DIRECTV 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

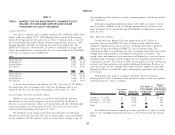

hardware under our movers program for subscribers relocating to a new residence. period by the number of gross new subscribers acquired during the period. We

Set-top receivers leased to existing subscribers under upgrade and retention calculate total subscriber acquisition costs for the period by adding together

programs are capitalized in ‘‘Property and equipment, net’’ in the Consolidated ‘‘Subscriber acquisition costs’’ expensed during the period and the amount of cash

Balance Sheets and depreciated over their useful lives. The amount of set-top paid for equipment leased to new subscribers during the period.

receivers capitalized each period for upgrade and retention programs is included in

‘‘Cash paid for property and equipment’’ in the Consolidated Statements of Cash EXECUTIVE OVERVIEW AND OUTLOOK

Flows. The United States and the other countries in which we operate are continuing

to undergo a period of economic uncertainty. As discussed in ‘‘Competition’’ in

General and Administrative Expenses. General and administrative expenses

Item 1, in addition to cable and satellite system operators, we are experiencing

include departmental costs for legal, administrative services, finance, marketing and

increasing competition from telcos and other emerging digital media distribution

information technology. These costs also include expenses for bad debt and other

providers. Please refer to ‘‘Risk Factors’’ in Item 1A for a further discussion of risks

operating expenses, such as legal settlements, and gains or losses from the sale or

which may affect forecasted results or our business generally.

disposal of fixed assets.

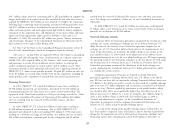

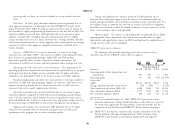

DIRECTV U.S. Our revenue growth is generated by both increases in the

Average Monthly Revenue Per Subscriber. We calculate ARPU by dividing

average monthly rates we earn from subscribers, or ARPU, and increases in the

average monthly revenues for the period (total revenues during the period divided

total number of subscribers. In 2011, we expect revenue growth in the mid to high

by the number of months in the period) by average subscribers for the period. We

single digit percentage range.

calculate average subscribers for the period by adding the number of subscribers as

of the beginning of the period and for each quarter end in the current year or In 2011, we expect that the anticipated growth in revenues will be partially

period and dividing by the sum of the number of quarters in the period plus one. offset by higher programming costs, including the costs associated with our contract

with the NFL, resulting in operating profit before depreciation and amortization

Average Monthly Subscriber Churn. Average monthly subscriber churn growth in the low to mid single digit percentage range.

represents the number of subscribers whose service is disconnected, expressed as a

percentage of the average total number of subscribers. We calculate average monthly In 2011, we expect capital expenditures to be slightly higher than in 2010.

subscriber churn by dividing the average monthly number of disconnected

DIRECTV Latin America. In 2011, we expect revenue and operating profit

subscribers for the period (total subscribers disconnected, net of reconnects, during

before depreciation and amortization growth of approximately 20%.

the period divided by the number of months in the period) by average subscribers

for the period. In 2011, we expect capital expenditures in Latin America to exceed 2010

capital expenditures due to higher gross subscriber additions, increased sales of

Subscriber Count. The total number of subscribers represents the total advanced products and other infrastructure projects.

number of subscribers actively subscribing to our service, including seasonal

subscribers, subscribers who are in the process of relocating and commercial DIRECTV. At the consolidated DIRECTV level, we anticipate 2011 free cash

equivalent viewing units. In March 2008, we implemented a change in DIRECTV flow, or cash provided by operating activities less capital expenditures, to be lower

U.S.’ commercial pricing and packaging to increase our competitiveness. As a result, than in 2010. The anticipated improvement in operating profit before depreciation

during the first quarter of 2008, DIRECTV U.S. made a one-time downward and amortization is expected to be offset by an increase in cash paid for income

adjustment to the subscriber count of approximately 71,000 subscribers related to taxes, higher capital expenditures and higher expected interest expense.

commercial equivalent viewing units.

Diluted earnings per common share is expected to grow in 2011 as a result of

SAC. We calculate SAC, which represents total subscriber acquisition costs the anticipated growth in income from continuing operations resulting from higher

stated on a per subscriber basis, by dividing total subscriber acquisition costs for the

39