Cincinnati Bell 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part I Cincinnati Bell Inc.

organizational, distribution, stockholder ownership and other requirements on a continuing basis. Its ability to

satisfy the asset tests depends upon its analysis of the characterization and fair market values of its assets, some

of which are not susceptible to a precise determination.

If CyrusOne were to fail to remain qualified as a REIT in any taxable year, it would be subject to U.S.

federal income tax, including any applicable alternative minimum tax, on its taxable income at regular corporate

rates, and dividends paid to its stockholders would not be deductible by it in computing its taxable income. Any

resulting corporate tax liability could be substantial and would reduce the amount of cash available for

distribution to its stockholders, which in turn could have an adverse impact on the value of its common stock.

Unless CyrusOne was entitled to relief under certain Internal Revenue Code provisions, it also would be

disqualified from re-electing to be taxed as a REIT for the four taxable years following the year in which it failed

to qualify as a REIT.

CyrusOne’s cash available for distribution to stockholders may not be sufficient to make distributions at

expected levels.

Distributions made by CyrusOne will be authorized and determined by its board of directors in its sole

discretion out of funds legally available therefor and will be dependent upon a number of factors, including

restrictions under applicable law and its capital requirements. CyrusOne may not be able to make or sustain

distributions in the future. To the extent that it decides to make distributions in excess of its current and

accumulated earnings and profits, such distributions would generally be considered a return of capital for U.S.

federal income tax purposes to the extent of the holder’s adjusted tax basis in its shares. A return of capital is not

taxable, but it has the effect of reducing the holder’s adjusted tax basis in its investment. To the extent that

distributions exceed the adjusted tax basis of a holder’s shares, they will be treated as gain from the sale or

exchange of such stock.

Other Risk Factors

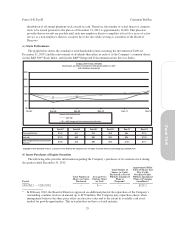

The trading price of the Company’s common stock may be volatile, and the value of an investment in the

Company’s common stock may decline.

The market price of the Company’s common stock has been volatile and could be subject to wide

fluctuations in response to, among other things, the risk factors described in this report and other factors beyond

the Company’s control, such as stock market volatility and fluctuations in the valuation of companies perceived

by investors to be comparable to the Company.

The stock markets have experienced price and volume fluctuations that have affected the Company’s stock

price and the market prices of equity securities of many other companies. These broad market and industry

fluctuations, as well as general economic, political, and market conditions, may negatively affect the market

price of the Company’s stock.

Companies that have experienced volatility in the market price of their stock have periodically been subject

to securities class action litigation. The Company may be the target of this type of litigation in the future.

Securities litigation could result in substantial costs and/or damages and divert management’s attention from

other business concerns.

The uncertain economic environment, including uncertainty in the U.S. and world securities markets, could

impact the Company’s business and financial condition.

The uncertain economic environment could have an adverse effect on the Company’s business and financial

liquidity. The Company’s primary source of cash is customer collections. If economic conditions were to worsen,

some customers may cancel services or have difficulty paying. These conditions could result in lower revenues

and increases in the allowance for doubtful accounts, which would negatively affect the results of operations.

Furthermore, the sales cycle could be further lengthened if business customers slow spending or delay decision-

making on the Company’s products and services, which could adversely affect revenues. If competitors lower

23

Form 10-K