DIRECTV 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

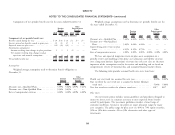

Under the terms of the agreement, the Malones exchanged 21.8 million shares of accelerated at any time. The sources of funds for the purchases under the remaining

high-vote DIRECTV Class B common stock, which was all of the outstanding authorizations are our existing cash on hand, cash from operations and potential

DIRECTV Class B shares, for 26.5 million shares of DIRECTV Class A common additional borrowings. Purchases are made in the open market, through block

stock, resulting in the reduction of the Malone’s voting interest in DIRECTV from trades and other negotiated transactions. Repurchased shares are retired but remain

approximately 24% to approximately 3%. The number of DIRECTV Class A authorized for registration and issuance in the future.

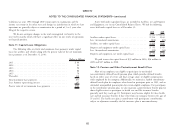

shares issued was determined as follows: one share of DIRECTV Class A common The following table sets forth information regarding shares repurchased and

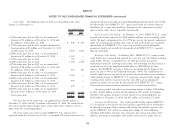

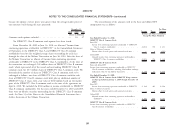

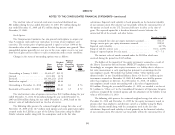

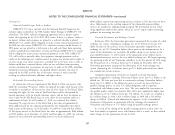

stock for each share of DIRECTV Class B common stock held, plus an additional retired for the years ended December 31:

number of DIRECTV Class A shares with a fair value of $160 million based on

the then current market price of the DIRECTV Class A (DTV) common stock. 2010 2009 2008

Following the exchange we dissolved the Puerto Rico trust. (Amounts in Millions,

Except Per Share Amounts)

We accounted for the exchange of DIRECTV Class B common stock into Total cost of repurchased and retired shares ....... $5,179 $1,696 $3,174

DIRECTV Class A common stock pursuant to accounting standards for induced Average price per share ..................... 38.20 23.79 24.12

conversions, whereby the $160 million in incremental DIRECTV Class A common Number of shares repurchased and retired ........ 136 71 131

stock issued to the former DIRECTV Class B stockholders has been deducted from

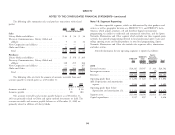

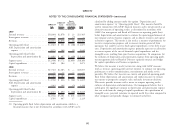

For the year ended December 31, 2010, we recorded the $5,179 million in

earnings attributable to DIRECTV Class A stockholders for purposes of calculating

repurchases as a decrease of $973 million to ‘‘Common stock and additional paid

earnings per share in the Consolidated Statements of Operations. This adjustment

in capital’’ and an increase of $4,206 million to ‘‘Accumulated deficit’’ in the

had the effect of reducing diluted earnings per DIRECTV Class A common share

Consolidated Balance Sheets. Of the $5,179 million in repurchases during the year

by $0.18 for the year ended December 31, 2010.

ended December 31, 2010, $68 million were paid for in January 2011. For the

year ended December 31, 2009, we recorded the $1,696 million in repurchases as a

Share Repurchase Program decrease of $591 million to ‘‘Common stock and additional paid in capital’’ and an

Since 2006 our Board of Directors has approved multiple authorizations for increase of $1,105 million to ‘‘Accumulated deficit’’ in the Consolidated Balance

the repurchase of our common stock, the most recent of which was announced in Sheets. For the year ended December 31, 2008, we recorded the $3,174 million in

the first quarter of 2011, authorizing share repurchases of $6 billion. The repurchases as a decrease of $1,089 million to ‘‘Common stock and additional paid

authorizations allow us to repurchase our common stock from time to time through in capital’’ and an increase of $2,085 million to ‘‘Accumulated deficit’’ in the

open market purchases and negotiated transactions, or otherwise. The timing, Consolidated Balance Sheets.

nature and amount of such transactions will depend on a variety of factors,

including market conditions, and the program may be suspended, discontinued or

87