DIRECTV 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

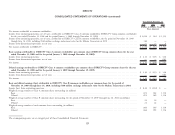

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

Cash and Cash Equivalents asset impaired when the anticipated undiscounted future cash flow from such asset

is separately identifiable and is less than its carrying value. In that event, we would

Cash and cash equivalents consist of cash on deposit and highly liquid recognize a loss based on the amount by which the carrying value exceeds the fair

investments we purchase with original maturities of three months or less. value of the long-lived asset. We determine fair value primarily using estimated

future cash flows associated with the asset under review, discounted at a rate

Inventories commensurate with the risk involved, or other valuation techniques. We determine

We state inventories at the lower of average cost or market. Inventories consist losses on long-lived assets to be disposed of in a similar manner, except that we

of finished goods for DIRECTV System equipment and DIRECTV System access reduce the fair value for the cost of disposal.

cards.

Foreign Currency

Property and Equipment, Satellites and Depreciation The U.S. dollar is the functional currency for most of our foreign operations.

We carry property and equipment, and satellites at cost, net of accumulated We recognize gains and losses resulting from remeasurement of these operations’

depreciation. The amounts we capitalize for satellites currently being constructed foreign currency denominated assets, liabilities and transactions into the U.S. dollar

and those that have been successfully launched include the costs of construction, in the Consolidated Statements of Operations.

launch, launch insurance, incentive obligations and capitalized interest. We generally We also have foreign operations where the local currency is their functional

compute depreciation using the straight-line method over the estimated useful lives currency. Accordingly, these foreign entities translate assets and liabilities from their

of the assets. We amortize leasehold improvements over the lesser of the life of the local currencies to U.S. dollars using year end exchange rates while income and

asset or term of the lease. expense accounts are translated at the average rates in effect during the year. We

record the resulting translation adjustment as part of accumulated other

Goodwill and Intangible Assets comprehensive income (loss), which we refer to as OCI, a separate component of

Goodwill and intangible assets with indefinite lives are carried at historical cost stockholders’ equity.

and are subject to write-down, as needed, based upon an impairment analysis that

we must perform at least annually, or sooner if an event occurs or circumstances Investments and Financial Instruments

change that would more likely than not result in an impairment loss. We perform We maintain investments in equity securities of unaffiliated companies. We

our annual impairment analysis in the fourth quarter of each year. If an impairment carry non-marketable equity securities at cost. We consider marketable equity

loss results from the annual impairment test, we would record the loss as a pre-tax securities available-for-sale and they are carried at current fair value based on quoted

charge to operating income. market prices with unrealized gains or losses (excluding other-than-temporary

We amortize other intangible assets using the straight-line method over their losses), net of taxes, reported as part of OCI. We regularly review our investments

estimated useful lives, which range from 5 to 20 years. to determine whether a decline in fair value below the cost basis is

‘‘other-than-temporary.’’ We consider, among other factors: the magnitude and

Valuation of Long-Lived Assets duration of the decline; the financial health and business outlook of the investee,

including industry and sector performance, changes in technology, and operational

We evaluate the carrying value of long-lived assets to be held and used, other and financing cash flow factors; and our intent and ability to hold the investment.

than goodwill and intangible assets with indefinite lives, when events and If we judge the decline in fair value to be other-than-temporary, we write-down the

circumstances warrant such a review. We consider the carrying value of a long-lived

65