DIRECTV 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

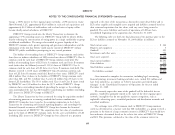

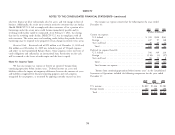

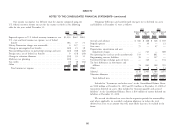

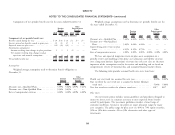

Senior Notes. The following table sets forth our outstanding senior notes unsecured and have been fully and unconditionally guaranteed, jointly and severally,

balance as of December 31: by substantially all of DIRECTV U.S.’ current and certain of its future domestic

subsidiaries on a senior unsecured basis. Principal on the senior notes is payable

Outstanding Balance upon maturity, while interest is payable semi-annually.

2010 2009

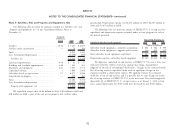

(Dollars in Millions) Senior Secured Credit Facility. At December 31, 2010, DIRECTV U.S.’ senior

4.750% senior notes due in 2014, net of unamortized secured credit facility consisted of a $500 million undrawn six-year revolving credit

discount of $2 million as of December 31, 2010 and facility. We paid a commitment fee of 0.175% per year for the unused commitment

$3 million as of December 31, 2009 ............... $ 998 $ 997 under the revolving credit facility. The senior secured credit facility was secured by

6.375% senior notes due in 2015, includes unamortized substantially all of DIRECTV U.S.’ assets and was fully and unconditionally

bond premium of $2 million as of December 31, 2010 guaranteed, jointly and severally by substantially all of DIRECTV U.S.’ material

and December 31, 2009 ....................... 1,002 1,002 domestic subsidiaries.

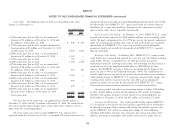

3.550% senior notes due in 2015, net of unamortized Revolving Credit Facility. In February 2011, DIRECTV U.S.’ senior secured

discount of $1 million as of December 31, 2010 ....... 1,199 — credit facility was terminated and replaced by a new five year, $2.0 billion revolving

3.125% senior notes due in 2016 .................. 750 — credit facility. We pay a commitment fee of .30% per year for the unused

7.625% senior notes due in 2016 .................. 1,500 1,500 commitment under the revolving credit facility, and borrowings will bear interest at

5.875% senior notes due in 2019, net of unamortized an annual rate of (i) the London interbank offer rate (LIBOR) (or for Euro

discount of $6 million as of December 31, 2010 and advances the EURIBOR rate) plus 1.50% or at our option (ii) the higher of the

$7 million as of December 31, 2009 ............... 994 993 prime rate plus 0.50% or the Fed Funds Rate plus 1.00%. The commitment fee

5.200% senior notes due in 2020, net of unamortized and the annual interest rate may be increased or decreased under certain conditions,

discount of $2 million as of December 31, 2010 ....... 1,298 — which include changes in DIRECTV U.S.’ long-term, unsecured debt ratings. The

4.600% senior notes due in 2021, net of unamortized revolving credit facility is unsecured and has been fully and unconditionally

discount of $1 million as of December 31, 2010 ....... 999 — guaranteed, jointly and severally, by substantially all of DIRECTV U.S.’ current

6.350% senior notes due in 2040, net of unamortized and certain of its future domestic subsidiaries on a senior unsecured basis.

discount of $1 million as of December 31, 2010 ....... 499 —

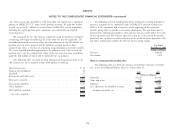

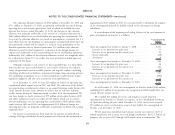

6.000% senior notes due in 2040, net of unamortized Our notes payable and short-term borrowings mature as follows: $38 million

discount of $17 million as of December 31, 2010 ...... 1,233 — in 2011, $1,000 million in 2014, $2,200 million in 2015 and $7,300 million

thereafter. The amount of interest accrued related to our outstanding debt was

Total senior notes ........................... $10,472 $4,492

$138 million at December 31, 2010 and $47 million at December 31, 2009.

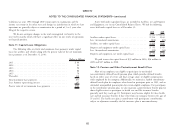

The fair value of our senior notes was approximately $10,881 million at Covenants and Restrictions. The revolving credit facility requires DIRECTV

December 31, 2010 and $4,713 million at December 31, 2009. We calculated the U.S. to maintain at the end of each fiscal quarter a specified ratio of indebtedness

fair values based on quoted market prices of our senior notes, which is a Level 1 to adjusted net income. The revolving credit facility also includes covenants that

input under the accounting guidance. restrict DIRECTV U.S.’ ability to, among other things, (i) incur additional

All of our senior notes were issued by DIRECTV U.S. and have been subsidiary indebtedness, (ii) incur liens, (iii) enter into certain transactions with

registered under the Securities Act of 1933, as amended. All of our senior notes are affiliates, (iv) merge or consolidate with another entity, (v) sell, assign, lease or

78