarevaluedunderanincomeapproachusingoptionpricing

modelsbasedondataeitherreadilyobservableinpublicmarkets,derivedfrompublicmarketsorprovidedbycounterpartieswhoregularlytradeinpublic

markets.Volatilitiesusedinthesevaluationsrangedfrom31%to53%dependingonthematuritydates,underlyingcommoditiesandstrikepricesofthe

optioncontracts.Swapcontractsarevaluedunderanincomeapproachusingadiscountedcashflowmodelbasedondataeitherreadilyobservableor

providedbycounterpartieswhoregularlytradeinpublicmarkets.Discountratesusedinthesevaluationsvarywiththematuritydatesoftherespective

contractsandarebasedontheLondoninterbankofferedrate("LIBOR").Futurescontractsandoptionsonfuturescontractsaretradedonapublicexchange

andvaluedbasedonquotedmarketprices.

•InterestRateContract.Ourinterestratederivativeisaswapcontract,whichisvaluedbasedondatareadilyobservableinpublicmarkets.

•ForeignCurrencyExchangeContracts.OurforeigncurrencyderivativesconsistofJapaneseyenandCanadiandollarforwardcontractsandarevalued

basedondatareadilyobservableinpublicmarkets.

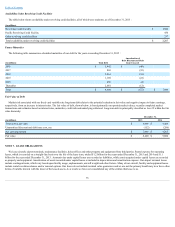

NOTE3.INVESTMENTS

Short-Term Investments

Theestimatedfairvaluesofshort-terminvestments,whichapproximatecostatDecember31,2015,areshownbelowbycontractualmaturity.Actual

maturitiesmaydifferfromcontractualmaturitiesbecauseissuersofthesecuritiesmayhavetherighttoretireourinvestmentswithoutprepaymentpenalties.

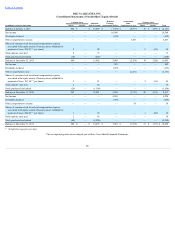

(inmillions)

Available-

For-Sale

Dueinoneyearorless $ 344

Dueafteroneyearthroughthreeyears 905

Dueafterthreeyearsthroughfiveyears 116

Dueafterfiveyears 100

Total $ 1,465

68