DIRECTV 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

$337 million charge related to a premium paid to LEI shareholders to complete the resulted from the write-off of deferred debt issuance costs and other transaction

merger in the form of an equity interest that exceeded the fair value of net assets costs. The charge was recorded in ‘‘Other, net’’ in our Consolidated Statements of

acquired by DIRECTV; $43 million of costs incurred to complete the transaction, Operations.

including legal, accounting, financial printing, investment banking and other costs; In 2008, DIRECTV U.S. issued $1.5 billion in senior notes, and borrowed

and $111 million in net losses recorded for the partial settlement of the equity $1 billion under a new Term Loan of its senior secured credit facility, resulting in

collars and stock options and stock appreciation rights held by Liberty employees proceeds, net of discount, of $2,490 million.

subsequent to the acquisition date, and adjustments of the equity collars and stock

options and stock appreciation rights carried as liabilities to fair value as of Venezuela Exchange Controls

December 31, 2009. We recorded a $67 million net gain in ‘‘Liberty transaction

and related gains (charges)’’ in the Consolidated Statements of Operations for the In January 2010, the Venezuelan government announced the creation of a dual

final settlement of the equity collars during 2010. exchange rate system, including an exchange rate of 4.3 bolivars fuerte per U.S.

dollar for most of the activities of our Venezuelan operations compared to an

See Note 3 of the Notes to the Consolidated Financial Statements in Part II, exchange rate of 2.15 Venezuelan bolivars fuerte prior to the announcement. As a

Item 8 of this Annual Report, which we incorporate herein by reference. result of this devaluation, we recorded a $6 million charge to net income in the

year ended December 31, 2010 related to the adjustment of net bolivars fuerte

180 Connect. In July 2008, we acquired 100% of 180 Connect’s outstanding

denominated monetary assets to the new official exchange rate. We began reporting

common stock and exchangeable shares. Simultaneously, in a separate transaction,

the operating results of our Venezuelan subsidiary in the first quarter of 2010 using

UniTek USA, LLC acquired 100% of 180 Connect’s cable service operating unit

the devalued rate of 4.3 bolivars fuerte per U.S. dollar. In December 2010, the

and operations in certain of our installation services markets in exchange for

Venezuelan government announced the elimination of the dual exchange rate

satellite installation operations in certain markets and $7 million in cash. These

system, eliminating the 2.6 bolivars fuerte per U.S. dollar preferential rate which

transactions provide us with ownership and control over a significant portion of

was available for certain activities.

DIRECTV U.S.’ home service provider network. We paid $91 million in cash, net

of the $7 million we received from UniTek USA, for the acquisition, including the Companies operating in Venezuela are required to obtain Venezuelan

equity purchase price, repayment of assumed debt and related transaction costs. government approval to exchange bolivars fuerte into U.S. dollars at the official

rate. We have not been able to consistently exchange Venezuelan bolivars fuerte into

Financing Transactions U.S. dollars at the official rate and as a result, we have relied on a parallel exchange

process to settle U.S. dollar obligations and to repatriate accumulated cash balances

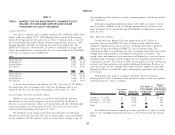

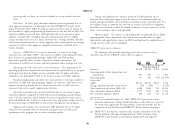

In 2010, DIRECTV U.S. issued $6.0 billion of senior notes resulting in

prior to its close. The rates implied by transactions in the parallel market, which

$5,978 million of proceeds, net of discount, and repaid the $2,205 million of

was closed in May, 2010, were significantly higher than the official rate (6 to 7

remaining principal on the Term Loans of its senior secured credit facility. The

bolivars fuerte per U.S. dollar). As a result, we recorded a $22 million charge in

repayment of the Term Loans resulted in a 2010 pre-tax charge recorded in ‘‘Other,

2010, a $213 million charge in 2009 and a $29 million charge in 2008 in

net’’ in our Consolidated Statements of Operations of $16 million, $10 million

‘‘General and administrative expenses’’ in the Consolidated Statements of

after tax, resulting from the write-off of deferred debt issuance and other

Operations in connection with the exchange of accumulated Venezuelan cash

transaction costs.

balances to U.S. dollars using the parallel exchange process.

In 2009, DIRECTV U.S. issued $2.0 billion of senior notes resulting in

As a result of the closing of the parallel exchange process in May 2010, we

$1,990 million of proceeds, net of discount. Also in 2009, DIRECTV U.S.

have been unable to repatriate excess cash balances and we therefore realized lower

purchased and redeemed its then outstanding $910 million 8.375% senior notes,

charges for the repatriation of cash in 2010 and our Venezuelan subsidiary had

resulting in a 2009 pre-tax charge of $34 million, $21 million after tax, of which

Venezuelan bolivar fuerte denominated cash of $169 million at December 31,

$29 million resulted from a premium paid for the redemption and $5 million

37