DIRECTV 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

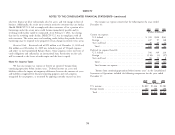

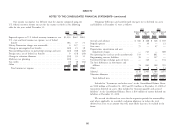

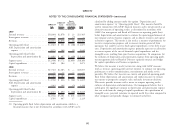

The objectives of the target allocations are to maintain investment portfolios The fair value measurement of plan assets using significant unobservable inputs

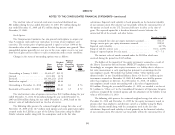

that diversify risk through prudent asset allocation parameters, achieve asset returns (Level 3) changed during 2010 due to the following:

that meet or exceed the plans’ actuarial assumptions, and achieve asset returns that Partnerships and Joint

are competitive with like institutions employing similar investment strategies. Venture Interests

(Dollars in Millions)

The investment policy is periodically reviewed by us and a designated third-

Balance at January 1, 2010 ...................... $21

party fiduciary for investment matters. We establish and administer the policy in a

Realized losses .............................. —

manner so as to comply at all times with applicable government regulations.

Unrealized gains ............................. 4

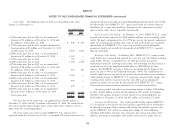

The fair value measurements of the plan assets as of December 31, 2010 were Purchases and sales ........................... 3

as follows: Balance at December 31, 2010 .................... $28

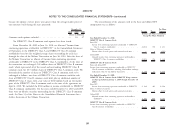

Fair Value Measurements as of December 31, 2010

Quoted Prices Cash Flows

in Active Percentage of

Markets for Significant Significant Plan Assets

Identical Observable Unobservable as of Contributions

Assets Inputs Inputs December 31,

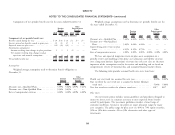

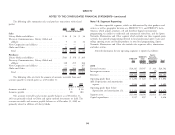

Total (Level 1) (Level 2) (Level 3) 2010 We expect to contribute approximately $15 million to our qualified pension

(Dollars in millions) plans and make payments of $6 million to our nonqualified pension plan

Asset Category participants in 2011.

Common collective trusts

Cash ....................$ 1 $1 $— $— —

Equity securities: Estimated Future Benefit Payments

U.S. large-cap .............. 125 — 125 — 29%

We expect the following benefit payments, which reflect expected future

U.S. mid-cap growth ......... 34 — 34 — 8%

International large-cap value . . . . . 60 — 60 — 14% service, as appropriate, to be paid by the plans during the years ending

Domestic real estate .......... 20 — 20 — 5% December 31:

Stable value ................ 159 — 159 — 37%

Partnership and joint venture interests . . . 28 — — 28 7% Estimated Future Benefit

Insurance contracts at contract value . . . 2 — 2— — Payments

Other

Total ......................$429 $ 1 $400 $28 100% Pension Postretirement

Benefits Benefits

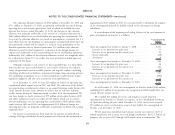

There were no shares of our common stock included in plan assets as of (Dollars in Millions)

December 31, 2010 and 2009. 2011 .................................... $ 42 $ 2

2012 .................................... 42 2

2013 .................................... 44 2

2014 .................................... 40 2

2015 .................................... 41 2

2015-2019 ................................ 228 10

85