DIRECTV 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

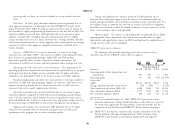

borrowings primarily consist of notes payable issued by DIRECTV U.S. as more Contingencies

fully described in Note 9 of the Notes to the Consolidated Financial Statements in National Football League Strike or Lockout. DIRECTV U.S. has a contract

Item 8, Part II of this Annual Report, which we incorporate herein by reference. with the National Football League for the exclusive rights to distribute the NFL

Our notes payable and short-term borrowings mature as follows: $38 million Sunday Ticket Package to DIRECTV U.S. subscribers. The NFL’s collective

in 2011, $1,000 million in 2014, $2,200 million in 2015 and $7,300 million bargaining agreement with its players expires before the beginning of the

thereafter. 2011-2012 NFL season. If there is a players’ strike or an owners’ lockout and no

games are played or a reduced schedule is played, DIRECTV U.S. would still be

Revolving Credit Facility obligated to make certain contractual payments to the NFL for such season.

DIRECTV U.S. subscriber revenues would decrease if NFL games are not played or

In February 2011, DIRECTV U.S.’ senior secured credit facility was a full season is lost and cash flows from operating activities would decrease from

terminated and replaced by a new 5 year, $2.0 billion revolving credit facility. We lower revenues as well as our continuing obligation to make certain contractual

pay a commitment fee of .30% per year for the unused commitment under the payments to the NFL. DIRECTV U.S. will be able to partially offset these

revolving credit facility, and borrowings will bear interest at an annual rate of payments through provisions such as credits in the following year, reimbursements

(i) the London interbank offer rate (LIBOR) (or for Euro advances the EURIBOR for games not played and its rights to an extra season if the entire season is

rate) plus 1.50% or at our option (ii) the higher of the prime rate plus 0.50% or cancelled, but in the near term a strike or lockout could have a material adverse

the Fed Funds Rate plus 1.00%. The commitment fee and the annual interest rate effect on our cash flows from operating activities primarily due to payments we

may be increased or decreased under certain conditions, which include changes in may have to make to the NFL, including minimum contractual obligations, an

DIRECTV U.S.’ long-term, unsecured debt ratings. The revolving credit facility is optional advance payment that may be requested by the NFL and the loss of

unsecured and has been fully and unconditionally guaranteed, jointly and severally, subscriber revenue, as well as possibly resulting in reduced subscriber additions and

by substantially all of DIRECTV U.S.’ current and certain of its future domestic higher churn.

subsidiaries on a senior unsecured basis.

Venezuela devaluation and exchange controls. In January 2010, the Venezuelan

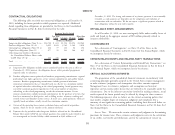

Covenants and Restrictions. The revolving credit facility requires DIRECTV government announced the creation of a dual exchange rate system, including an

U.S. to maintain at the end of each fiscal quarter a specified ratio of indebtedness exchange rate of 4.3 bolivars fuerte per U.S. dollar for most of the activities of our

to adjusted net income. The revolving credit facility also includes covenants that Venezuelan operations compared to an exchange rate of 2.15 Venezuelan bolivars

restrict DIRECTV U.S.’ ability to, among other things, (i) incur additional fuerte prior to the announcement. As a result of this devaluation, we recorded a

subsidiary indebtedness, (ii) incur liens, (iii) enter into certain transactions with $6 million charge to net income in the year ended December 31, 2010 related to

affiliates, (iv) merge or consolidate with another entity, (v) sell, assign, lease or the adjustment of net bolivars fuerte denominated monetary assets to the new

otherwise dispose of all or substantially all of its assets, and (vi) change its lines of official exchange rate. We began reporting the operating results of our Venezuelan

business. Additionally, the senior notes contain restrictive covenants that are similar. subsidiary in the first quarter of 2010 using the devalued rate of 4.3 bolivars fuerte

Should DIRECTV U.S. fail to comply with these covenants, all or a portion of its per U.S. dollar. In December 2010, the Venezuelan government announced the

borrowings under the senior notes could become immediately payable and its elimination of the dual exchange rate system, eliminating the 2.6 bolivars fuerte per

revolving credit facility could be terminated. As of February 7, 2011, the closing U.S. dollar preferential rate which was available for certain activities.

date of the revolving credit facility, DIRECTV U.S. was in compliance with all

such covenants. The senior notes and revolving credit facility also provide that the Companies operating in Venezuela are required to obtain Venezuelan

borrowings may be required to be prepaid if certain change-in-control events occur. government approval to exchange Venezuelan bolivars fuerte into U.S. dollars at the

official rate. We have not been able to consistently exchange Venezuelan bolivars

fuerte into U.S. dollars at the official rate and as a result, we have relied on a

49