DIRECTV 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

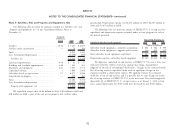

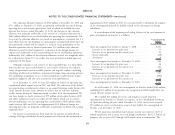

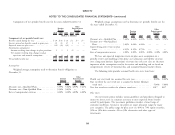

California tax years 1994 through 2009 remain open to examination and the Assets held under capitalized leases are included in Satellites, net and Property

income tax returns in the other state and foreign tax jurisdictions in which we have and Equipment, net in our Consolidated Balance Sheets. We had the following

operations are generally subject to examination for a period of 3 to 5 years after assets held under capital leases as of December 31:

filing of the respective return. 2010 2009

We do not anticipate changes to the total unrecognized tax benefits in the (Dollars in Millions)

next twelve months which will have a significant effect on our results of operations Satellites under capital leases ...................... $554 $543

or financial position. Less: Accumulated amortization .................... (106) (63)

Satellites, net under capital leases ................... $448 $480

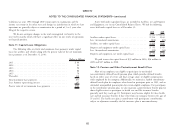

Note 11: Capital Lease Obligations

Property and equipment under capital leases ........... $ 93 $ 63

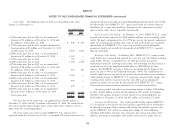

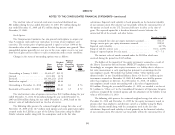

The following table sets forth total minimum lease payments under capital Less: Accumulated amortization .................... (22) (14)

leases for satellites and vehicles along with the present value of the net minimum Property and equipment, net under capital leases ........ $ 71 $ 49

lease payments as of December 31, 2010:

(Dollars in Millions) We paid interest for capital leases of $55 million in 2010, $56 million in

2009 and $27 million in 2008.

2011 ....................................... $ 94

2012 ....................................... 92 Note 12: Pension and Other Postretirement Benefit Plans

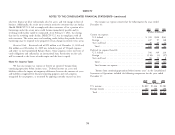

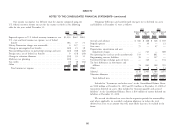

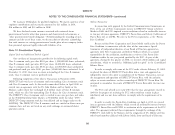

2013 ....................................... 90

2014 ....................................... 86 Most of our employees are eligible to participate in our funded

2015 ....................................... 79 non-contributory defined benefit pension plan, which provides defined benefits

Thereafter .................................... 436 based on either years of service and final average salary, or eligible compensation

while employed by the company. Additionally, we maintain a funded contributory

Total minimum lease payments ...................... 877

defined benefit plan for employees who elected to participate prior to 1991, and an

Less: Amount representing interest ................... 297

unfunded, nonqualified pension plan for certain eligible employees. For participants

Present value of net minimum lease payments ............ $580 in the contributory pension plan, we also maintain a postretirement benefit plan for

those eligible retirees to participate in health care and life insurance benefits

generally until they reach age 65. Participants may become eligible for these health

care and life insurance benefits if they retire from our company between the ages of

55 and 65. The health care plan is contributory with participants’ contributions

subject to adjustment annually; the life insurance plan is non-contributory.

82