Cincinnati Bell 2012 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2012 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

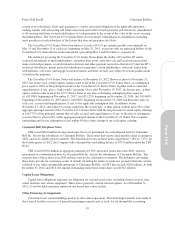

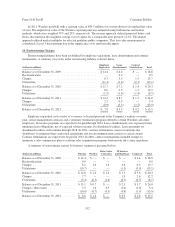

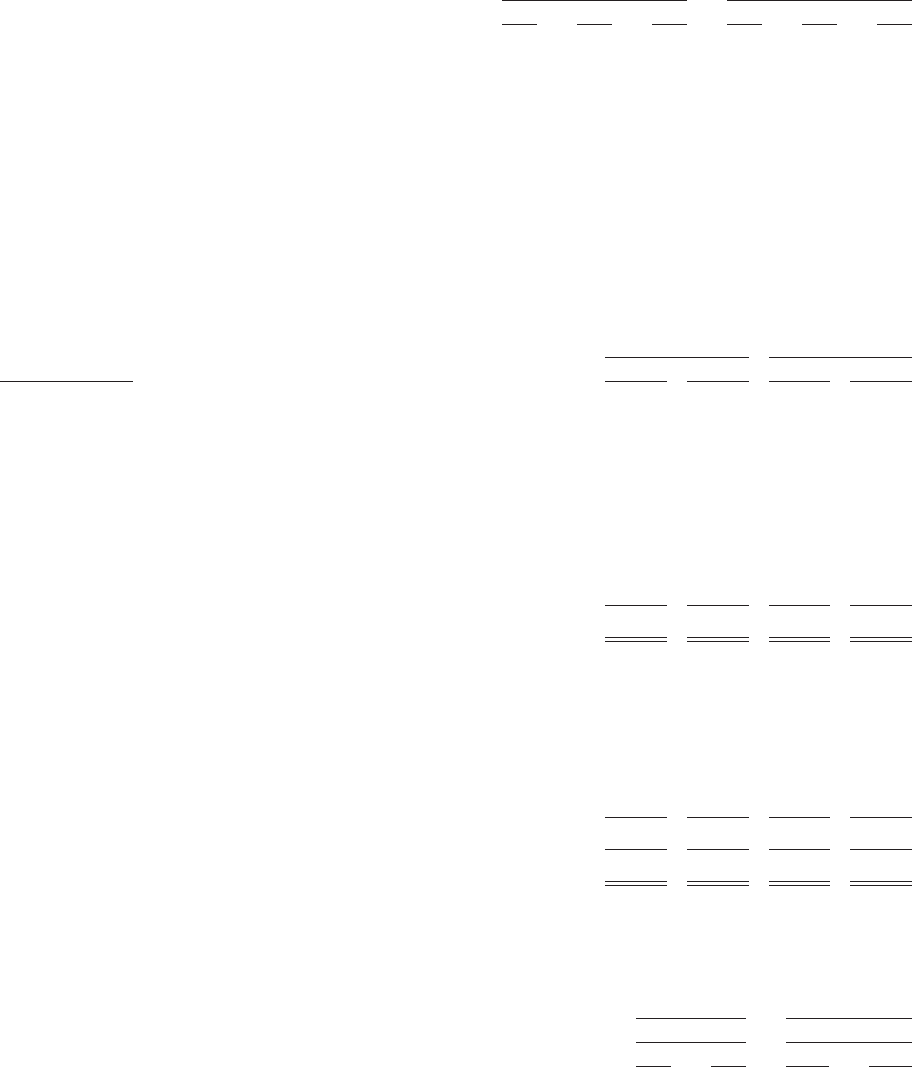

The following are the weighted-average assumptions used in measuring the net periodic cost of the pension

and postretirement benefits:

Pension Benefits

Postretirement and Other

Benefits

2012 2011 2010 2012 2011 2010

Discount rate ................................... 3.90% 4.90% 5.50% 3.60% 4.50% 5.10%

Expected long-term rate of return ................... 7.75% 8.25% 8.25% 0% 0% 0%

Future compensation growth rate ................... 3.00% 3.00% 3.00% — — —

The expected long-term rate of return on plan assets, developed using the building block approach, is based

on the mix of investments held directly by the plans and the current view of expected future returns, which is

influenced by historical averages. Changes in actual asset return experience and discount rate assumptions can

impact the Company’s operating results, financial position and cash flows.

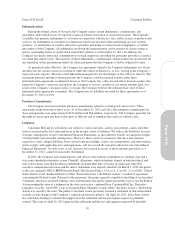

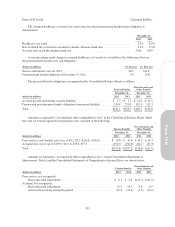

Benefit Obligation and Funded Status

Changes in the plans’ benefit obligations and funded status are as follows:

Pension Benefits

Postretirement and

Other Benefits

(dollars in millions) 2012 2011 2012 2011

Change in benefit obligation:

Benefit obligation at January 1, ................................. $569.2 $ 526.1 $ 164.9 $ 163.5

Service cost .............................................. 2.6 5.1 0.5 0.3

Interest cost .............................................. 21.3 24.8 5.6 7.1

Actuarial loss ............................................. 30.6 60.2 2.2 13.8

Benefits paid ............................................. (38.8) (47.0) (26.0) (27.2)

Retiree drug subsidy received ................................ — — 0.6 0.7

Early retiree subsidy received (refunded) ....................... — — (0.1) 1.9

Other ................................................... — — 4.7 4.8

Benefit obligation at December 31, .............................. $584.9 $ 569.2 $ 152.4 $ 164.9

Change in plan assets:

Fair value of plan assets at January 1, ............................ $312.5 $ 324.0 $ 12.1 $ 12.3

Actual return on plan assets .................................. 44.2 15.4 0.4 0.3

Employer contributions ..................................... 25.9 20.1 24.7 24.1

Retiree drug subsidy received ................................ — — 0.6 0.7

Early retiree subsidy received (refunded) ....................... — — (0.1) 1.9

Benefits paid ............................................. (38.8) (47.0) (26.0) (27.2)

Fair value of plan assets at December 31, ......................... 343.8 312.5 11.7 12.1

Unfunded status ............................................. $(241.1) $(256.7) $(140.7) $(152.8)

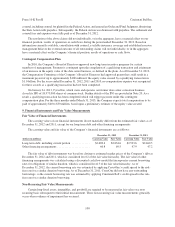

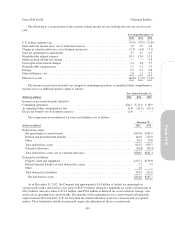

The following are the weighted-average assumptions used in accounting for and measuring the projected

benefit obligations:

Pension Benefits

Postretirement and

Other Benefits

December 31, December 31,

2012 2011 2012 2011

Discount rate ................................................ 3.30% 3.90% 3.10% 3.60%

Expected long-term rate of return ................................ 7.75% 7.75% 0% 0%

Future compensation growth rate ................................. 3.00% 3.00% — —

104

Form 10-K Part II Cincinnati Bell Inc.