DIRECTV 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

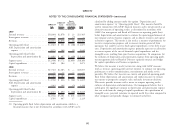

Note 16: Other Income and Expenses Malone Transaction, with John Malone and his wife and certain trusts for the

benefit of their children, which we refer to as the Malones, which resulted in the

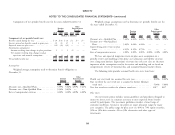

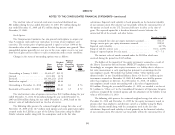

The following table summarizes the components of ‘‘Other, net’’ in our reduction of the Malones’ voting interest in DIRECTV from approximately 24% to

Consolidated Statements of Operations for the years ended December 31: approximately 3% and Dr. Malone’s resignation from our Board of Directors.

2010 2009 2008 Prior to the completion of the Malone Transaction, Dr. Malone was Chairman

(Dollars in Millions) of the Board of Directors of DIRECTV and of Liberty Media. Dr. Malone also had

Equity in earnings from unconsolidated affiliates ......... $90 $51 $55 an approximate 35% voting interest in Liberty Media, an approximate 31% voting

Net foreign currency transaction gain ................ 11 62 — interest in Discovery Communications, Inc., or Discovery Communications, an

Loss from impairment of investments ................ — (45) — approximate 40% voting interest in Liberty Global Inc., or Liberty Global, and

Fair-value adjustment loss on non-employee stock options . . . (11) — — serves as Chairman of Liberty Global, and certain of Liberty Media’s management

Loss on early extinguishment of debt ................ (16) (34) — and directors also serve as directors of Discovery Communications or Liberty

Net gain from sale of investments ................... 6 — 1 Global. As a result of this common ownership and management, transactions with

Other ..................................... (11) — (1) Liberty Media, Discovery Communications and Liberty Global and their

Total other, net ............................. $69 $34 $55 subsidiaries or equity method investees were considered to be related party

transactions through the completion of the Malone Transaction. Our transactions

See Note 7 regarding equity method investments and net gains and losses with Liberty Media, Discovery Communications and Liberty Global consisted

recorded on the sale of investments. primarily of purchases of programming created, owned or distributed by Liberty

Media and Discovery Communications and its subsidiaries and investees.

Note 17: Related-Party Transactions

News Corporation and affiliates

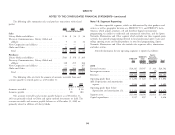

In the ordinary course of our operations, we enter into transactions with

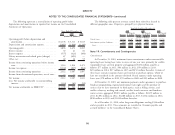

related parties as discussed below. News Corporation and its affiliates were considered related parties until

February 27, 2008, when News Corporation transferred its 41% interest in our

Related parties include Globo, which provides programming and advertising to

common stock to Liberty Media. Accordingly, the following contractual

Sky Brazil, and companies in which we hold equity method investments, including

arrangements with News Corporation and its affiliates are considered related party

Sky Mexico and GSN.

transactions and reported through February 27, 2008: purchase of programming,

The majority of payments under contractual arrangements with related parties products and advertising; license of certain intellectual property, including patents;

are pursuant to multi-year programming contracts. Payments under these contracts purchase of system access products, set-top receiver software and support services;

are typically subject to annual rate increases and are based on the number of sale of advertising space; purchase of employee services; and use of facilities.

subscribers receiving the related programming.

As discussed above in Note 13, during the first quarter of 2008, we received a

Liberty Media, Liberty Global and Discovery Communications $160 million cash capital contribution, which we recorded as ‘‘Additional

paid-in-capital’’ in the Consolidated Balance Sheets.

As discussed above in Note 13 of the Notes to the Consolidated Financial

Statements, on June 16, 2010, we completed a transaction, which we refer to as the

93