DIRECTV 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

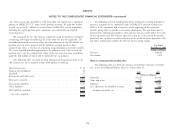

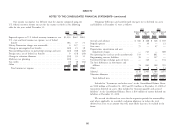

cash. These transactions provided us with ownership and control over a significant The following selected unaudited pro forma information is being provided to

portion of DIRECTV U.S.’ home service provider network. We paid $91 million present a summary of the combined results of DIRECTV and 180 Connect for

in cash, net of the $7 million we received from UniTek USA, for the acquisition, 2008 as if the acquisition had occurred as of the beginning of the respective

including the equity purchase price, repayment of assumed debt and related periods, giving effect to purchase accounting adjustments. The pro forma data is

transaction costs. presented for informational purposes only and may not necessarily reflect the results

of our operations had 180 Connect operated as part of us for each of the periods

We accounted for the 180 Connect acquisition using the purchase method of presented, nor are they necessarily indicative of the results of future operations. The

accounting, and began consolidating the results from the date of acquisition. The pro forma information excludes the effect of non-recurring charges.

consolidated financial statements reflect the final allocation of the $91 million net

purchase price to assets acquired and the liabilities assumed based on their Year Ended

December 31, 2008

estimated fair values at the date of acquisition using information currently available.

(Dollars in Millions)

The assets acquired included approximately $5 million in cash. The excess of the

Revenues .................................... $19,693

purchase price over the estimated fair values of the net assets has been recorded as

Net income .................................. 1,479

goodwill, $28 million of which will be deductible for tax purposes.

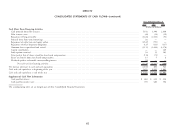

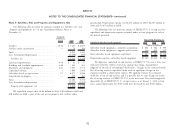

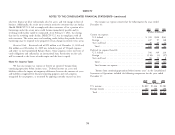

The following table sets forth the final allocation of the purchase price to the Note 4: Accounts Receivable, Net

180 Connect net assets acquired in July 2008 (dollars in millions):

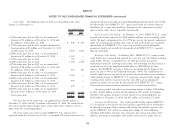

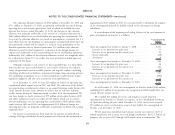

The following table sets forth the amounts recorded for ‘‘Accounts receivable,

net’’ in our Consolidated Balance Sheets as of December 31:

Total current assets ...................................... $ 18

Property and equipment .................................. 16 2010 2009

Goodwill ............................................ 97 (Dollars in Millions)

Investments and other assets ................................ 51 Subscriber ..................... $1,302 $1,036

Total assets acquired ..................................... $182 Trade and other ................. 775 645

Total current liabilities .................................... $ 83 Subtotal ...................... 2,077 1,681

Other liabilities ........................................ 8 Less: Allowance for doubtful accounts . . (76) (56)

Total liabilities assumed ................................... $ 91 Accounts receivable, net .......... $2,001 $1,625

Net assets acquired .................................... $ 91

71