DIRECTV 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

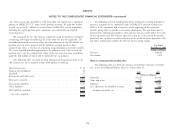

DIRECTV Group stock, the original hedging function of the equity collars ceased 2010 Financing Transactions

upon the completion of the Liberty Transaction by reason of the acquisition of the On August 17, 2010, pursuant to a registration statement, DIRECTV U.S.

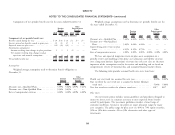

DIRECTV Group stock underlying the hedge by DIRECTV, and we became issued the following senior notes:

exposed to significant potential cash liability upon any upward movements in the

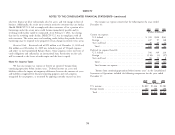

price of DIRECTV Class A common stock. Proceeds, net

Principal of discount

Thus, the equity collars, when acquired by DIRECTV in the Liberty (Dollars in Millions)

Transaction, posed an unhedged risk of substantial economic loss upon upward 3.125% senior notes due in 2016 ................. $ 750 $ 750

movements in the price of DIRECTV Class A common stock, which was adverse 4.600% senior notes due in 2021 ................. 1,000 999

to the company’s short and long-term operational and stock price goals and was 6.000% senior notes due in 2040 ................. 1,250 1,233

therefore an uneconomic and burdensome obligation to DIRECTV. Accordingly, in $3,000 $2,982

connection with the assumption of the Collar Loan, we agreed with the lending

bank to promptly repay the Collar Loan and settle the equity collars. From the We incurred $19 million of debt issuance costs in connection with these

acquisition date to December 31, 2009, we repaid a total of $751 million, transactions.

including $676 million in principal payments and $75 million in payments to settle

a portion of the equity collars. We also recorded a $105 million loss during the On August 20, 2010, DIRECTV U.S. repaid the $1,220 million of remaining

year ended December 31, 2009 in ‘‘Liberty transaction and related charges’’ in the principal on Term Loans A and B of its senior secured credit facility. The

Consolidated Statements of Operations related to the partial settlement of the collar repayment of Term Loans A and B resulted in a third quarter 2010 pre-tax charge

and the adjustment of the remaining collar derivative financial instruments to their of $7 million, $4 million after tax, resulting from the write-off of deferred debt

fair value as of December 31, 2009 to a liability of $400 million. During the first issuance and other transaction costs. The charge was recorded in ‘‘Other, net’’ in

quarter of 2010, we paid $1,537 million to repay the remaining principal balance our Consolidated Statements of Operations.

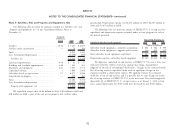

of the loan and settle the equity collars, which had a fair value of $400 million as On March 11, 2010, DIRECTV U.S. issued the following senior notes:

of December 31, 2009 and as a result, recorded a gain of $67 million in ‘‘Liberty

transaction and related gains (charges)’’ in the Consolidated Statements of Proceeds, net

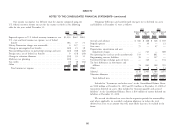

Principal of discount

Operations in 2010 related to the Collar Loan.

(Dollars in Millions)

We accounted for the equity collars pursuant to the accounting standards for 3.550% senior notes due in 2015 ................. $1,200 $1,199

derivatives and hedging, which require that all derivatives, whether designated in 5.200% senior notes due in 2020 ................. 1,300 1,298

hedging relationships or not, are recorded on the balance sheet at fair value. The 6.350% senior notes due in 2040 ................. 500 499

equity collars were not designated as a hedge, and therefore changes in the fair $3,000 $2,996

value of the derivative were recognized in earnings. We determined the

December 31, 2009 fair value of the equity collars using the Black-Scholes Model. We incurred $17 million of debt issuance costs in connection with these

Our use of the Black-Scholes Model to value the equity collars was considered a transactions.

Level 2 valuation technique, which used observable inputs such as exchange-traded

equity prices, risk-free interest rates, dividend yields and volatilities. On March 16, 2010, DIRECTV U.S. repaid the $985 million of remaining

principal on Term Loan C of its senior secured credit facility. The repayment of

See Note 3 for further discussion of the Liberty Transaction.

76