DIRECTV 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

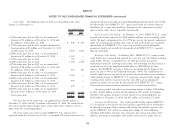

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

in purchase accounting. The adoption of the new accounting requirements as disclosure requirements for revenue arrangements for multiple deliverables. We do

required, on January 1, 2009, changed the way we account for adjustments to not expect the adoption of the revised standard to have an effect on our

deferred tax asset valuation allowances recorded in purchase accounting for prior consolidated results of operations and financial position, when adopted, as required,

business combinations so that adjustments to these deferred tax asset valuation on January 1, 2011.

allowances will no longer be recorded to goodwill but rather adjustments will be

recorded in ‘‘Income tax expense’’ in the Consolidated Statements of Operations. Note 3: Acquisitions

Additionally, the adoption of the new accounting guidance changed the accounting Globo Transaction

for all business combinations we consummate after January 1, 2009.

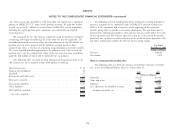

In connection with our acquisition of Sky Brazil in 2006, Globo was granted

Sky Brazil Functional Currency. Based on cumulatively significant changes in the right, until January 2014, to require us to purchase all or a portion (but not

economic facts and circumstances, we have determined that the local Brazilian less than half) of its 25.9% interest in Sky Brazil. In June 2010, Globo notified us

currency should be the functional currency of Sky Brazil for purposes of financial that it was exercising its right to exchange 178,830,000 shares representing

statement translation beginning in the second quarter of 2009. As a result of this approximately 19% of the ownership interests in Sky Brazil. In accordance with our

change in functional currency, on April 1, 2009 we recorded a $165 million agreement, Globo will have the right to exchange all (but not less than all) of its

decrease to previously reported values for nonmonetary assets and a $53 million remaining equity interest in Sky Brazil until January 2014.

increase in our related deferred income tax assets and liabilities, and an offsetting

As a result of Globo’s notice, the fair value of the approximate 19% interest

$112 million decrease to the ‘‘Cumulative translation adjustment’’, a component of

was determined to be $605 million by an independent investment bank according

‘‘Accumulated other comprehensive loss’’ in stockholders’ equity in the Consolidated

to a process specified by Globo and us in the related agreement. During the fourth

Balance Sheets. In addition, as a result of this change in functional currency,

quarter of 2010, we paid the purchase price in cash, which was recorded as a

changes in exchange rates will result in gains or losses, which will be recorded in

reduction to ‘‘Redeemable noncontrolling interest’’ in the Consolidated Balance

‘‘Other, net’’ in the Consolidated Statements of Operations related to the

Sheet, for their approximate 19% interest in Sky Brazil. In addition, we recorded

revaluation of U.S. dollar denominated monetary assets and liabilities, such as cash

$79 million of net deferred tax assets related to the acquisition of this interest as an

deposits, notes payable and capital lease obligations held by Sky Brazil. During

offset to ‘‘Additional paid in capital’’ in the Consolidated Balance Sheets. We and

2009, we recorded a net foreign currency transaction gain of $62 million in ‘‘Other,

our subsidiaries now own approximately 93% of Sky Brazil and Globo owns the

net’’ in the Consolidated Statements of Operations related to U.S. dollar

remaining 7%.

denominated monetary assets and liabilities held by Sky Brazil.

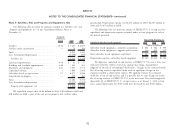

Liberty Transaction

New Accounting Standards

On November 19, 2009, DIRECTV Group and Liberty Media, obtained

Multiple Element Revenue Arrangements. In September 2009, the FASB

stockholder approval of and closed a series of related transactions which we refer to

approved a revised standard for revenue arrangements with multiple deliverables.

collectively as the Liberty Transaction. The Liberty Transaction included the

Under the revised standard, the criteria for determining whether a deliverable

split-off of certain of the assets of the Liberty Entertainment group into LEI, which

should be considered a separate unit of accounting has changed to remove a

was then split-off from Liberty. Following the split-off, DIRECTV Group and LEI

limitation for separation to only items with objective and reliable evidence of fair

merged with subsidiaries of DIRECTV. As a result of Liberty Transaction,

value. Instead, the revised standard allows entities to use the ‘‘best estimate of

DIRECTV Group, which is comprised of the DIRECTV U.S. and DIRECTV

selling price’’ in addition to third-party evidence or actual selling prices for

Latin America businesses, and LEI, which held Liberty’s 57% interest in DIRECTV

determining the fair value of a deliverable. The standard also includes additional

68