DIRECTV 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

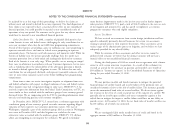

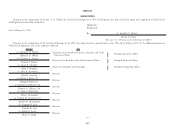

DIRECTV

Exhibit

Number Exhibit Name

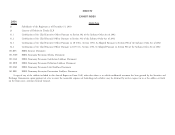

*10.1 Amended and Restated Agreement for the Allocation of United States Income Taxes, dated as of April 9, 2003, by and between General Motors

Corporation and Hughes Electronics Corporation (incorporated by reference to Exhibit 99.3 to the Form S-4 of Hughes Electronics Corporation filed

June 5, 2003 (SEC File No. 1-31945))

*10.2 DTH Agreement, dated as of October 8, 2004, by and among Grupo Televisa, S.A., The News Corporation Limited, Innova, S. de R.L. de C.V., The

DIRECTV Group, Inc. and DIRECTV Latin America, LLC (incorporated by reference to Exhibit 10.8 to the Form 8-K of The DIRECTV Group, Inc.

filed October 15, 2004 (SEC File No. 1-31945))

*10.3 Credit Agreement dated as of April 13, 2005 by and among DIRECTV Holdings LLC, Bank of America, N.A., as Administrative Agent and Collateral

Agent, the lenders party to the Credit Agreement, certain subsidiaries of the DIRECTV Holdings LLC, as guarantors, JP Morgan Chase Bank, N.A., as

Syndication Agent, Credit Suisse First Boston, Goldman Sachs Credit Partners, L.P. and Citicorp North America, Inc. as Co-Documentation Agents, and

Banc of America Securities LLC and J.P. Morgan Securities Inc., as Co-Lead Arrangers and Co-Book Managers (incorporated by reference to

Exhibit 10.1 to the Form 8-K of DIRECTV Holdings LLC and DIRECTV Financing Co., Inc. filed April 13, 2005 (SEC File No. 333-106529))

*10.4 Security Agreement, dated as of April 13, 2005, by and among DIRECTV Holdings LLC, its subsidiaries named therein as grantors and Bank of America,

N.A., as Collateral Agent (incorporated by reference to Exhibit 10.2 to the Form 8-K of DIRECTV Holdings LLC and DIRECTV Financing Co., Inc.

filed April 13, 2005 (SEC File No. 333-106529))

*10.5 Pledge Agreement, dated as of April 13, 2005, by and among DIRECTV Holdings LLC, its subsidiaries named therein as pledgors and Bank of America,

N.A., as Collateral Agent (incorporated by reference to Exhibit 10.3 to the Form 8-K of DIRECTV Holdings LLC and DIRECTV Financing Co., Inc.

filed April 13, 2005 (SEC File No. 333-106529))

*10.6 Amendment No.1, dated as of May 14, 2008, by and among DIRECTV Holdings LLC, the Guarantors and Lenders signatory thereto and Bank of

America, N.A. as Administrative Agent (incorporated by reference to Exhibit 10.3 of the Form 8-K of DIRECTV Holdings LLC and DIRECTV

Financing Co., Inc. filed May 16, 2008 (SEC File No. 333-106529))

*10.7 Tranche C Term Loan Joinder Agreement, dated as of May 14, 2008, by and among DIRECTV Holdings LLC and Bank of America, N.A., as

Administrative Agent and Collateral Agent (incorporated by reference to Exhibit 10.4 of the Form 8-K of DIRECTV Holdings LLC and DIRECTV

Financing Co., Inc. filed May 16, 2008 (SEC File No. 333-106529))

*10.8 Credit Agreement dated as of February 7, 2011, by and among DIRECTV Holdings LLC and certain of DIRECTV Holdings LLC’s subsidiaries as

Guarantors, and Citibank, N.A., as Administrative Agent, the lenders party to the Credit Agreement, Barclays Capital, as Syndication Agent, Credit

Suisse Securities (USA) LLC, J.P. Morgan Securities LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, The Royal Bank Of Scotland PLC and

UBS AG, Stamford Branch as Co-Documentation Agents, and Citigroup Global Markets Inc., Barclays Capital, Credit Suisse Securities (USA) LLC, J.P.

Morgan Securities LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, RBS Securities Inc. and UBS AG, Stamford Branch as Joint Lead

Arrangers and Joint Bookrunners (incorporated by reference to Exhibit 10.1 to the Form 8—K of DIRECTV Holdings LLC and DIRECTV

Financing Co., Inc. filed February 10, 2011 (SEC File No. 333-106529))

105