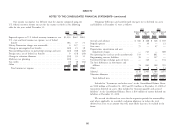

DIRECTV 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

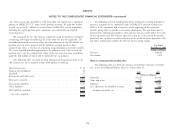

Note 8: Accounts Payable and Accrued Liabilities; Other Liabilities and Note 9: Debt

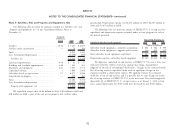

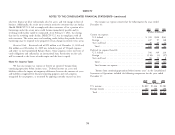

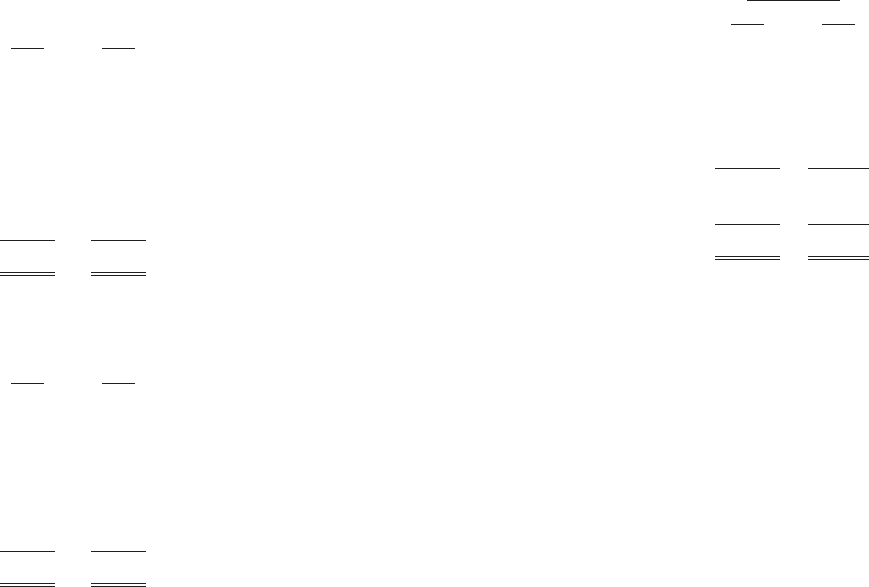

Deferred Credits The following table sets forth our outstanding debt:

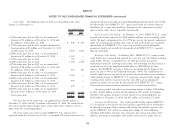

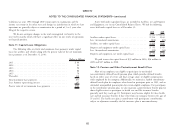

The following represent significant components of ‘‘Accounts payable and December 31,

accrued liabilities’’ in our Consolidated Balance Sheets as of December 31: 2010 2009

2010 2009 (Dollars in Millions)

(Dollars in Millions) Senior notes ................................. $10,472 $ 4,492

Programming costs ............................ $1,751 $1,788 Senior secured credit facility, net of unamortized discount of

Accounts payable ............................. 951 582 $7 million as of December 31, 2009 ............... — 2,316

Equity collars (see Note 9 for additional information) ..... — 400 Collar Loan ................................. — 1,202

Property and income taxes ....................... 217 157 Other ..................................... 38 —

Payroll and employee benefits ..................... 272 204 Total debt ................................ 10,510 8,010

Interest payable .............................. 138 47 Less: Current portion of long-term debt .............. (38) (1,510)

Other ..................................... 597 579 Long-term debt ............................. $10,472 $ 6,500

Total accounts payable and accrued liabilities ......... $3,926 $3,757

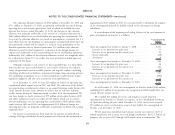

All of the senior notes and the senior secured credit facility were issued by

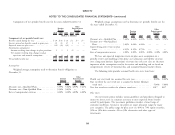

The following represent significant components of ‘‘Other liabilities and DIRECTV U.S. The senior secured credit facility was secured by substantially all of

deferred credits’’ in our Consolidated Balance Sheets as of December 31: DIRECTV U.S.’ assets. As discussed below, in financing transactions in March and

August 2010, DIRECTV U.S. repaid the remaining balance of the Term Loans

2010 2009 under its senior secured credit facility, which was terminated in February 2011. As

(Dollars in Millions) of February 7, 2011, DIRECTV U.S. had the ability to borrow up to $2 billion

Obligations under capital leases .................... $ 523 $ 537 under a new revolving credit facility discussed below.

Other accrued taxes ............................ 409 595

Pension and other postretirement benefits ............. 106 135 Collar Loan

Deferred credits .............................. 69 78

Programming costs ............................ 43 76 As part of the Liberty Transaction completed on November 19, 2009, we

Other ..................................... 137 257 assumed a credit facility and related equity collars, which we refer to as the Collar

Loan.

Total other liabilities and deferred credits ............ $1,287 $1,678

The equity collars, which used DIRECTV Group shares as the underlying

As of December 31, 2010, there were $30 million of amounts payable to security, were entered into by Liberty prior to the Liberty Transaction for the

vendors for property and equipment and $17 million of amounts payable for purpose of providing credit security to the lending bank on the Collar Loan and, as

satellites in ‘‘Accounts payable and accrued liabilities’’ in the Consolidated Balance a consequence, hedging Liberty’s exposure to default on the Collar Loan by limiting

Sheets, which is considered a non-cash investing activity for purposes of the Liberty’s exposure to downward movements in the price of DIRECTV Group stock

Consolidated Statements of Cash Flows for the year ended December 31, 2010. in exchange for Liberty’s increased exposure to upward movements in the price of

DIRECTV Group stock. As the derivative financial instruments were in respect of

75