DIRECTV 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

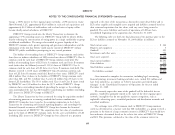

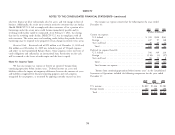

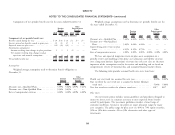

otherwise dispose of all or substantially all of its assets, and (vi) change its lines of Our income tax expense consisted of the following for the years ended

business. Additionally, the senior notes contain restrictive covenants that are similar. December 31:

Should DIRECTV U.S. fail to comply with these covenants, all or a portion of its 2010 2009 2008

borrowings under the senior notes could become immediately payable and its (Dollars in Millions)

revolving credit facility could be terminated. As of February 7, 2011, the closing Current tax expense:

date for the revolving credit facility, DIRECTV U.S. was in compliance with all U.S. federal ............................. $ 391 $308 $543

such covenants. The senior notes and revolving credit facility also provide that the Foreign ................................ 227 97 128

borrowings may be required to be prepaid if certain change-in-control events occur. State and local ........................... 20 63 72

Restricted Cash. Restricted cash of $70 million as of December 31, 2010 and Total ................................ 638 468 743

$16 million as of December 31, 2009 was included as part of ‘‘Prepaid expenses Deferred tax expense (benefit):

and other’’ in our Consolidated Balance Sheets. These amounts secure our letter of U.S. federal ............................. 596 309 210

credit obligations and collateralize an international loan. Restrictions on the cash Foreign ................................ (118) (1) (97)

will be removed as the letters of credit expire and the loan is repaid. State and local ........................... 86 51 8

Note 10: Income Taxes Total ................................ 564 359 121

Total income tax expense ................... $1,202 $827 $864

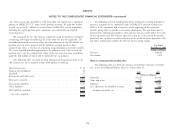

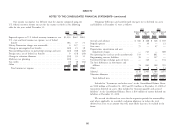

We base our income tax expense or benefit on reported ‘‘Income from

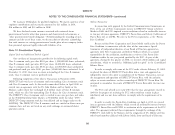

continuing operations before income taxes.’’ Deferred income tax assets and ‘‘Income from continuing operations before income taxes’’ in the Consolidated

liabilities reflect the impact of temporary differences between the amounts of assets Statements of Operations included the following components for the years ended

and liabilities recognized for financial reporting purposes and such amounts December 31:

recognized for tax purposes, as measured by applying currently enacted tax laws.

2010 2009 2008

(Dollars in Millions)

U.S. income ............................ $2,809 $1,446 $1,981

Foreign income .......................... 705 388 490

Total ............................... $3,514 $1,834 $2,471

79