DIRECTV 2010 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

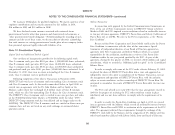

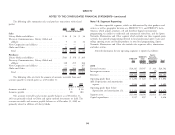

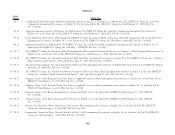

The following represents a reconciliation of operating profit before The following table presents revenues earned from subscribers located in

depreciation and amortization to reported net income on the Consolidated different geographic areas. Property is grouped by its physical location.

Statements of Operations: Years Ended and As of December 31,

2010 2009 2008

Years Ended December 31,

Net Property Net Property Net Property

2010 2009 2008 Revenues & Satellites Revenues & Satellites Revenues & Satellites

(Dollars in Millions) (Dollars in Millions)

Operating profit before depreciation and United States ................$20,684 $4,987 $18,844 $5,247 $17,454 $5,728

amortization ......................... $6,378 $ 5,313 $ 5,015 Latin America and the Caribbean ..... 3,418 1,692 2,721 1,229 2,239 919

Depreciation and amortization expense ......... (2,482) (2,640) (2,320) Total ...................$24,102 $6,679 $21,565 $6,476 $19,693 $6,647

Operating profit ........................ 3,896 2,673 2,695

Interest income ........................ 39 41 81 Note 19: Commitments and Contingencies

Interest expense ........................ (557) (423) (360) Commitments

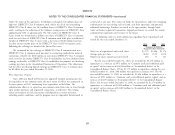

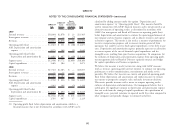

Liberty transaction and related gains (charges) .... 67 (491) —

Other, net ............................ 69 34 55 At December 31, 2010, minimum future commitments under noncancelable

operating leases having lease terms in excess of one year were primarily for satellite

Income from continuing operations before income transponder leases and real property and aggregated $434 million, payable as

taxes.............................. 3,514 1,834 2,471 follows: $77 million in 2011, $64 million in 2012, $59 million in 2013,

Income tax expense ...................... (1,202) (827) (864) $45 million in 2014, $37 million in 2015 and $152 million thereafter. Certain of

Income from continuing operations ........... 2,312 1,007 1,607 these leases contain escalation clauses and renewal or purchase options, which we

Income from discontinued operations, net of taxes . — — 6 have not considered in the amounts disclosed. Rental expenses under operating

Net income ........................... 2,312 1,007 1,613 leases were $78 million in 2010, $72 million in 2009 and $95 million in 2008.

Less: Net income attributable to noncontrolling At December 31, 2010, our minimum payments under agreements to purchase

interests ............................ (114) (65) (92) broadcast programming, regional professional team rights and the purchase of

Net income attributable to DIRECTV ......... $2,198 $ 942 $ 1,521 services that we have outsourced to third parties, such as billing services, and

satellite telemetry, tracking and control, satellite launch contracts and broadcast

center services aggregated $9,001 million, payable as follows: $2,029 million in

2011, $2,092 million in 2012, $1,688 million in 2013, $1,364 million in 2014,

$818 million in 2015 and $1,010 million thereafter.

As of December 31, 2010, other long-term obligations totaling $136 million

and are payable in 2011. These amounts are recorded in ‘‘Accounts payable and

accrued liabilities’’ in the Consolidated Balance Sheets.

96