DIRECTV 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

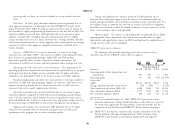

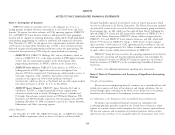

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT fluctuations in foreign currency exchange rates. Our objective in managing our

MARKET RISK exposure to foreign currency changes is to reduce earnings and cash flow volatility

associated with foreign exchange rate fluctuations. Accordingly, we may enter into

The following discussion and the estimated amounts generated from the foreign exchange contracts to mitigate risks associated with foreign currency

sensitivity analyses referred to below include forward-looking statements of market denominated assets, liabilities, commitments and anticipated foreign currency

risk which assume for analytical purposes that certain adverse market conditions transactions. The gains and losses on derivative foreign exchange contracts offset

may occur. Actual future market conditions may differ materially from such changes in value of the related exposures. As of December 31, 2010, we had no

assumptions and the amounts noted below are the result of analyses used for the significant foreign currency exchange contracts outstanding. The impact of a

purpose of assessing possible risks and the mitigation thereof. Accordingly, you hypothetical 10% adverse change in exchange rates on our net assets would be a

should not consider the forward-looking statements as our projections of future loss of $121 million, net of taxes, at December 31, 2010, a significant portion of

events or losses. which would be recorded in ‘‘Foreign currency translation activity during the

period’’ in our Consolidated Statement of Changes in Stockholders’ Equity.

General

Our cash flows and earnings are subject to fluctuations resulting from changes Interest Rate Risk

in foreign currency exchange rates, interest rates and changes in the market value of From time to time, we may be subject to fluctuating interest rates for variable

our equity investments. We manage our exposure to these market risks through rate borrowings, which may adversely impact our consolidated results of operations

internally established policies and procedures and, when deemed appropriate, and cash flows. We had outstanding debt of $10,510 million at December 31,

through the use of derivative financial instruments. We enter into derivative 2010, which mostly consisted of DIRECTV U.S.’ fixed rate borrowings.

instruments only to the extent considered necessary to meet our risk management

objectives, and do not enter into derivative contracts for speculative purposes. ***

Foreign Currency Risk

We generally conduct our business in U.S. dollars with some business

conducted in a variety of foreign currencies and therefore we are exposed to

54