DIRECTV 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

Group, a 100% interest in three regional sports networks, a 65% interest in Game expensed at the close of the transaction as discussed in more detail below and to

Show Network, LLC, approximately $120 million in cash and cash equivalents and LEI’s other tangible and intangible assets acquired and liabilities assumed based on

approximately $2.1 billion of indebtedness and a related series of equity collars, their estimated acquisition date fair values, with any excess being treated as

became wholly-owned subsidiaries of DIRECTV. goodwill. The assets, liabilities and results of operations of LEI have been

consolidated beginning on the acquisition date, November 19, 2009.

DIRECTV Group entered into the Liberty Transaction to eliminate the

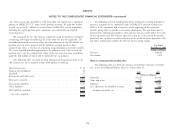

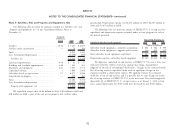

approximate 57% ownership interest in DIRECTV Group held by Liberty Media, The following table sets forth the final allocation of the purchase price to the

thereby reducing the concentration of voting power in a single stockholder or group LEI net liabilities assumed on November 19, 2009 (dollars in millions):

of affiliated stockholders. The merger also resulted in greater liquidity of the

DIRECTV common stock, greater operating and governance independence and the Total current assets ..................................... $ 244

elimination of the risk that Liberty could transfer control of DIRECTV without Property and equipment ................................. 5

DIRECTV public stockholders participating in any control premium. Goodwill ........................................... 295

Investments and other assets .............................. 754

The holders of outstanding shares of DIRECTV Group common stock (other

Total assets acquired .................................... $1,298

than direct or indirect subsidiaries of LEI) received one share of DIRECTV Class A

common stock for each share of DIRECTV Group common stock held. The Total current liabilities .................................. $2,492

holders of outstanding shares of LEI Series A common stock and Series B common Other liabilities ....................................... 259

stock (other than the Malones) received 1.11130 shares of DIRECTV Class A Total liabilities assumed .................................. $2,751

common stock for each share of LEI Series A or Series B common stock held. The

Malones received 1.11130 shares of DIRECTV Class B common stock for each Net liabilities assumed ................................. $1,453

share of LEI Series B common stock held. Based on these terms, DIRECTV issued

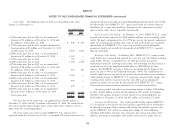

408.4 million Class A shares to the holders of DIRECTV Group common stock Costs incurred to complete the transaction, including legal, accounting,

other than LEI, and 501.1 million Class A and 21.8 million Class B shares to the financial printing, investment banking and other costs, totaled $43 million and

former LEI shareholders. The 931.3 million total Class A and Class B shares issued have been included as an expense in ‘‘Liberty transaction and related gains

by DIRECTV was 25.8 million less than the 957.1 million DIRECTV Group (charges)’’ in the Consolidated Statements of Operations for the year ended

common shares outstanding immediately preceding the merger, as the exchange December 31, 2009.

ratio contemplated the fact that LEI would be contributing net liabilities (excluding We currently expect that none of the goodwill will be deductible for tax

LEI’s interest in DIRECTV Group) to DIRECTV. purposes. Goodwill is primarily related to the value of the three regional sports

The Liberty Transaction has been accounted for using the acquisition method networks’ intangibles that do not qualify for separate recognition, such as

of accounting pursuant to accounting standards for business combinations. exploitable advertising space, assembled production and distribution networks and

DIRECTV Group has been treated as the acquiring corporation in the Liberty assembled workforces.

Transaction for accounting and financial reporting purposes, and accordingly the The exchange ratio of LEI common stock to DIRECTV Group common

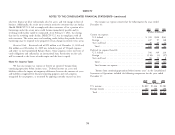

historical financial statements of DIRECTV Group have become the historical stock was determined in a manner such that LEI stockholders as a group received a

financial statements of DIRECTV. The acquisition date fair value of consideration premium in the form of a larger economic interest in DIRECTV than would have

paid, in the form of DIRECTV common stock, for the assets and liabilities of LEI been otherwise determined based on the relative fair values of DIRECTV Group

(excluding LEI’s interest in DIRECTV Group) has been allocated to a premium and LEI. This premium, calculated as the value of the economic interest in

69