DIRECTV 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

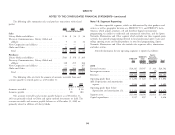

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

Contingencies $400 million, respectively, representing our best estimates of the fair value on those

dates. Adjustments to the carrying amount of the redeemable noncontrolling

National Football League Strike or Lockout interest are recorded to additional paid-in-capital. We determined the fair values

DIRECTV U.S. has a contract with the National Football League for the using significant unobservable inputs, which are Level 3 inputs under accounting

exclusive rights to distribute the NFL Sunday Ticket Package to DIRECTV U.S. guidance for measuring fair value.

subscribers. The NFL’s collective bargaining agreement with its players expires

before the beginning of the 2011-2012 NFL season. If there is a players’ strike or Venezuela Devaluation and Exchange Controls

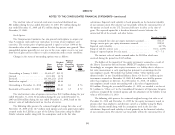

an owners’ lockout and no games are played or a reduced schedule is played, In January 2010, the Venezuelan government announced the creation of a dual

DIRECTV U.S. would still be obligated to make certain contractual payments to exchange rate system, including an exchange rate of 4.3 bolivars fuerte per U.S.

the NFL for such season. DIRECTV U.S. subscriber revenues would decrease if dollar for most of the activities of our Venezuelan operations compared to an

NFL games are not played or a full season is lost and cash flows from operating exchange rate of 2.15 Venezuelan bolivars fuerte prior to the announcement. As a

activities would decrease from lower revenues and because DIRECTV U.S. would result of this devaluation, we recorded a $6 million charge to net income in the

still be obligated to make certain contractual payments to the NFL. DIRECTV year ended December 31, 2010 related to the adjustment of net bolivars fuerte

U.S. will be able to partially offset these payments through provisions such as denominated monetary assets to the new official exchange rate. We began reporting

credits in the following year, reimbursements for games not played and its rights to the operating results of our Venezuelan subsidiary in the first quarter of 2010 using

an extra season if an entire season were cancelled, but in the near term a strike or the devalued rate of 4.3 bolivars fuerte per U.S. dollar. In December 2010, the

lockout could have a material adverse effect on our cash flows from operating Venezuelan government announced the elimination of the dual exchange rate

activities primarily due to payments we may have to make to the NFL, including system, eliminating the 2.6 bolivars fuerte per U.S. dollar preferential rate which

minimum contractual obligations, an optional advance payment that may be was available for certain activities.

requested by the NFL and the loss of subscriber revenue as well as possibly

Companies operating in Venezuela are required to obtain Venezuelan

resulting in reduced subscriber additions and higher churn.

government approval to exchange Venezuelan bolivars fuerte into U.S. dollars at the

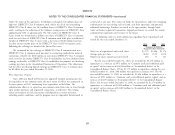

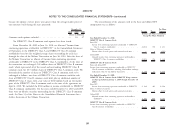

Redeemable Noncontrolling Interest official rate. We have not been able to consistently exchange Venezuelan bolivars

fuerte into U.S. dollars at the official rate and as a result, we have relied on a

In connection with our acquisition of Sky Brazil in 2006, our partner who parallel exchange process to settle U.S. dollar obligations and to repatriate

holds the remaining 7% interest, Globo was granted the right, until January 2014, accumulated cash balances prior to its close. The rates implied by transactions in

to require us to purchase all but not less than all of its shares in Sky Brazil. Upon the parallel market, which was closed in May 2010, were significantly higher than

exercising this right, the fair value of Sky Brazil shares will be determined by the official rate (6 to 7 bolivars fuerte per U.S. dollar). As a result, we recorded a

mutual agreement or by an outside valuation expert, and we have the option to $22 million charge in 2010, a $213 million charge in 2009 and a $29 million

elect to pay for the Sky Brazil shares in cash, shares of our common stock or a charge in 2008 in ‘‘General and administrative expenses’’ in the Consolidated

combination of both. As of December 31, 2010, we estimated that Globo’s Statements of Operations in connection with the exchange of accumulated

remaining 7% equity interest in Sky Brazil had a fair value of approximately Venezuelan cash balances to U.S. dollars using the parallel exchange process.

$224 million based on the valuation performed by the independent investment

bank as part of the process. As of December 31, 2009 we estimated that Globo’s As a result of the closing of the parallel exchange process in May 2010, we

25.9% equity interest in Sky Brazil had a fair value of approximately $400 million have been unable to repatriate excess cash balances and as a result, we have realized

to $550 million. As of December 31, 2010, and December 31, 2009, the carrying lower charges for the repatriation of cash in 2010.

amount of the redeemable noncontrolling interest was $224 million and

97