DIRECTV 2010 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2010 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

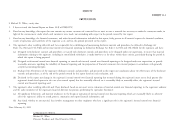

Operating profit before depreciation and amortization, which is a financial measure that is not

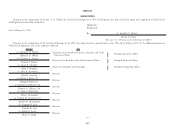

Non-GAAP Financial Measure Reconciliation Schedules

determined in accordance with accounting principles generally accepted in the United States of

(Unaudited) (Dollars in Millions)

America, or GAAP, should be used in conjunction with other GAAP financial measures and is not

2008 2009 2010 presented as an alternative measure of operating results, as determined in accordance with GAAP.

DIRECTV Consolidated Please see each of DIRECTV and DIRECTV Holdings LLC’s Annual Reports on Form 10-K for the

Operating Profit before Depreciation & Amortization ...... $5,015 $5,313 $ 6,378 year ended December 31, 2010 for further discussion of operating profit before depreciation and

Subtract: Depreciation and amortization expenses ......... 2,320 2,640 2,482 amortization. Operating profit before depreciation and amortization margin is calculated by dividing

Operating Profit ............................. $2,695 $2,673 $ 3,896 operating profit before depreciation and amortization by total revenues.

Cash flow before interest and taxes, which is a financial measure that is not determined in

2008 2009 2010

accordance with GAAP, is calculated by deducting amounts under the captions ‘‘Cash paid for

Cash Flow before Interest & Taxes .................. $2,640 $3,215 $ 3,916 property and equipment’’, ‘‘Cash paid for satellites’’, ‘‘Cash paid for subscriber leased equipment—

Adjustments: subscriber acquisitions’’ and ‘‘Cash paid for subscriber leased equipment—upgrade and retention’’

Cash Interest & Taxes ........................ (959) (855) (1,126) from ‘‘Net cash provided by operating activities’’ from the Consolidated Statements of Cash Flows

Subtotal—Free Cash Flow ....................... 1,681 2,360 2,790 and adding back net interest paid and ‘‘Cash paid for income taxes’’. This financial measure should be

Add Cash Paid For: used in conjunction with other GAAP financial measures and is not presented as an alternative

Property, Plant & Equipment .................... 2,229 2,071 2,416 measure of cash flows from operating activities, as determined in accordance with GAAP. DIRECTV

management use cash flow before interest and taxes to evaluate the cash generated by our current

Net Cash Provided by Operating Activities ............. $3,910 $4,431 $ 5,206 subscriber base, net of capital expenditures, and excluding the impact of interest and taxes, for the

purpose of allocating resources to activities such as adding new subscribers, retaining and upgrading

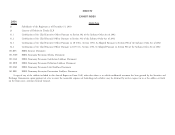

2008 2009 2010

DIRECTV U.S. existing subscribers, for additional capital expenditures and as a measure of performance for incentive

Operating Profit before Depreciation & Amortization ...... $4,391 $4,685 $ 5,216 compensation purposes. DIRECTV believe this measure is useful to investors, along with other

Subtract: Depreciation and amortization expenses ......... 2,061 2,275 1,926 GAAP measures (such as cash flows from operating and investing activities), to compare our

operating performance to other communications, entertainment and media companies. We believe

Operating Profit ............................. $2,330 $2,410 $ 3,290

that investors also use current and projected cash flow before interest and taxes to determine the

ability of our current and projected subscriber base to fund required and discretionary spending and

2008 2009 2010

to help determine the financial value of the company.

Cash Flow before Interest & Taxes .................. $2,517 $3,072 $ 3,510

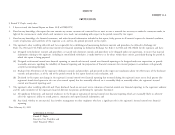

Adjustments: Free cash flow is a financial measure that is not determined in accordance with GAAP. Free

Cash Interest & Taxes ........................ (1,005) (866) (1,162) Cash Flow is calculated by deducting amounts under the captions ‘‘Cash paid for property and

equipment’’, ‘‘Cash paid for satellites’’, ‘‘Cash paid for subscriber leased equipment—subscriber

Subtotal—Free Cash Flow ....................... 1,512 2,206 2,348 acquisitions’’, and ‘‘Cash paid for subscriber leased equipment—upgrade and retention’’ from ‘‘Net

Add Cash Paid For: cash provided by operating activities’’ from the Consolidated Statements of Cash Flows. This

Property, Plant & Equipment .................... 1,765 1,485 1,557 financial measure should be used in conjunction with other GAAP financial measures and is not

Net Cash Provided by Operating Activities ............. $3,277 $3,691 $ 3,905 presented as an alternative measure of cash flows from operating activities, as determined in

accordance with GAAP. DIRECTV management use this measure to evaluate the cash generated by

2008 2009 2010

DIRECTV Latin America our current subscriber base, net of capital expenditures, for the purpose of allocating resources to

Operating Profit before Depreciation & Amortization ...... $ 690 $ 697 $1,164 activities such as adding new subscribers, retaining and upgrading existing subscribers, for additional

Subtract: Depreciation and amortization expenses ......... 264 366 541 capital expenditures and as a measure of performance for incentive compensation purposes.

DIRECTV believes this measure is useful to investors, along with other GAAP measures (such as cash

Operating Profit ............................. $ 426 $ 331 $ 623 flows from operating and investing activities), to compare our operating performance to other

communications, entertainment and media companies. We believe that investors also use current and

projected free cash flow to determine the ability of our current and projected subscriber base to fund

required and discretionary spending and to help determine the financial value of the company.