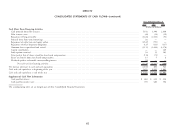

DIRECTV 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

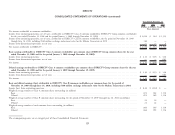

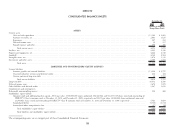

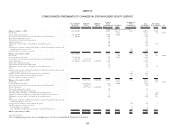

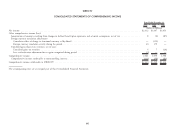

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

or liability and may be observable or unobservable. The three level hierarchy of the noncontrolling interest separately in the consolidated financial statements. These

inputs is as follows: new standards are required to be applied prospectively, except for the presentation

and disclosure requirements, which must be applied retrospectively for all periods

Level 1: Valuation is based on quoted market prices in active markets for presented. As a result of our adoption of these standards, ‘‘Net income’’ in the

identical assets or liabilities. Consolidated Statements of Operations now includes net income attributable to

Level 2: Valuation is based upon quoted prices for similar assets and liabilities noncontrolling interest as compared to the previous presentation, where net income

in active markets, or other inputs that are observable, for substantially attributable to the noncontrolling interest was deducted in the determination of net

the full term of the asset or liability. income. Additionally, the Consolidated Statements of Cash Flows are now presented

using net income as calculated pursuant to the new accounting requirements.

Level 3: Valuation is based upon other unobservable inputs that are not

corroborated by market data. On January 1, 2009 we adopted the revisions made by the SEC to accounting

standards regarding the financial statement classification and measurement of equity

Accounting Changes securities that are subject to mandatory redemption requirements or whose

redemption is outside the control of the issuer. The revisions to the accounting

Consolidation of Variable Interest Entities. On January 1, 2010, we adopted guidance require that redeemable noncontrolling interests, such as Globo

the revisions issued by the Financial Accounting Standards Board, or FASB, to Comunicacoes e Participacoes S.A.’s, or Globo’s, redeemable noncontrolling interest

consolidation accounting standards for variable interest entities, or VIEs. The new in Sky Brazil described in Note 19 of the Notes to the Consolidated Financial

standard replaces the quantitative-based risks and rewards calculation for Statements that are redeemable at the option of the holder be recorded outside of

determining which enterprise, if any, has a controlling financial interest in a variable permanent equity at fair value, and the redeemable noncontrolling interests be

interest entity. Instead, the new approach is qualitative and focused on identifying adjusted to their fair value at each balance sheet date. Adjustments to the carrying

which enterprise has the power to direct the activities of a VIE that most amount of a redeemable noncontrolling interest are recorded to retained earnings

significantly impact the entity’s performance and (1) the obligation to absorb the (or additional paid-in-capital in the absence of retained earnings). As a result of the

losses of an entity or (2) the right to receive benefits from the entity. As a result of adoption of this accounting requirement, we have reported Globo’s redeemable

the changed requirements, it is possible that an entity’s previous assessment of a noncontrolling interest in Sky Brazil in ‘‘Redeemable noncontrolling interest’’ at fair

VIE will change, and the standard now requires ongoing reassessments of whether value in the Consolidated Balance Sheets for each period presented. See Note 19

an enterprise is the primary beneficiary of a VIE. The adoption of these changes on for additional information.

January 1, 2010 did not have an effect on our consolidated results of operations

and financial position. Business Combinations. On January 1, 2009 we adopted a new business

combination accounting standard that requires the acquiring entity in a business

Noncontrolling interests. On January 1, 2009 we adopted new accounting combination to record 100% of all assets and liabilities acquired, including goodwill

standards for the accounting and reporting of noncontrolling interests in and any non-controlling interest, generally at their fair values for all business

subsidiaries, also known as minority interests, in consolidated financial statements. combinations, whether partial, full or step acquisitions. Under the new standard,

The new standards also provide guidance on accounting for changes in the parent’s certain contingent assets and liabilities, as well as contingent consideration, are also

ownership interest in a subsidiary and establishes standards of accounting for the required to be recognized at fair value on the date of acquisition and acquisition-

deconsolidation of a subsidiary due to the loss of control. Reporting entities must related transaction and restructuring costs will be expensed. Additionally, disclosures

now present certain noncontrolling interests as a component of equity and present are required describing the nature and financial effect of the business combination

net income and consolidated comprehensive income attributable to the parent and and the standard also changes the accounting for certain income tax assets recorded

67